Samuel Chua

14th January 2025 - 2 min read

The Ministry of Finance (MOF) has granted a digital banking licence to YTL Digital Bank Berhad, a joint venture between YTL Digital Capital Sdn Bhd and Sea Limited. The newly launched entity, Ryt Bank, marks the introduction of Malaysia’s first AI-powered digital bank.

Approved to commence operations from 20 December 2024, the bank is adopting a phased rollout to ensure a smooth and effective launch to the public.

Melvin Ooi, the Chief Executive Officer of Ryt Bank, described the bank as a significant step in modernising financial services in Malaysia.

“By harnessing the power of artificial intelligence (AI) to provide an unequalled customer experience, we will deliver financial services that are meaningful and inclusive, while helping customers achieve their financial goals.

“By empowering exceptional local talent, we have built a next-generation AI-powered platform that simplifies the customer experience – from fast, seamless onboarding to daily transactions – while delivering personalised and collaborative banking through advanced behaviour insights,” he said in a statement.

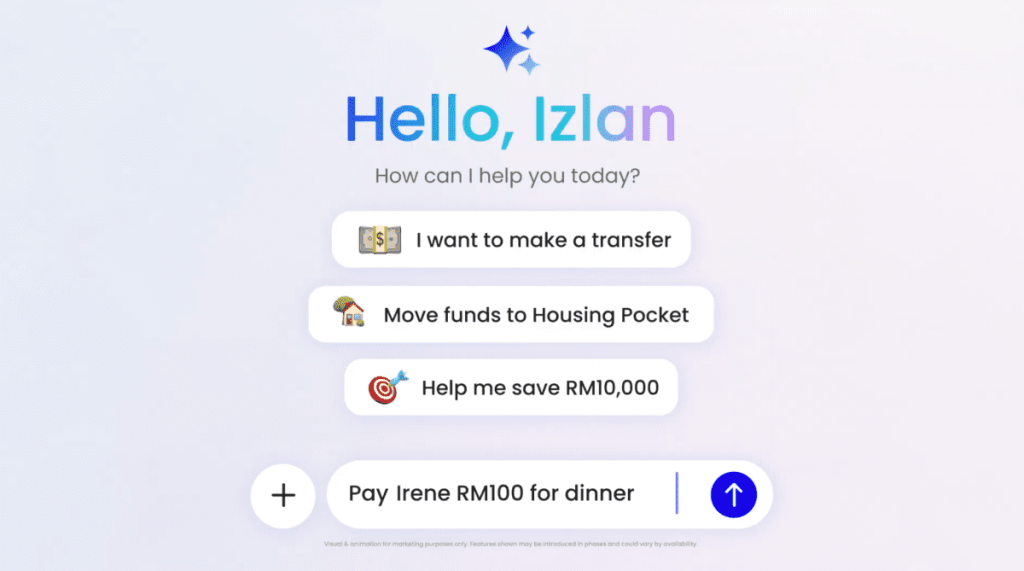

A key feature of Ryt Bank’s offering is Ryt AI, a personalised digital banking assistant designed to deliver tailored financial advice, manage savings strategies, and simplify banking processes. Ryt AI seeks to address the specific needs of customers, providing services that are efficient and seamless. It also includes 24/7 support to ensure accessibility and convenience at any time.

Additionally, Ryt AI features an advanced fund transfer capability, allowing users to initiate and complete transfers using a single text input. This functionality is designed to save time and support multiple languages, enhancing its usability for a diverse range of customers.

Comments (0)