Alex Cheong Pui Yin

1st November 2021 - 6 min read

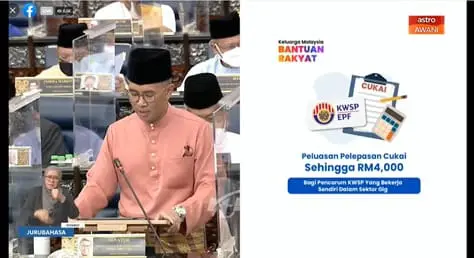

Finance Minister Tengku Datuk Seri Zafrul Abdul Aziz has tabled the national Budget for 2022 last Friday, proposing a range of programmes that aims to help Malaysia overcome the economic challenges that came at the heels of the Covid-19 pandemic. Among the initiatives put forward included several income tax-related proposals.

For Malaysians, it is important to know what are the new tax reliefs and previous short-term ones that have been extended into the 2022 year of assessment, so that you can maximise tax refunds that will help ease cash flow issues that you may have. This is, after all, another form of assistance for the rakyat.

New And/Or Extended Tax Reliefs

Tax relief for self-funded Covid-19 booster shots and related costs

The government has proposed to provide individual tax relief – as well as tax deduction to employers – on costs that are associated with the adoption of self-funded Covid-19 booster vaccines. In other words, if you end up paying for booster vaccines (or any related costs), you will be entitled to claim that amount as tax relief.

Tax relief for health examination expenses expanded to cover mental health services

In a bid to provide better mental health support for the nation, the scope of income tax relief for full medical check-up expenses (currently set at RM1,000) will be expanded to cover the cost of mental health services. These include check-up or consultation services related to mental health from registered psychiatrists, clinical psychologists, and counsellors.

Special tax relief for the purchase of phones, computers, and tablets extended

The ongoing special tax relief of RM2,500 – which is allocated specifically for the purchase of phones, computers, and tablets – will be extended for a second time, from 31 December 2021 to 31 December 2022.

This special tax relief was originally introduced as a way to assist Malaysians in adopting the work-from-home culture, following the government’s implementation of an extensive movement control order (MCO) period in its fight against the pandemic. Rolled out as part of the PENJANA economic recovery plan in the middle of last year, the tax relief was supposed to last from June to December 2020, but was subsequently extended to the end of 2021 under the Permai stimulus package.

This special tax relief is provided on top of the existing tax relief for lifestyle purchases – which is also set at RM2,500.

Note, however, that the wording remains vague – an “extension” may mean that an individual could claim for this special tax relief for YA 2020, YA 2021, and YA 2022…but it may also mean just one time for those three assessment years. The IRB only updates its income tax guide closer to tax filing season, which means we may only know for certain next year. We will try to get in touch with the IRB on this.

Tax relief for self-enhancement and upskilling course fees increased and extended

To encourage Malaysians to upskill and pick up new skills to venture into new fields, the government has proposed to increase the tax relief limit for self-enhancement and upskilling courses from up to RM1,000 to up to RM2,000. Additionally, this benefit will be extended to 2023.

At present, Malaysians are allowed to claim up to RM1,000 from the total education fees relief of RM7,000 for upskilling or self-enhancement courses, provided they are in industries that are recognised by the Department of Skills Development (under the Ministry of Human Resources). This relief was slated to end in 2022.

Tax relief expanded to include EPF members who perform voluntary contributions

The tax relief of up to RM4,000 that is currently provided only for mandatory contributions of employees or self-employed individuals to the EPF will be expanded to encompass voluntary contributors as well. These include those who are self-employed in the gig economy as well as pensionable civil servants.

Tax relief limit for SOCSO increased and expanded

Currently, private sector employees are provided with tax relief of up to RM250 for contributing to the social security protection scheme that is regulated by the Social Security Organisation (SOCSO). The government has proposed to increase the limit of this tax relief from RM250 to RM350, as well as expand the scope to include employees’ contributions through the Employment Insurance System (EIS) as well.

Higher tax relief limit for payments of nursery and kindergarten fees extended

Parents paying fees to registered childcare centres are originally allowed to claim of up to RM2,000. Under the PENJANA stimulus package, this limit is increased to RM3,000 – to be provided until the end of 2022.

Under Budget 2022, it is proposed that this increased amount be extended for two years, until the year of assessment 2023 instead. This is in a bid to ease parents’ financial burden in providing early education for children.

Tax exemption on prize money earned from recognised e-sports tournaments

As a form of recognition of the achievements of local e-sports athletes, the government has proposed exempt the tax for the prize money won from recognised e-sports tournaments. This is also intended as a way to encourage and cultivate more e-sports athletes.

Tax relief for electric vehicles (EV) ownership

Aside from providing import duty, excise duty, as well as sales and road tax exemptions for EV owners, the government has also proposed to offer income tax reliefs of up to RM2,500 for the purchase and installation, rental, and hire-purchase of EV charging facilities. The tax relief will also apply to payments of EV charging facility subscription fees.

Tax relief for deferred annuity extended

Malaysians were originally allowed tap into annual income tax relief of up to RM3,000 on the premium payment for deferred annuity and contributions to the PRS, provided up to year of assessment (YA) 2021. Under Budget 2021, this benefit was extended for PRS contributions until YA2025, but not for deferred annuity.

This year, under Budget 2022, the government has proposed to extend the tax relief for deferred annuity premium payments for another four years.

Other tax initiatives proposed in Budget 2022

Income tax imposed on income from foreign sources

The government has proposed to begin taxing Malaysian residents who are earning income from foreign sources and receiving them in Malaysia. This is expected to take place starting from 1 January 2022.

Additionally, the Inland Revenue Board of Malaysia (LHDN) will implement tax identification numbers (TIN) for taxpayers starting from 2022 to broaden the income tax base. This has actually been announced earlier in 2021, but will take effect more broadly in 2022.

i-Saraan initiative to be expanded

The i-Saraan initiative under the Employees Provident Fund (EPF) will be expanded to include beneficiaries who are aged between 55 to 60 years old as well. This initiative – which is an incentivised programme to encourage voluntary contributions by self-employed individuals and those who are working in the informal sector – originally only applies to EPF members who are aged below 55 years old.

***

Do also keep up to date with the main highlights of Budget 2022 through our infographic here!

Comments (0)