Samuel Chua

10th October 2025 - 2 min read

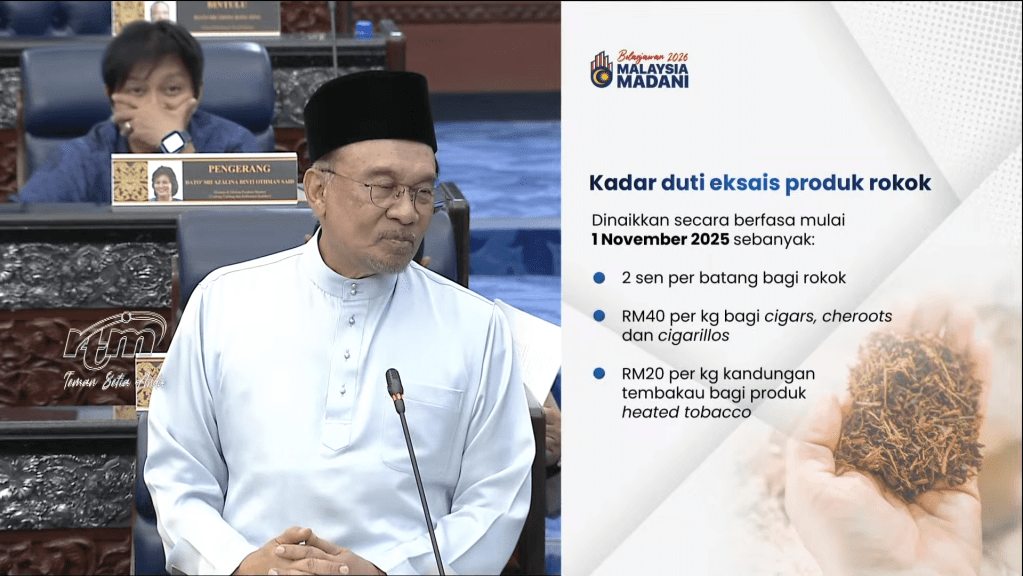

The government will increase excise duties on tobacco and alcoholic beverages starting 1 November 2025, as part of efforts to promote healthier lifestyles and strengthen public health funding. The announcement was made by Prime Minister Datuk Seri Anwar Ibrahim under Belanjawan MADANI 2026.

Specific Increases For Tobacco Products

The excise duty on cigarettes will rise by 2 sen per stick, while the duty on cigars, cheroots, and cigarillos will increase by RM40 per kilogram. For heated tobacco products, the duty will go up by RM20 per kilogram of tobacco content.

These adjustments are aimed at reducing smoking prevalence in Malaysia, aligning with the government’s long-term tobacco control initiatives.

Alcohol Excise Duty To Increase By 10%

To curb alcohol consumption and encourage healthier lifestyles, the excise duty on alcoholic beverages will be increased by 10%, also taking effect from 1 November 2025.

The higher rate applies to all alcohol categories, both locally produced and imported.

Continued Incentives For Nicotine Replacement Therapies

To support smokers transitioning away from tobacco, the import duty and sales tax exemption on nicotine replacement therapy products has been extended until 31 December 2027.

The exemption now covers nicotine mist and nicotine lozenges, expanding access to safer alternatives.

Additional Revenue To Fund Health Programmes

Revenue from the higher excise duties on cigarettes and alcohol will be channelled to the Ministry of Health (KKM) to fund key health initiatives, including the Lung Health Programme, as well as diabetes and heart disease treatment.

Stay tuned for more updates from Budget 2026.

Follow us on our official WhatsApp channel for the latest money tips and updates.

Comments (0)