Samuel Chua

10th October 2025 - 2 min read

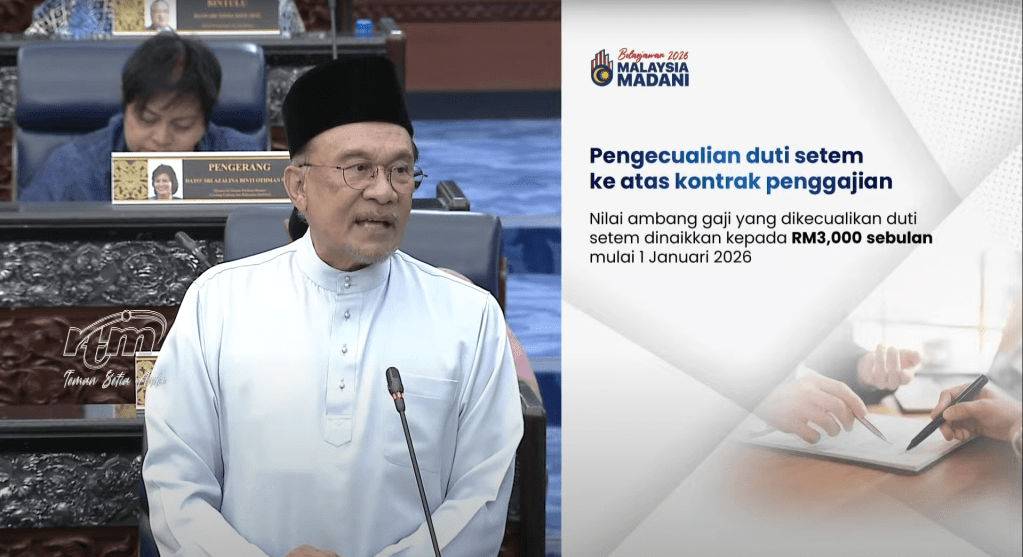

Prime Minister Datuk Seri Anwar Ibrahim has announced that the government will raise the stamp duty exemption threshold for employment contracts from RM300 to RM3,000 per month, effective 1 January 2026. The measure was introduced under Belanjawan MADANI 2026 to reduce business costs and support small-scale employers and workers in Malaysia’s growing micro, small, and medium enterprise (MSME) sector.

Lowering Costs For Businesses And Workers

The change means that employment contracts involving monthly salaries of RM3,000 or below will no longer be subject to stamp duty. Previously, only contracts for wages up to RM300 a month were exempted, which limited the benefit to very short-term or low-wage arrangements.

By expanding this threshold, the government aims to ease the cost of formalising employment agreements, especially for small businesses, self-employed individuals, and gig workers. The move also encourages businesses to adopt proper documentation practices while keeping administrative costs manageable.

Supporting MSMEs And Inclusive Employment

This initiative complements other financing and support measures for MSMEs under Belanjawan MADANI 2026, including RM50 billion in government-backed loans and guarantees. Together, these efforts are designed to make it easier for small businesses to operate, hire, and comply with labour regulations.

The updated threshold reflects the government’s ongoing commitment to building a more inclusive and affordable business environment, ensuring that smaller employers and workers benefit from fairer, more practical regulations without unnecessary financial burden.

Stay tuned for more updates from Budget 2026.

Follow us on our official WhatsApp channel for the latest money tips and updates.

Comments (2)

is it means new joiner for 2025 and salary below rm3k no need to stamp?

Hey Aza,

Not quite, all new employment contracts from 2025 onwards still need to be stamped, regardless of salary. The exemption only applies if the monthly salary is below RM300 (not RM3,000).