Alex Cheong Pui Yin

11th December 2023 - 4 min read

CIMB Bank has announced some revisions to the benefits of its three CIMB Travel credit cards, which include an update on the amount of Bonus Points (BP) that you can earn for selected local transactions. Set to take effect on 1 January 2024, it is also expanding the existing 1 million cap on the BPs that you can earn to cover more transactions – such as overseas, airlines, duty-free, and OctoTravel spend – as well as updating some insurance coverage benefits that are provided for CIMB Travel World Elite credit cardholders.

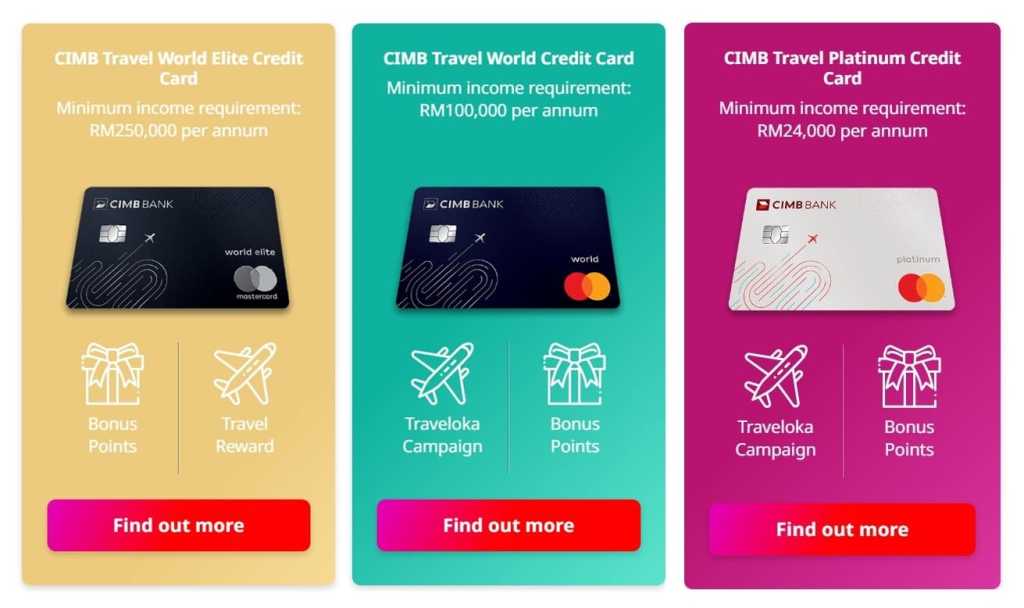

With regard to the Bonus Points that can be earned via these Travel cards, those holding the CIMB Travel World Elite, CIMB Travel World, and CIMB Travel Platinum are currently able to earn BPs at the following rates for every RM1 that they spend in the eligible categories:

| Eligible spend category | CIMB Travel World Elite | CIMB Travel World | CIMB Travel Platinum |

| – Overseas – Airlines – Duty-free purchases – OctoTravel | 10x BP | 8x BP | 5x BP |

| Other local expenses | 2x BP | 2x BP | 2x BP |

When the revision kicks in on 1 January, however, specific transactions under local expenses – namely local education, insurance, and utility spend – will only earn 1x BP for every RM1 spent. Here’s a table to better show the updated earning rate for the three cards:

| Eligible spend category | CIMB Travel World Elite | CIMB Travel World | CIMB Travel Platinum |

| – Overseas – Airlines – Duty-free purchases – OctoTravel | 10x BP | 8x BP | 5x BP |

| – Local education spend – Local insurance spend – Local utility spend | 1x BP | 1x BP | 1x BP |

| Other local expenses | 2x BP | 2x BP | 2x BP |

Aside from this, CIMB’s notice also said that it will be expanding the existing 1 million cap on the total BP that you can earn per month via your Travel credit cards to cover even more transactions. At present, this cap (per statement cycle) – which was introduced in August 2023 – is only applicable to local transactions (excluding airlines and duty-free expense), but come 1 January, it will be expanded to cover all retail spend, including overseas, airlines, duty-free expenses, and OctoTravel as well.

This latest expansion of the cap will continue to abide by the sub-caps of 50,000 or 100,000 BPs that were also implemented back in August, assigned according to various spend categories like transportation, supermarkets/hypermarkets, utilities, telecommunication, and automobile. Here’s the full list for your easy reference:

| Spend category | BP cap per statement cycle |

| Transportation | 50,000 |

| Supermarkets/Hypermarkets | 50,000 |

| Utilities | 50,000 |

| Professional services | 50,000 |

| Insurance | 100,000 |

| Mail & telephone orders | 100,000 |

| Telecommunication | 100,000 |

| Automobile | 100,000 |

| Retail | 100,000 |

Meanwhile, a third amendment that CIMB also announced along with the above two will impact the CIMB Travel World Elite credit card in particular. Specifically, the insurance coverage provided for these cardholders – which is offered by card issuer Mastercard through the services of AIG Insurance – will be revised as per the following:

| Coverage | Current benefits (USD) | Benefits effective from 1 January 2024 (USD) |

| Overseas quarantine allowance (max 14 days) | US$150 per day | US$100 per day |

| Mobile phone protection | – US$1,000 per occurrence – US$2,000 annual aggregate – US$50 deductible | Discontinued |

| Rideshare insurance | – US$500 per trip – US$1,000 annual aggregate | Discontinued |

| Wallet guard | – US$500 per occurrence – US$500 annual aggregate | Discontinued |

The card’s travel insurance coverage of up to US$500,000 remains unchanged, as does several other protection, such as the e-commerce protection (up to US$1,000) and purchase protection (up to US$20,000)

Lastly, it should also be noted that CIMB has yet to update whether it will be extending the 8x Bonus Points campaign for its Travel World Elite card when this perk ends on 31 December 2023. This campaign currently allows CIMB Travel World Elite cardholders to enjoy a temporary benefit where they earn an extra 8x BPs for every RM1 spent on local expenses, on top of the base 2x BP – ultimately giving them a total of 10x BPs. If it is not renewed upon its expiry by the end of this year, CIMB Travel World Elite cardholders will revert to the base earning rate of up to 2x BP that kicks in on 1 January 2024.

Understandably, these latest updates may somewhat impact cardholders’ reception of the CIMB Travel credit cards moving forward – particularly the CIMB Travel World Elite card – given that it has been a favourite among air miles chasers since its launch in September 2022. This is largely thanks to the upsized amount of BPs that they can earn both through overseas and local spend.

As a travel card specifically, however, the CIMB Travel World Elite card continues to be one of the best in the market. Its 10x BP for overseas, airlines, and duty-free expenses remains unchanged, and it also offers a combined 12x access to Plaza Premium First, Plaza Premium Lounges, and affiliated lounges worldwide (shared between principal and supplementary cardholders). Not to mention, it has other perks as well, such as in-flight WiFi cashback.

Comments (0)