Alex Cheong Pui Yin

13th April 2022 - 3 min read

CIMB has announced that it is enhancing the rewards structure of its CIMB e Credit Card with several revisions. These include enabling its 12x Bonus Points (BP) reward for all merchants under selected expense categories during the monthly eDay event, as well as standardising the BP that can be earned for these categories at 3x on ordinary days. These revisions are set to take effect starting from 5 May 2022.

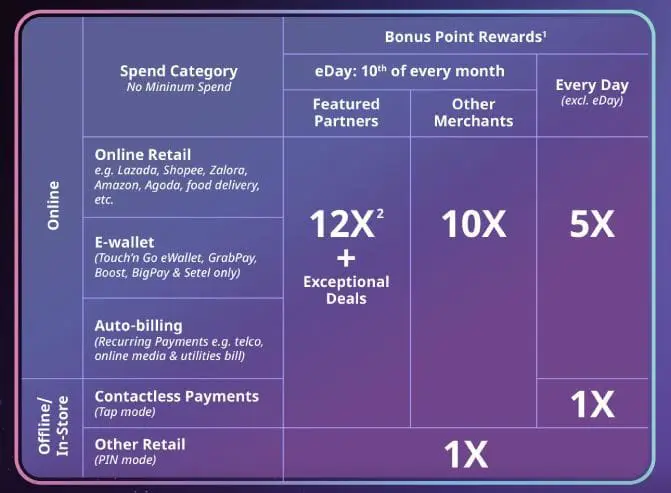

At present, the CIMB e Credit Card has a relatively complex BP rewards structure that benefits cardholders differently, depending on whether they are spending on the once-a-month eDay (on the 10th of every month) or other ordinary days.

On eDays, you’ll earn 12x BP for online retail, e-wallet, and auto-billing transactions, as well as contactless payments made in store – if you shop with a featured merchant partner. For all other merchants, you’ll earn 10x BP. Meanwhile, online retail, e-wallet, and auto-billing expenses on ordinary days will net you 5x BP, whereas contactless payments will get you 1x BP. For other offline retail expenses, you’ll get 1x BP, regardless of whether you spend on the special eDay or ordinary days.

Come 5 May 2022, CIMB is changing its eDay from the 10th of every month to the 28th of every month, as well as doing away with the concept of featured partners. Instead, on this special day, cardholders will earn 12x for expenses made with all merchants that are listed under the online retail, e-wallet, auto-billing, and contactless payment category. Meanwhile, other retail spend (offline payments) will continue to earn you 1x BP.

On ordinary days, CIMB is also simplifying things by allowing cardholders to earn a flat 3x BP for all online retail, e-wallet, auto-billing, and contactless payments. As for other retail spend (offline payments), you’ll still earn 1x BP on these days.

Here’s a table to help you better grasp the enhanced rewards structure for the CIMB e Credit Card, starting from 5 May onwards:

| Spend category | BP earned on eDay (28th of every month) | BP earned on ordinary days |

| Online retail E-wallet expenses Auto-billing Contactless payments (in-store) | 12x BP | 3x BP |

| Other retail (offline/in-store payments) | 1x BP | 1x BP |

So as you can see, cardholders will no longer need to go through the hassle of constantly tracking who they must spend with in order to maximise the perks of the CIMB e Credit Card. Given that the card is already a fairly rewarding one with its eDay perk and Pay With Points feature, this revision is set to make it easier to use.

On top of the changes to the BP reward structure, CIMB also said that it is waiving the annual fee for the card until December 2025. This includes current cardholders. The annual fee for the CIMB e Credit Card is set at RM100, and is waived for the first year.

Other than these revisions, other features of the CIMB e Credit Card will remain the same. Its BP conversion rate remains at 400 BP = RM1, and the BP rewards cap is still set at 20,000 BP per statement cycle.

(Source: CIMB)

Comments (0)