Jacie Tan

27th July 2020 - 8 min read

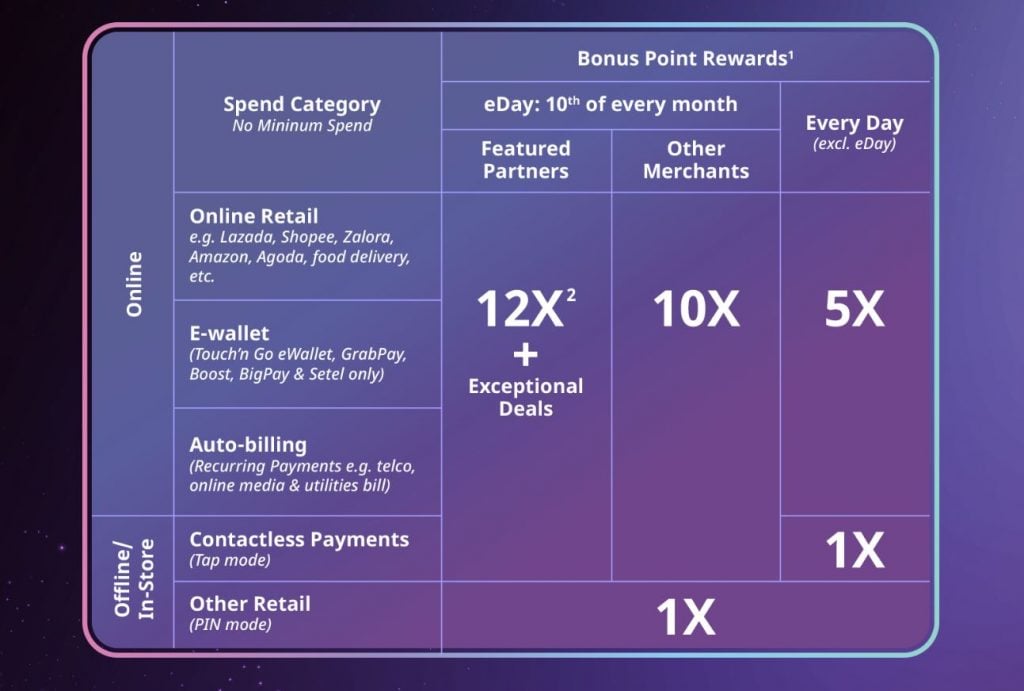

CIMB’s newest credit card has been designed with the demands of the digital era in mind. The CIMB e Credit Card offers rewards points on online shopping, e-wallet reloads, and auto-billing expenditure, covering most of the online expenditure that has become increasingly frequent these days. But the CIMB e Credit Card also grants you rewards points for contactless and ordinary PIN payments, thus seeing to your other daily spending needs too.

The main highlight of the e Credit Card is its once-a-month eDay, where it offers higher Bonus Points (BP) on the 10th of every month and for spending with Featured Partners. Because of this, calculating exactly how rewarding this card is can get a little messy, which is why we’ve done it for you.

Everyday Rewards Both Online And Offline

On ordinary days (i.e. not eDay), it’s quite easy to keep track of the CIMB e Credit Card’s benefits – you get 5x BP on online expenditure and 1x BP for ordinary in-person spend. This card defines online spend as online retail, e-wallet reloads, and auto-billing, whereas contactless and retail PIN payments make up its in-store expenditure, with examples of the types of spend as below:

- Online retail: Eg. Lazada, Shopee, Zalora, Amazon, Agoda, food delivery, etc.

- E-wallet: Touch ’n Go eWallet, GrabPay, Boost, BigPay, and Setel only

- Auto-billing: Recurring payments, eg. telco, online media, and utilities bill

- Contactless payments: In-store tap mode payments

- Other retail: In-store PIN mode payments.

eDay Bonuses On The 10th Of Every Month

It’s on the special eDay taking place on the 10th of every month where the CIMB e Credit Card really shines.

On eDays, you get 10x BP for online, e-wallet, auto-billing, and contactless payments, leaving only the normal PIN payments on the ordinary 1x multiplier. While the eDay probably won’t be very useful for auto-billing payments (unless your auto-billing date is fixed for the 10th), you can definitely take advantage of the eDay’s double BP by planning to do your online shopping, e-wallet top-ups, or even any in-person spend using contactless payments on this day.

In addition, every eDay, CIMB will also highlight several Featured Partners, where the e Credit Card holder can get 12x rewards points on transactions made with these selected strategic partners. According to CIMB, the partners may vary from month to month.

There are also exclusive eDay Deals with merchants like Taobao, The Coffee Bean, The Body Shop, and more. For example, one of the current eDay Deals that is running until September 2020 is the RM1 Deal with Shopee and Lazada, where you can get RM49 off with a minimum spend of RM50 on the Shopee or Lazada app – which is a steal to say the least.

A Cashback Card In Disguise

While the card earns Bonus Points, the CIMB e Credit Card can be used primarily to earn cashback, thanks to its cashback redemption as well as its “Pay With Points” features. You can use your Bonus Points to redeem cashback from the CIMB rewards catalogue and settle your credit card account balance, or opt to use Pay With Points – a programme which allows you to use your Bonus Points at any one of its thousands of participating merchants to offset your payment.

At a set conversion rate of 400 Bonus Points to redeem RM1 for both features, CIMB boasts that it has the best bonus points conversion in comparison with other consumer banks in Malaysia. Let’s calculate how much effective cashback you actually get using your Bonus Points.

Digging Deeper: How Valuable Is The Cashback?

Starting at the lowest multiplier of 1x Bonus Points, you’d get 0.25% cashback on contactless or PIN payments. For online, e-wallet, and auto-billing at 5x Bonus Points, you would receive RM1 back for every RM80 you spend – which equals to an effective 1.25% cashback rate. At double the points on eDays, you get RM1 back for every RM40 you spend, with an effective cashback rate of 2.5%; for spend with featured partners garnering 12x points, the cashback works out to 3.0%.

| Bonus Points | Cashback Rate | Returns | Effective Cap |

| 1x | 0.25% | RM1 back for every RM400 spent | Rewards on RM20,000 worth of spend |

| 5x | 1.25% | RM1 back for every RM80 spent | Rewards on RM4,000 worth of spend |

| 10x | 2.5% | RM1 back for every RM40 spent | Rewards on RM2,000 worth of spend |

| 12x | 3.0% | RM1 back for every RM33 spent | Rewards on RM1,667 worth of spend |

However, one important thing to note is that Bonus Points are capped at 20,000 Bonus Points per statement cycle. At 5x Bonus Points, this equates to a rewards cap on RM4,000 worth of spending; for the 10x and 12x points, you can spend up to RM2,000 and RM1,667 respectively before you hit the rewards limit. Based on these numbers, your effective cashback will be capped at RM50 per month for all Bonus Points tiers – a pretty decent amount for monthly cashback.

With an effective cashback rate of up to 3%, the earnings aren’t the most lucrative, but the good news is you are not required to spend a certain amount to unlock these rates – there’s no minimum spend required. Besides, the fact that the CIMB e Credit Card offers 5x BP on auto-billing payments on a normal day is also a plus point; these days, not many credit cards offer attractive rewards for utility bills.

Plot Twist: It’s A Surprisingly Good Air Miles Card

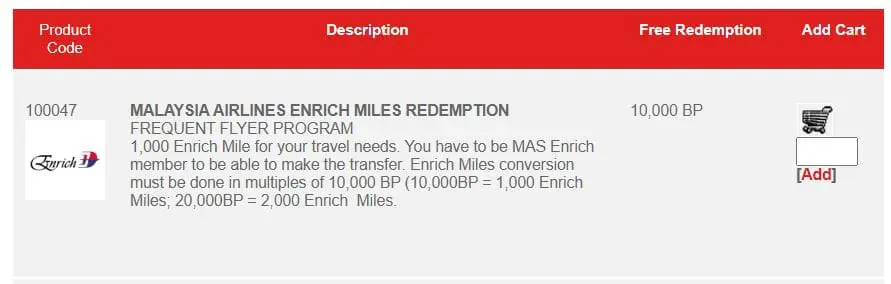

Although CIMB puts great emphasis on the cashback aspect of this card, you still use your Bonus Points to make the usual redemptions from the CIMB Rewards Catalogue, which includes household items, vouchers, and of course, air miles. Our analysis of the latter revealed a pleasant surprise: the CIMB e credit is actually a solid contender to become one of the best air miles credit cards in Malaysia.

CIMB only has Enrich as its sole air miles partner (besides AirAsia BIG), and you need 10,000 Bonus Points to redeem 1,000 Enrich Miles. Again, the e Credit Card offers varying points multipliers, so here is the conversion rate of 1 Enrich Mile for each one:

| Bonus Points | Air Miles Conversion Rate |

| 1x | RM10 per 1 Enrich Mile |

| 5x | RM2 per 1 Enrich Mile |

| 10x | RM 1 per 1 Enrich Mile |

| 12x | RM0.83 per 1 Enrich Mile |

To give you some idea of how attractive the e Credit Card’s conversion rates are, we can compare them to the rates of a couple of the most rewarding air miles credit cards in the market: the Maybank 2 Premier Cards, which offer a rate of RM1 per 1 Enrich Mile, and the Hong Leong Visa Infinite, which yields a rate of RM1.80 per 1 Enrich Mile on overseas spend and RM2.80 per 1 Enrich Mile on local spend.

At 10x and 12x BP, the e Credit Card matches or even trumps the redemption rates of long-standing favourite air miles credit cards – which is all the more impressive when you consider that the e Credit Card is an entry-level card with an income requirement of just RM2,000 per month (vs the Maybank 2 Premier’s RM8,333/month and the HLB Visa Infinite’s RM12,500/month requirement!)

Even at 5x BP, which you can get for everyday online spend, the conversion rate of RM2 per 1 Enrich Mile is an attractive one – and is still better than many popular air miles credit cards in Malaysia.

Verdict: An Entry-Level Card That Punches Well Above Its Weight

The CIMB e Credit Card comes with a minimum annual income requirement of RM24,000 or RM2,000 per month, making it a good pick for fresh graduates just entering the workforce. The annual fee is RM100, but it is free for the first year and subsequently waived with a total annual spending of RM12,000, which works out to RM1,000 a month and is quite a manageable amount to hit. Meanwhile, the annual fees for supplementary cards are waived for life.

Overall, the CIMB e Credit Card’s benefits all depend on how you make use of the card. If you are diligent enough to maximise the double BP of eDay on the 10th of every month, and are looking for a credit card to use mainly for online, e-wallet, and auto-billing payments, then you should be able to get the highest potential benefits out of the e Credit Card.

Thanks to the flexibility of the CIMB e Credit Card, you can cash in on your rewards either through its cashback options, normal rewards catalogue redemptions (if you wish) or more lucratively, by redeeming Enrich Miles.

You can find out more about the CIMB e Credit Card here.

Comments (7)

what is the monthly credit limit?

the monthly credit limit is different across individuals.

I applied Cimb cc thru ringgitplus, received SMS from CIMb that mine has been approved. What should i do next? Should i call them or just wait to receive the card then activate?

Best practice is to activate the card only when you receive it. I’ve been told CIMB tends to deliver their cards quite quickly too 🙂

Will this CIMB e credit card subject to government tax of MYR 25.00?

Yes, currently all credit cards will be subjected to SST of RM25 per year.

Saya ada cimb depet card ada