RinggitPlus

28th August 2025 - 4 min read

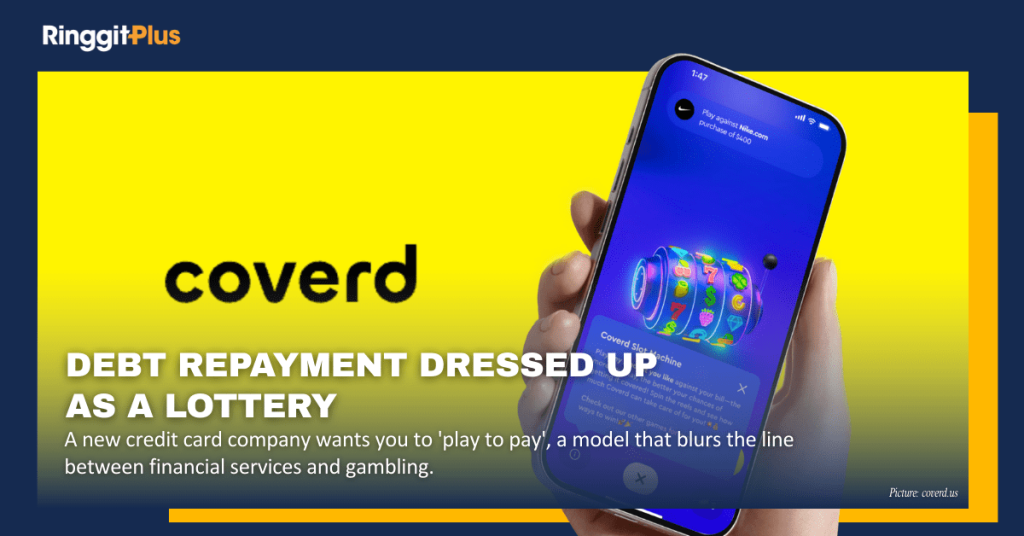

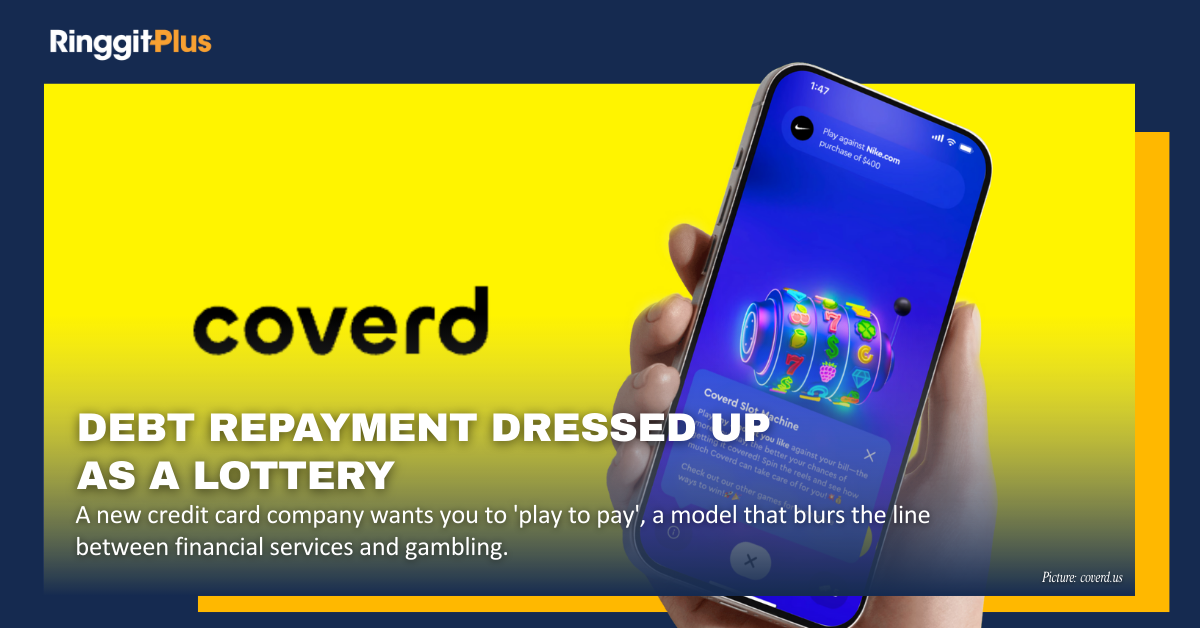

A US-based company called Coverd is taking a very different approach to credit card payments. Instead of simply rewarding spending with points or cashback, it adds a game-like layer. You buy tokens, you play sweepstakes-style games, and you earn something called Coverd Cash that can be redeemed to reduce your credit card bill.

It is not quite gambling, and it is not a traditional rewards programme either. Think of it as a mix of entertainment and finance that turns repayment into something playful — and dangerously unpredictable. At its core, this is debt repayment dressed up as a lottery.

How Coverd Works

The platform offers two types of tokens. Practice Coins are meaningless and only for show. Coverd Cash, which you get as a “bonus” when you buy tokens, is the part that matters. If you win, it reduces your credit card balance.

Your odds of winning depend on how much you play relative to the total prize pool. The more you contribute, the better your chances. But luck decides everything. You could spend plenty and still walk away empty-handed. That is not financial empowerment, that is risk.

Coverd Cash and Redemption

Coverd Cash cannot be withdrawn, sold, or given to anyone else. It is locked to your account and only applies to your own balance. Redemption rules are also set by the platform, which means you never really control how much you can use.

That makes Coverd Cash a rebate you have to gamble for. It is not guaranteed, and it adds uncertainty to something that should be simple and clear: paying off your debt.

The Coverd Card

Coverd also plans to launch its own credit card in 2026. It promises features such as up to 100 per cent cashback, no hidden fees, and spending insights, along with automatic entries into win-back games whenever you use the card.

On paper, that sounds attractive. In practice, it is a way to pull consumers deeper into a system where debt repayment is tied to chance. It encourages people to spend more, not because they need to, but because they are chasing a win.

Why This Would Never Fly Here

Coverd may be possible in the United States, but in Malaysia it would never stand a chance. Bank Negara Malaysia requires credit card rewards to be predictable, transparent, and fair. Repayment cannot be left to luck.

If a product like this arrived here, it would be seen for what it is: a system that normalises gambling behaviour under the guise of financial services. It blurs the line between managing your debt and taking a bet. And it risks preying on people who may already be struggling to keep up with payments.

Malaysia’s strong regulations protect us from experiments like this. And that protection matters. Without it, companies would be free to create financial products that profit when consumers lose. This is exactly why Malaysians are better off not seeing Coverd — or anything like it — enter Southeast Asia.

Playing with Debt is Not a Game

Coverd may be marketed as fun and innovative, but at its core it is reckless. It takes something serious, your credit card debt, and turns it into entertainment. It rewards overspending, shifts the financial risk onto consumers, and makes repayment dependent on chance rather than responsibility.

This is not innovation. It is gambling with another name. And it is exactly the kind of product Southeast Asia should reject.

Debt is not entertainment. It should be clear, structured, and safe. Any company that treats repayment as a lucky draw is bad for consumers, bad for financial stability, and has no place in Malaysia or anywhere in the region.

Follow us on our official WhatsApp channel for the latest money tips and updates.

Comments (0)