Alex Cheong Pui Yin

30th September 2020 - 4 min read

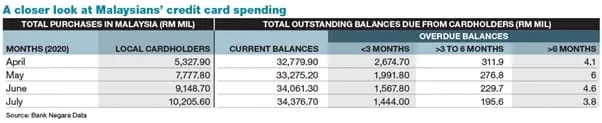

Recent statistics from Bank Negara Malaysia (BNM) has shown that domestic credit card spend among Malaysians has almost doubled in July since April 2020. The amount of expenditure was shown to have increased from RM5.3 billion to RM10.205 billion during this period of time.

Meanwhile, a year-on-year comparison of credit card expenditure between July 2020 and July 2019 – which recorded a total expense of RM10.26 billion – showed that the level of spending has almost returned to pre-Covid-19 level. For further comparison, local cardholders spent RM9.4 billion in July 2018, and RM8.5 billion in July 2017.

Where is the money going?

(Image: Reuters)

With regard to the types of expenditures being made, Maybank detailed that credit card spending had rebounded to pre-MCO levels for some categories of purchases. “The lifestyle category is one of the key benefactors of cardholders’ increased spending, most notably in the automotive segment. The jump in spending for cars is most likely due to customers taking advantage of the SST (sales and services tax) exemptions for all automobiles purchased and registered this year, an initiative under Penjana to boost economic activities,” it said in report by The Edge Markets.

Maybank further revealed that cardholders are also spending more on home improvements, particularly furniture, interior decorations, and renovation-related expenses. This comes as people spend more time staying indoors as well as working from home. “We also observed a slight uptick in EzyPay instalments for larger ticket items, as this helps consumers with their budget planning,” the bank added.

The recovery MCO (RMCO) has also spurred a steady increase in travel-related expenses, especially hotel stays, as cardholders opt for local holidays. This, in turn, has boosted other related spending, such as petrol as well as food and beverages. Additionally, the upsurge in credit card transactions may have also been driven by the government’s effort in encouraging cashless payments.

CIMB, on the other hand, said that their credit cardholders are mostly spending on daily essentials, such as groceries, dining, and purchases on e-commerce platforms.

Increasing outstanding balances

(Image: Free Malaysia Today)

Following the increased credit card expenses in July since April 2020, cardholders’ outstanding balances have also grown during the same period – albeit to a lesser degree. Recent records showed that there has been an increase of 5% from the RM32.8 billion of outstanding balance at the end of April, to RM34.4 billion at the end of July. To compare, a total of RM37.07 billion was recorded in outstanding balances at the end of July 2019.

It should also be noted that only a portion of the outstanding balances of RM34.4 billion consist of overdue payments. Of the amount, RM1.44 billion is overdue for less than three months, RM195.6 million for a period of between three to six months, and RM3.8 million for more than six months.

(Image: The Edge Markets)

In response to this increasing outstanding balances, Maybank said that that it is “a sign of spending normalising and it reflects the pent-up demand among consumers after MCO”. As such, it does not pose a major concern to the bank, although it will continue to monitor their cardholders’ spending and repayment trends, in line with risk management controls put in place.

“At the same time, we have been supporting our cardholders who require assistance by converting outstanding balances to term loans, whether automatically or requested by customers, in order to relieve them during this difficult period. And this assistance will remain available to them until the end of the year,” said the bank. Maybank was referring to a financial aid that was announced alongside the six-month automatic moratorium, which allows banks to convert outstanding credit card balances into 3-year term loans for those who are in need.

Meanwhile, CIMB also expects the trend of spending to continue post-moratorium before normalising by the end of 2020.

(Source: The Edge Markets)

Comments (0)