Farah Awanis

9th January 2026 - 13 min read

Between October 2025 and January 2026, seven Islamic banks in Malaysia converted Islamic credit card contracts from the Ujrah structure to Tawarruq. This affected millions of cardholders across the country and represents a shift in how Islamic banking standardises its practices. As of 5 January 2026, all conversions have been completed.

This article explains how Tawarruq works, why banks made this change, and what it means now that all banks have completed their conversions.

What Does Shariah Contract Conversion Mean?

Islamic credit cards aren’t simply conventional credit cards that have been rebranded. Instead, they operate based on specific Shariah contracts to ensure all transactions are free from riba (interest) and comply with Shariah principles.

Previously, most Islamic banks used the Ujrah structure, where credit facilities were provided through a Qard contract (interest-free loan), while the bank charged a service fee for card management. In short, this structure combined two separate contracts, one for the credit facility and another for card services.

Now, all Islamic banks in Malaysia (except Bank Islam and Bank Muamalat, which already use Tawarruq) have switched to the Tawarruq concept, also known as Commodity Murabahah, as the basis for Islamic credit card structure. Through this mechanism, the card’s credit limit isn’t created through a cash loan, but rather through Shariah-compliant commodity trading transactions.

How Does Tawarruq Work?

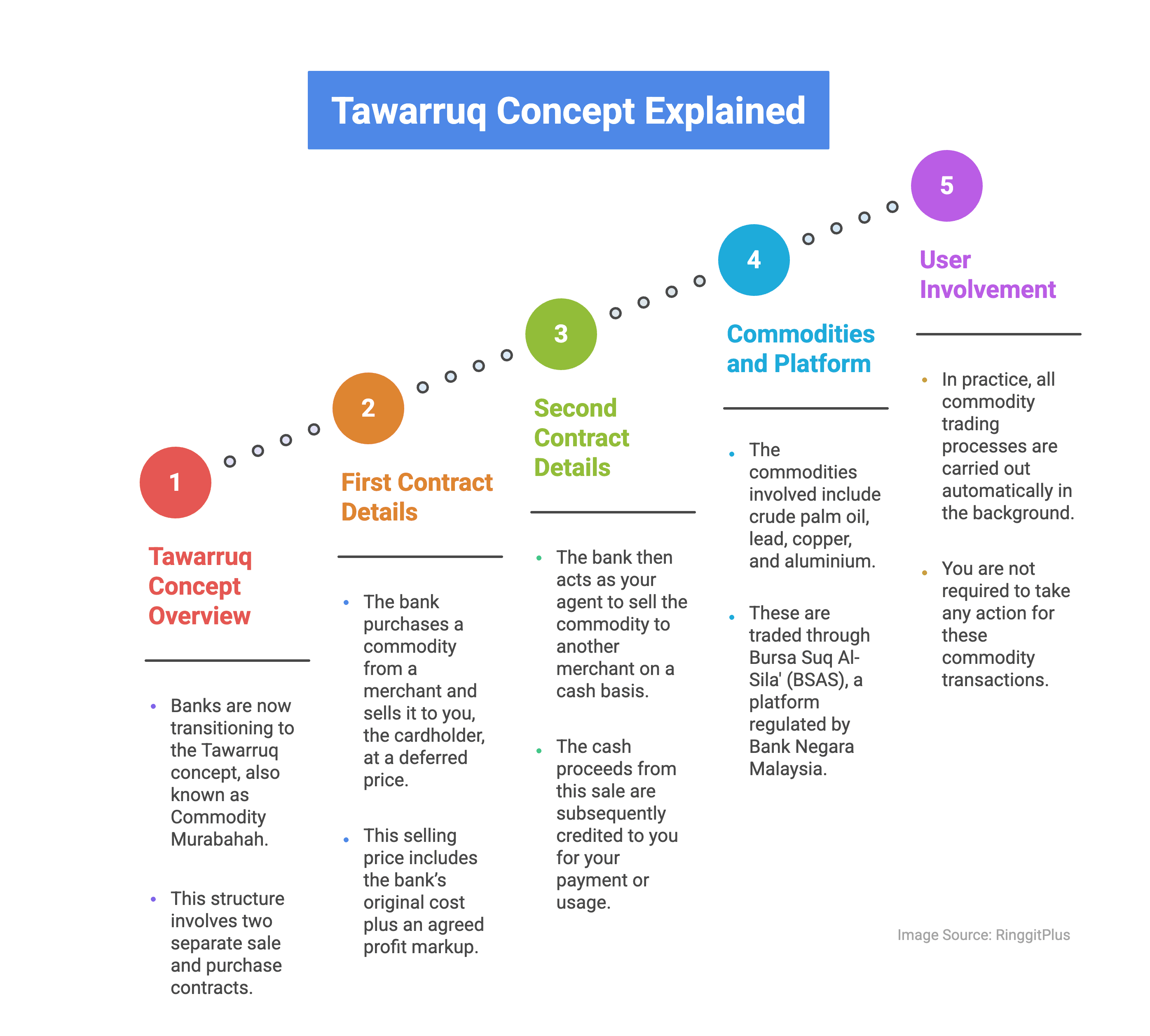

Tawarruq involves several stages of transactions that happen automatically in the background. You don’t see any of this happening, but here’s what’s actually taking place.

You Appoint the Bank as Your Agent (Wakalah)

By continuing to use your card, you automatically authorise the bank to buy and sell commodities on your behalf. In this role, the bank acts as a purchasing agent to acquire commodities and also as a sales agent to sell those commodities to other parties.

First Sale: Bai’ Murabahah (Sale with Profit)

Next, the bank, as your purchasing agent, will buy commodities such as crude palm oil or metals from a third-party commodity seller at cost price. These commodities are then sold to you through a Bai’ Murabahah contract, where the cost price and the bank’s profit rate are clearly stated. This purchase is made on a deferred payment basis, which represents your debt obligation to the bank.

For example:

- Bank buys commodities at cost: RM10,000

- Annual profit rate: 18%

- Bank sells to you: RM10,000 + profit (deferred payment)

This deferred amount becomes your debt obligation under the Bai’ Murabahah contract.

How You Actually Use Your Tawarruq Card

Second Sale: Cash Sale (Spot Sale)

After that, the bank, as your sales agent, will sell the same commodities to another commodity buyer immediately (on a spot payment basis). The cash sale proceeds are then used as the available credit limit in your card.

You Use the Credit Limit Like a Regular Credit Card

This credit limit can be used like a regular credit card for daily spending. Each time you make a payment, that amount will restore the available credit limit. From a Shariah perspective, this available balance is classified as Dayn, which is Shariah-compliant debt, while your repayment is kept by the bank under the Wadi’ah or trust concept.

If there’s an unused limit, that amount will be settled through a Muqasah process, which is a net offset between the debt balance and the bank’s sale price, either during card renewal or account closure.

Why Isn’t This Process Visible to Users?

The entire commodity trading process occurs automatically through Bursa Suq Al-Sila’ (BSAS), a platform regulated by Bank Negara Malaysia (BNM). As a cardholder, you don’t need to buy or sell commodities yourself, manage documentation, or take any additional action.

The bank handles all these transactions as your agent, and you simply use your card as usual.

Why Did Banks Switch to Tawarruq?

This contract conversion wasn’t a decision made by a single bank. It was an industry-wide standardisation step supervised by the Association of Islamic Banking and Financial Institutions Malaysia (AIBIM), in line with Shariah guidelines set by BNM.

Issues with Ujrah Structure in Islamic Credit Cards

Under the Ujrah structure, Islamic credit cards combined Qard as a credit facility and service fees for card management. While both contracts are Shariah-compliant, Shariah resolutions from BNM emphasise that service fees shouldn’t depend on the loan.

Since credit card usage itself involves Qard, this structure requires clearer separation and explanation of contracts to ensure there’s no conditional benefit from the loan, in line with current Shariah requirements.

Why Banks Used Tawarruq Instead

The Islamic banking industry switched to the Tawarruq structure as the solution. Tawarruq is based on actual sale and purchase transactions, where profit comes from sales margin rather than from a loan. The contract structure is clearer, and it’s easier to comply with Shariah principles and resolutions set by BNM.

Important note: Both Ujrah and Tawarruq structures are Shariah-compliant and have been approved by their respective Shariah bodies. This conversion was made to standardise industry practices and ensure Islamic credit card products remain aligned with current regulatory frameworks and Shariah guidelines.

What Remains the Same After Conversion

The good news: from a user perspective, almost everything stays exactly as it was.

Your physical card continues to work with the same card number, credit limit, and expiry date. If your limit was RM10,000 before, it stays RM10,000 after. All your card benefits, including cashback, reward points, airport lounge access, and travel insurance, remain unchanged.

Annual fees don’t change either. If your card was free for life, it stays free. If there’s an annual fee, the amount remains the same. The overall charge rate for outstanding balances also stays constant, so a card with an 18% effective rate continues at 18%.

The Merchant Category Code (MCC) restrictions that prevent spending at non-halal merchants continue to apply. Your card will still automatically decline transactions at prohibited merchants.

Any existing instalment plans you’ve signed up for, such as balance transfers, cash advance plans, instalment payment plans, or easy payment plans, continue according to their original terms until completion. Your interest-free grace period (typically 20 to 25 days from statement date) remains the same, as does the late payment charge structure.

All your automatic payment instructions for utilities, Takaful premiums, and other recurring bills continue functioning without interruption. Your e-wallet connections (Touch ‘n Go, GrabPay, Boost) work exactly as before.

What Changes After Conversion

The changes are mainly technical and happen behind the scenes. Card calculation shifts from a management fee-based system to a sales price-based system, but banks emphasise that the net charge you actually pay remains the same.

Your card’s terms and conditions will be updated to reflect the new Tawarruq contract. Banks will send you the latest version via email, banking app, or with your credit card statement. The Tawarruq contract has a 5-year term for Maybank, for instance, and will automatically renew at the end of the term according to Shariah requirements.

Quick Comparison: Ujrah vs Tawarruq

| Aspect | Ujrah (Old) | Tawarruq (New) |

| Contract basis | Qard (loan) + Ujrah (fee) | Bai’ Murabahah (sale) |

| Credit creation | Direct loan | Commodity trading |

| Charges applied as | Management fee | Profit from sale |

| Commodities involved | No | Yes (via BSAS) |

| The effective rate you pay | 18% p.a. | 18% p.a. (SAME) |

| Grace period | 20-25 days | 20-25 days (SAME) |

| Shariah status | Compliant | Compliant |

What this means: The mechanism changed, but your actual experience and costs remain identical.

New Terminology in Your Statements from January 2026

From January 2026 onwards, you’ll notice some new terms appearing in your credit card statements. The changes reflect the shift from Ujrah’s management fee structure to Tawarruq’s sales-based structure.

New terms you’ll see:

- Bank’s Sale Price – The maximum contract ceiling (e.g., RM24,000 for a RM10,000 limit over 5 years). This is NOT what you’ll actually pay unless you use maximum credit for 5 years without paying anything, which is highly unlikely. Your actual charges are still based on outstanding balances only.

- Bank’s Purchase Price – The original cost the bank paid for commodities, usually matching your credit limit (or credit limit + 50% for some banks)

- Total Profit / Ceiling Profit Rate – The maximum profit amount that can be charged, which forms part of the Bank’s Sale Price

Old terms being replaced:

- Fixed Management Fee (FMF) → Ceiling Profit Rate / Charge

- Actual Management Fee (AMF) → Effective Profit Rate / Charge

- Management Fee → Profit Charge

Conversion Timeline: What Happened

All seven banks completed their conversions between October 2025 and January 2026. Here’s what happened:

Bank Simpanan Nasional (BSN)

Implementation date: 25 October 2025 (COMPLETED)

BSN was the first bank to implement the conversion from Ujrah to Tawarruq. All active BSN Islamic credit cards now operate under the Tawarruq contract, including all Al-Aiman card variants and BSN Corporate Card-i Visa.

HSBC Amanah

Implementation date: 9 December 2025 (COMPLETED)

All active HSBC Amanah Islamic credit cards (HSBC Amanah MPower Platinum Credit Card-i, HSBC Amanah Premier World Mastercard Credit Card-i, HSBC Amanah MPower Credit Card-i) now operate under Tawarruq.

AmBank Islamic

Implementation date: 17 December 2025 (COMPLETED)

All AmBank Islamic credit cards, including SIGNATURE Priority Banking variants, Visa Infinite, World Mastercard, Visa Signature, Al-Taslif, CARz, and e-Cosway cards, now operate under Tawarruq.

RHB Islamic

Implementation date: 18 December 2025 (COMPLETED)

All RHB Islamic credit cards, including Cash Back Credit Card-i, Rewards Visa Credit Card-i, and World MasterCard Credit Card-i, now operate under Tawarruq.

Maybank Islamic

Implementation date: 26 December 2025 (COMPLETED)

All Maybank Islamic credit cards, including all Ikhwan Card variants, Visa/MasterCard, Visa Signature, and all consumer and commercial cards, now operate under Tawarruq.

Public Islamic Bank (PIBB)

Implementation date: Late December 2025 (COMPLETED)

All Public Islamic Bank credit cards (Platinum and Gold variants of both MasterCard and Visa Credit Card-i) now operate under Tawarruq.

CIMB Islamic

Implementation date: 1 January 2026 (COMPLETED)

CIMB Islamic was the final bank to complete the conversion. All active Islamic credit cards (CIMB PETRONAS Visa Platinum-i, CIMB PETRONAS Visa Infinite-i, CIMB Platinum-i MasterCard, CIMB Preferred Visa Infinite-i) now operate under Tawarruq.

Banks Already Using Tawarruq

The following Islamic banks weren’t involved in the conversion because their Islamic credit cards already used Tawarruq from the beginning:

- Bank Islam Malaysia Berhad

- Bank Muamalat Malaysia

What If You Don’t Agree with the Conversion?

All opt-out deadlines have now passed, and all conversions have been completed. If you’re still using your Islamic credit card from any of the seven banks (BSN, HSBC Amanah, AmBank Islamic, RHB Islamic, Maybank Islamic, Public Islamic, or CIMB Islamic), you’ve automatically agreed to the new Tawarruq contract.

If you want to close your card now

Even though all conversions are complete, you can still close your Islamic credit card at any time. You’re not locked in permanently. Contact your bank to close the card and settle all outstanding balances. Standard closure procedures apply, with no special penalties for closing a Tawarruq-based card.

If you’re facing financial difficulties

All banks offer alternative settlement arrangements for cardholders experiencing financial hardship. Contact your bank to discuss what options might be available, regardless of whether your card uses Ujrah or Tawarruq.

Things to Consider Before Closing Your Card

Before you decide to close your card, consider a few practical points.

This wasn’t a decision made by a single bank acting alone. The conversion from Ujrah to Tawarruq was a coordinated, industry-wide effort guided by AIBIM and BNM to standardise Islamic banking practices. Both Ujrah and Tawarruq have been approved by each bank’s Shariah Advisory Council as well as BNM’s SAC. Tawarruq was selected because its structure separates profit from lending more clearly, which matches current Shariah resolutions.

All Islamic banks in Malaysia now use the Tawarruq contract (except those that already used it from the beginning). If you close your current card and apply for a new Islamic credit card elsewhere, you’ll end up with a Tawarruq-based card anyway.

Closing a card can also affect your credit profile, particularly if it’s a longstanding card or one with a high credit limit. The impact on your CCRIS record could be worth considering, especially if you’re planning to apply for other credit facilities in the near future.

Frequently Asked Questions (FAQ)

1. Does this conversion increase my credit card costs?

No. The total charges you pay don’t change. The calculation structure shifts from management fees to sales profit, but the effective rate remains the same. If your card charged 18% per annum on outstanding balances before, it remains 18% per annum after conversion. Annual fees, late payment fees, and all other charges stay identical.

2. Can I still reject this conversion?

No. All conversions have been completed, and all opt-out deadlines have passed. If you’re still using your card, you’ve automatically agreed to the Tawarruq contract. However, you can still close your card at any time if you disagree with the new structure.

3. Does this conversion mean my old card wasn’t Shariah-compliant?

Not at all. Both Ujrah and Tawarruq contracts are Shariah-compliant and have been approved by each bank’s SAC and BNM’s SAC. This conversion aimed to standardise industry practices and ensure uniformity, not to change your card’s Shariah compliance status.

4. Do I need to reapply for a card or receive a new card?

No need. The physical card you hold now can still be used with the same card number, credit limit, and expiry date. The change only occurred in the Shariah contract behind the scenes. No new card or new number is required.

5. Are my rewards, benefits, and instalment plans affected?

No. All rewards, cashback, points, and benefits remain the same. Existing instalment plans such as balance transfers, EzyPay-i, and easy payment plans continue functioning according to original terms until completion. The conversion only changed the Shariah contract, not the card features you see or use.

6. How will my card statement differ after conversion?

You’ll see new terms such as Bank’s Sale Price, Bank’s Purchase Price, and Ceiling Profit Rate starting from your January or February 2026 statement. Although terms change, the statement’s basic function remains the same, where it shows outstanding balance, minimum payment, and charges (if any).

7. What do I need to do now?

Nothing. If you’re still using your card, you’ve automatically agreed to the Tawarruq contract. All conversions are complete. You can continue using your card normally, or you can close it at any time if you prefer.

8. Will this conversion appear in my CCRIS or credit report?

No. The Shariah contract conversion doesn’t affect your CCRIS report or credit score. Your card account will continue to be maintained as before the conversion.

9. What about e-wallets or Touch ‘n Go linked to my card?

All your e-wallet links such as Touch ‘n Go, GrabPay, or Boost, will continue functioning as usual without any disruption. You don’t need to take any additional action.

10. Who can I contact if I’m still confused?

Each bank provides dedicated customer service to help cardholders understand this contract conversion. You can contact customer service, visit a bank branch, use live chat in the app, or send an email. Staff have been trained to explain the Tawarruq concept and answer all questions related to Shariah contract conversion clearly.

11. Are all my transactions charged with markup?

No. Charges only apply to outstanding balances, exactly like before. If you pay your full statement balance every month before the due date, no profit charges apply.

The Bank’s Sale Price (e.g., RM24,000) shown in your contract is the maximum ceiling for the entire 5-year contract term, not a charge on each transaction. It’s only relevant if you carry an outstanding balance, in which case, the same effective profit rate (18% per annum) applies as the old Ujrah structure.

Want smarter financial tips? Join our WhatsApp Channel.

Comments (0)