Pang Tun Yau

17th August 2020 - 3 min read

With its virtual launch event set for tomorrow, Maybank appears to have jumped the gun by publishing the product page of the Maybank Grab Mastercard Platinum credit card ahead of time. All of the card’s features appear to have been disclosed, including a detailed FAQ on the product.

Maybank Grab Mastercard Platinum – Up To 5x GrabRewards Points Per RM1 Spent

Despite earlier rumours and expectations that Grab will launch its GrabPay Card, the Malaysian market will instead see a full-fledged credit card introduced to the market. The Maybank Grab Mastercard is the latest co-branded card by the country’s largest bank, and just like the Maybank Shopee Visa Platinum that was launched recently, this card is heavily linked with Grab’s GrabRewards points system instead of Maybank’s own TreatsPoints.

Depending on the type of transaction, every RM1 spent using the Grab Mastercard will yield rewards in the form of GrabRewards points. The most rewarding will be on using the card on any transaction in Grab – including topping up the GrabPay e-wallet – at a rate of 5 GrabRewards points for every RM1.

Meanwhile, cardholders also earn 2 GrabRewards points for every RM1 spent on overseas, cross-border, and e-commerce transactions. Finally, other transactions will yield 1 GrabRewards points for every RM3 spent on local transactions (based on Maybank’s list of eligible transactions).

How valuable are GrabRewards points? You can read up on latest redemption rates here, but if we’re using the RM5 for 800 points rate (they differ depending on value of redemption), 1 point is worth 0.625 sen; at max earnings potential of 5x points, you’ll earn an effective 3.125 sen for every RM1 spent on Grab using the Maybank Grab Mastercard – that’s a return of 3.125%, which is pretty solid. We’ll analyse the card’s potential returns even deeper in our review.

New cardholders will receive two welcome gifts: 1,000 GrabRewards points upon activation, as well as five RM5 GrabFood and GrabRide vouchers upon meeting a spend criteria of RM300 on Grab services within 45 days from card approval.

There are also a number of lifestyle voucher codes that offer instant discounts when using the Maybank Grab Mastercard at participating partners such as Zalora, Hermo, Harvey Norman, and others. The list of partners will refresh every month.

In addition, all Maybank Grab Mastercard holders will automatically be upgraded to Platinum on GrabRewards, allowing them to enjoy accelerated points earnings of 3 GrabRewards Points for every RM1 spent using GrabPay, as well as other perks. Cardholders will enjoy six months of Platinum, but will need to meet Grab’s requirements of earning more than 3,500 GrabRewards points to maintain Platinum status for the following six months.

Maybank Grab Mastercard Annual Fee & Income Requirements

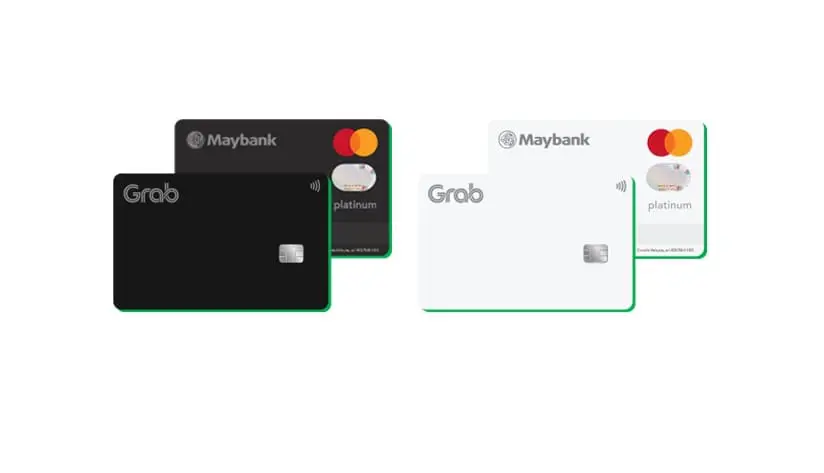

One unique aspect of the Maybank Grab Mastercard is the option of choosing the physical card in either Black or White. Both colour variants have a green outline along the edges of the card, and the front face is clean with only the Grab logo present – the Maybank and Mastercard logos as well as the cardholder’s details will all be located at the back.

The Maybank Grab Mastercard is an entry-level credit card with an annual income requirement of RM36,000 (RM3,000 a month), and is free for life with zero annual fees. The card will officially be launched tomorrow at a virtual launch event.

Comments (0)