Pang Tun Yau

20th March 2020 - 6 min read

Grab will be delivering a one-two blow to GrabRewards in Malaysia very, very soon. Fresh from revising the amount of points you can earn with GrabPay, the company has shifted its focus to revising the value of GrabRewards Points come 15 April 2020.

Grab’s updated Rewards page contain a number of new information to process, but in short they can be summed up with four key points: devaluation of GrabRewards earn rate, devaluation of GrabRewards redemption rate, removal of high-value vouchers, and a last-chance period to redeem vouchers at reduced rates.

Devaluation of GrabRewards Earn Rate

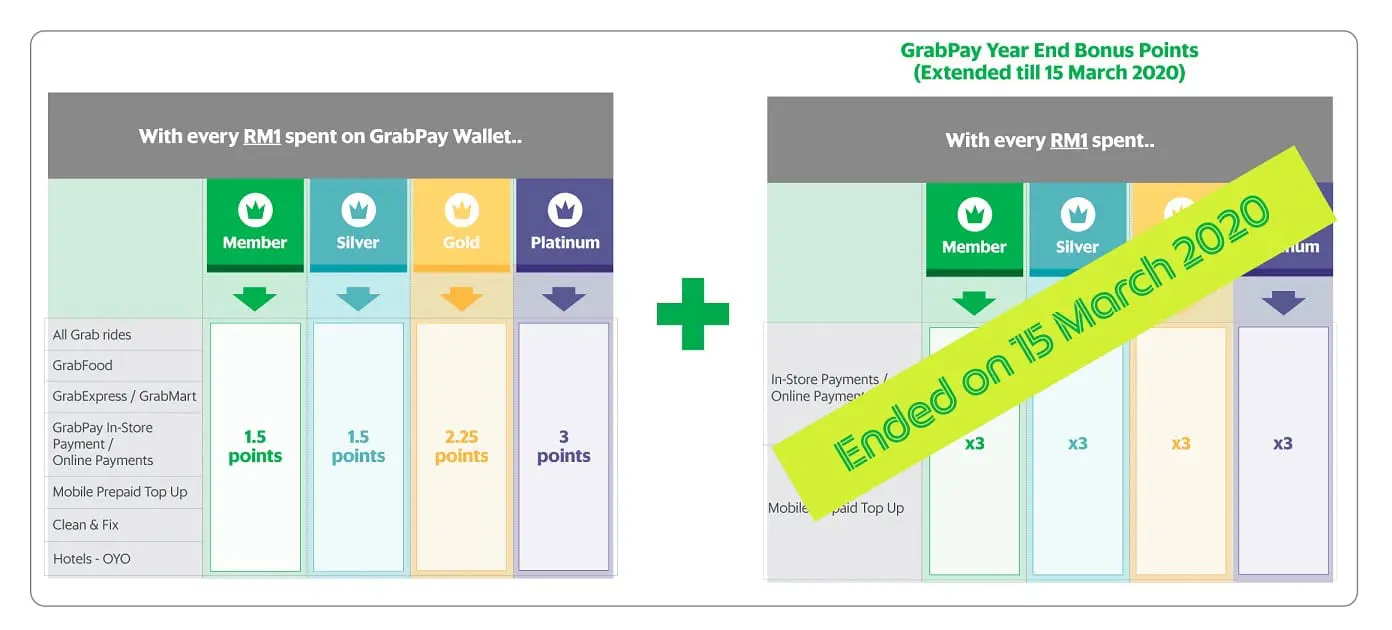

We knew this was since July 2019, but unlike the end of last year, Grab did not offer another extension to the earn rates of GrabRewards Points. As of 16 March 2020, Grab has streamlined the earn rates for all GrabPay transactions across all membership tiers, where the maximum earn rate is 3 points for every RM1 spent (Platinum).

This blow was cushioned somewhat by the Grab “Year End Bonus Points” promo that started in October 2019 and ended on 15 March 2020 after an additional three-month extension in January. The “Year End Bonus Points” added a bonus multiplier for various Grab transactions. In particular, it made the jump from 20x points for GrabPay in-store payments to 3x easier to stomach thanks to the multiplier that let users enjoy 9x points for six months.

We’ve analysed this devaluation in a previous post – do check that out before reading the next section.

Devaluation to GrabRewards Redemption Rate

From 15 April onwards, Grab will be reducing the redemption rates for all GrabRewards members by around 34%. Let that sink in – a 200% reduction in earn rate in March, and a 34% increase in the number of points needed to redeem a voucher in April. How’s that for a one-two blow?

The current earn rate of 3 points per RM1 is equivalent to 2.5% returns (based on Grab’s redemption rate of 600 points = RM5). The value naturally gets lower as you go down the tiers (1.875% for Gold, 1.25% for Silver and Basic), and this combined with no changes to the membership tier qualification levels means you’ll need to spend more to upgrade your GrabRewards tier.

Unfortunately, this calculation will change from 15 April onwards as it will now take 800 points to redeem a RM5 voucher – a 33.33% increase. This means that your rate of return will now be reduced to 1.875% (Platinum), 1.41% (Gold), and 0.94% (Silver and Basic). Most cashback credit cards give better return rates.

| Voucher Value | Points Required (Until 14 April 2020) | Points required (From 15 April 2020) | Points increase |

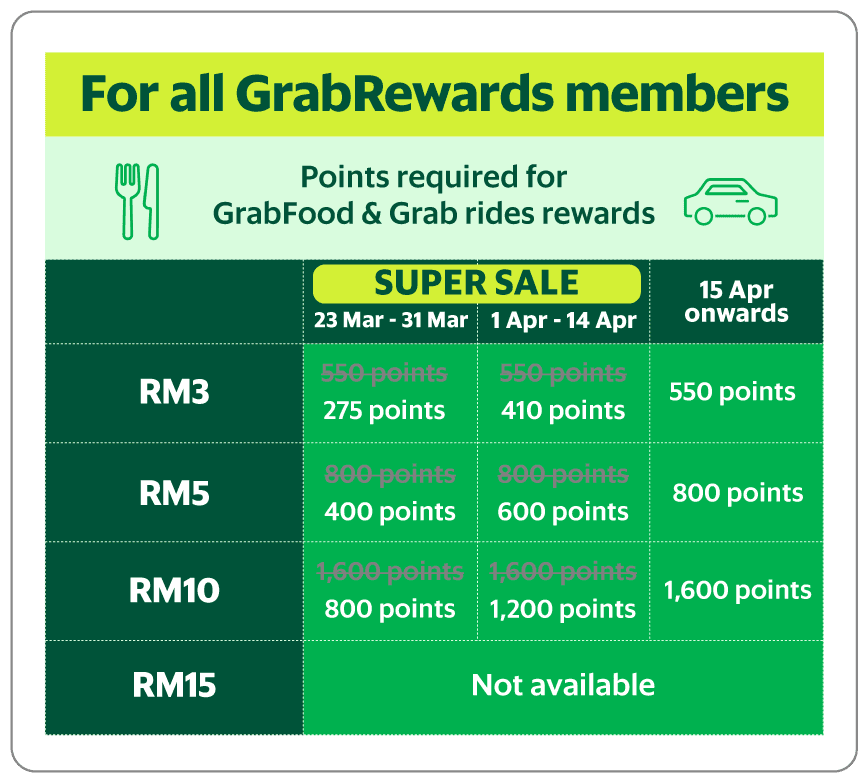

| RM3 | 410 | 550 | 140 (34.15%) |

| RM5 | 600 | 800 | 200 (33.33%) |

| RM10 | 1200 | 1600 | 400 (33.33%) |

Note that this is the base redemption rate for Grab services. The partner redemption rates will surely be adjusted at a slightly higher rate. We already saw this with the current GrabRewards catalogue, where some RM5 vouchers can be redeemed for 600 points or 650 points.

Removal of High-Value Grab Vouchers

Ready for worse news? The new GrabRewards catalogue will also remove high-value Grab vouchers. Grab has gradually been removing its high-value vouchers; first to go were the RM20 and RM25 ones, and the RM15 that’s still available now will be next to go. From 15 April, the maximum discount voucher you can redeem will be RM10 (1,200 points currently, 1,600 points from 15 April). Instead, Grab will introduce a new RM3 voucher (550 points from 15 April). The removal puts a low cap on how much you can save per transaction, making it rather difficult to use up your points.

For GrabFood in particular, where delivery fees can now range from RM5 to RM8, this RM10 voucher cap means it will only cover delivery charges and a slight portion of your food order. Combine that with the fact that Grab regularly offers free delivery vouchers, and you’ll have fewer opportunities to spend your points.

Sure, that’s not a bad thing as you only need to make one qualifying transaction to extend your points validity, but what’s the use of non-expiring points when there isn’t anything of value to redeem them with? Fingers crossed, the Limited Edition range will be good – but I personally haven’t seen anything noteworthy on any month since the first month it was introduced. In fact, the dearth of options available and their poor redemption value makes Boost’s points redemption for high-value items a lot more enticing.

One Last Chance To Redeem Discounted Vouchers

If all that sounds gloomy… well, it is. This is a clear indication that the GrabPay e-wallet has exited the user acquisition phase and into a more sustainable business model with monetisation. Grab obviously cannot continue to offer crazy points multipliers at its current redemption rate, and it is also obvious that other e-wallets are also beginning to scale down on discounts and other acquisition activities.

So, what can you do with the points you have left? Fortunately, Grab is offering one last chance to use your points with the GrabRewards Super Sale.

From 23 – 31 March 2020, Grab is offering 50% off redemption rates for GrabFood, Grab Rides, and selected Grab partner rewards. This eight-day window is your only chance of milking as much value out of your GrabRewards points as possible – in fact, the redemption rate during this period is even better than the forever-discounted rates pre-October 2019. So if you’re a regular user of Grab’s services, it’s the best time to stock up on Grab vouchers. Grab did not mention which partner rewards will also be included in this campaign, unfortunately.

In addition, from 1-14 April 2020, Grab is offering “25% off” redemption rates for GrabFood, Grab Rides, and selected Grab partner rewards. To put it bluntly, it’s not a 25% discount – it’s merely the same redemption rate that Grab has maintained since it started (600 points = RM5).

Goodbye, Old Friend?

If it isn’t already, all these revisions will definitely dethrone Grab as one of the best e-wallets in Malaysia. With a maximum rate of return of just 1.875%, it’s lower than Boost’s rewards programme (and that doesn’t count the potential bonus you get from the Shake Rewards).

That’s a hard pill to swallow. With its warchest, GrabPay very quickly became a favourite thanks to the insane 20x points bonus for GrabPay when it began rolling out in mid-2018, and the ability to use American Express cards. Come 15 April, Grab’s only major pulling factor will be the Grab Ride and GrabFood services that it’s synonymous with today. To that end, Grab achieved what it set out to do when it offered steep benefits to entice users to use its services.

But come 15 April, it makes more sense to use credit cards to pay for those services, since direct payment for Grab services (Grab Ride, GrabExpress, GrabMart, and GrabFood) are all eligible for cashback or rewards points. Actually, where possible, it makes more sense to use credit cards over GrabPay at this point.

In Singapore, GrabPay is still considered the best e-wallet around – even after its own major devaluation. But in Malaysia where there are at least two major competitors, it’ll be interesting to see where consumers will swing to when the big GrabPay nerf sets in. Will GrabPay users today still stick around?

Comments (0)