Alex Cheong Pui Yin

11th March 2022 - 2 min read

UOB Bank has announced some revisions to the cashback benefit of its YOLO credit card, which includes introducing an e-wallet cashback sub-limit under the Online spend category, as well as updating the cashback earning mechanics and the monthly payout allocated. These changes are slated to take effect starting from 1 April 2022.

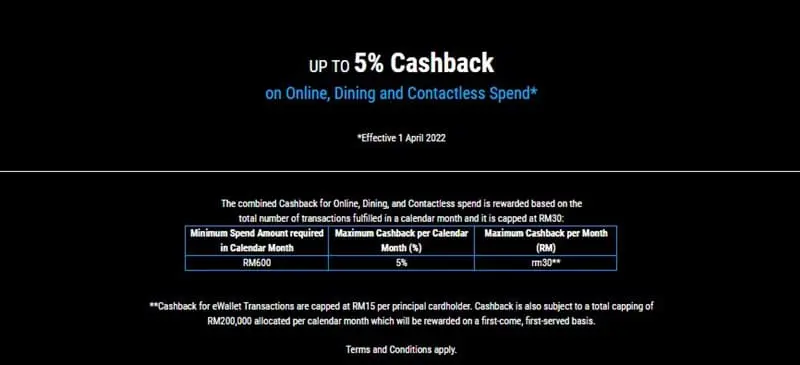

UOB YOLO cardmembers are currently able to earn 5% cashback on Online, Dining, and Contactless expenses, capped at a maximum of RM30 per month. This is provided you meet the qualifying criteria of making at least five transactions each month (minimum spend of RM15 each transaction).

Come 1 April 2022, UOB is introducing a new RM15 sub-limit on the cashback that you can get for e-wallet reloads under the Online category. So if you’re planning to earn the full RM30 cashback allowed via the YOLO card through online spend, you can receive 5% cashback on e-wallet reloads up to a maximum spend of RM300 (which gives you a cashback of RM15), after which you’ll need to get the remaining RM15 cashback via other non-e-wallet online spend, Dining, or Contactless transactions.

Aside from that, the bank is also removing the earning condition that requires you to perform at least five transactions each month to qualify for cashback. Instead, you can only unlock UOB YOLO’s cashback by spending a minimum of RM600 per month starting from April. This makes it easier to earn cashback with the card.

Finally, UOB is increasing the amount allocated for the total monthly cashback payout from the current RM120,000 to RM200,000, allowing more cardholders to enjoy the cashback benefit of the YOLO credit card. To compare, the current monthly payout of RM120,000 benefits a minimum of 4,000 YOLO cardholders (assuming each cardholder earns the maximum RM30 cashback allowed), while the new payout of RM200,000 will benefit at least 6,666 cardholders.

Ultimately, this upcoming revision will offer UOB YOLO cardholders more flexibility to enjoy the card’s cashback rewards; you will no longer need to rush to make five transactions each month just to qualify for the cashback. Additionally, there’s a higher chance of earning cashback with the larger cashback set by the bank. However, the new e-wallet sub-limit under the Online category may be somewhat limiting, especially if you’ve been using this card for e-wallet top-ups.

(Source: UOB)

Comments (0)