Jacie Tan

9th May 2019 - 2 min read

Starting 1 June 2019, transactions made to Grab will no longer be eligible for cashback under the UOB YOLO credit card. They will also be excluded from the total number of transactions required to qualify for cashback each month.

A revised T&C for the UOB YOLO, which takes into effect from 1 June, adds Grab transactions to the “Exclusions” section for both cashback eligibility and transaction count. Previously, Grab transactions were eligible for cashback under the online spend category and also contributed towards the number of transactions you had to make in order to qualify for cashback.

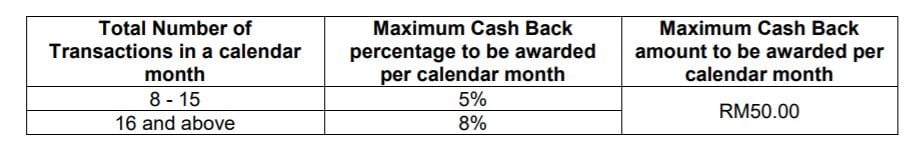

The UOB YOLO credit card offers 5–8% cashback on online spend and dining, depending on how many transactions you make using the card. 8–15 transactions in a month gets you 5% cashback, whereas 16 or more transactions will earn you the higher rate of 8%. Cashback is capped at RM50 per month for each cardholder and limited to a total cashback payout of RM120,000 per month to all UOB YOLO cardholders.

Although cardholders will no longer be able to get cashback for their Grab rides, GrabFood deliveries, or GrabPay e-wallet top-ups, the bank is still offering cashback for Grab – but in a different form. It currently offers weekday and weekend cashback of 5% and 10% respectively for all Grab transactions. This cashback is capped at RM20 a month, and with a monthly cashback cap of RM20,000. It is quite decent as a cashback replacement, but the low monthly cap still means you’ll need to top up at the start of every month. This campaign ends on 31 January 2020.

While this revision will affect those who regularly use the card for Grab transactions, the UOB YOLO still remains a rewarding cashback card – if you can hit the required number of transactions before the general monthly quota runs out, of course. It’s the only credit card that allows you to get cashback for paying bills online through JomPAY, and if you’re a movie buff, it’s got a year-long promotion where you get movie tickets for just RM5 on Fridays at GSC.

Comments (0)