Alex Cheong Pui Yin

3rd October 2023 - 5 min read

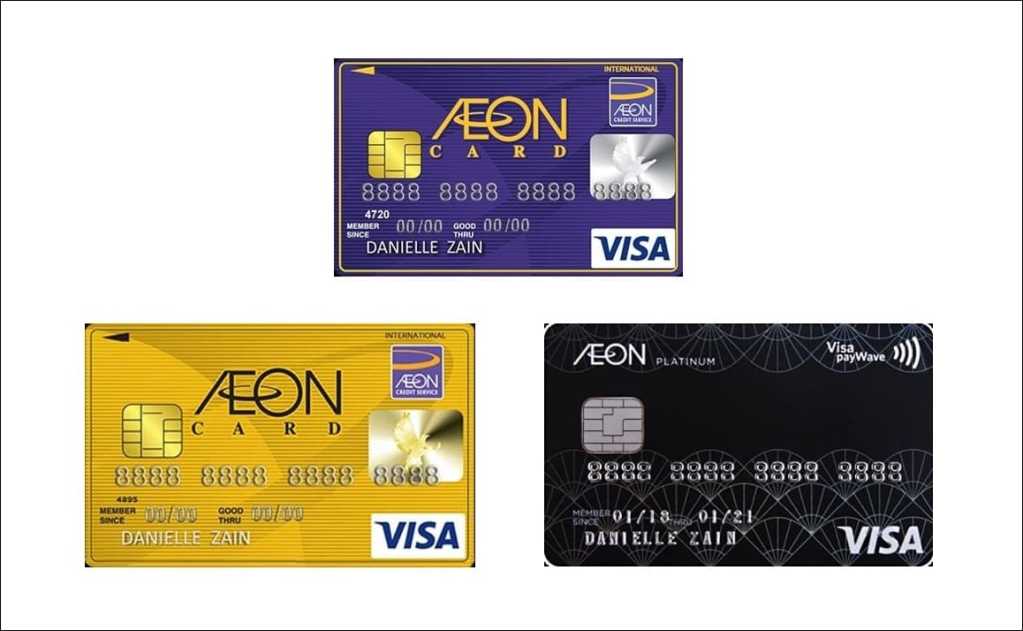

AEON Credit Service Malaysia has announced some updates to the benefits of its AEON Classic, AEON Gold, and AEON Platinum Visa/Mastercard credit cards. Effectively immediately, these revisions are quite extensive, including an increase in the cashback rate for some cards, as well as the widening of selected benefits to all AEON stores instead of only selected outlets.

In its notice, AEON Credit Service noted that this round of updates is made as part of its effort to consolidate and merge some existing cards, in a bid to better serve cardholders’ needs. Specifically, AEON Credit is merging the AEON Classic and New AEON Classic credit cards (Visa/Mastercard) into the updated AEON Classic with improved features, as well as the AEON Gold and New AEON Gold cards (Visa/Mastercard) into the revised AEON Gold card. Meanwhile, the AEON Platinum card is receiving an update to its current list of benefits.

Here are the new benefits of the updated AEON Classic card, in comparison to the two original cards (AEON Classic and New AEON Classic cards):

| Current features | Updated features (Effective immediately) |

| AEON Classic (Visa/Mastercard) – 5% cashback on 28th of the month at AEON BiG (capped at RM100 per card per month) – 1x Member Point for every RM2 spent on other transactions New AEON Classic (Visa/Mastercard) – 5% cashback on 20th of the month at AEON stores (capped at RM100 per card per month) – 4x Member Points for every RM1 spent on 10th of every month at AEON stores – 2x Member Points for every RM1 spent at AEON stores – 1x Member Point for every RM2 spent on other transactions | – 5% cashback on Thank You Day at all AEON stores*, i.e. on 20th and 28th every month (capped at RM100 per card per month) – 2x Member Points for every RM1 spent at all AEON stores* – 1x Member Point for every RM2 spent on other transactions * Includes AEON Retail, AEON BiG, MaxValu, Daiso (by AEON), MyAEON2Go, and AEON Wellness |

Meanwhile, the latest AEON Gold credit card will feature the following perks, in contrast to the previous AEON Gold and New AEON Gold cards:

| Current features | Updated features (Effective immediately) |

| AEON Gold (Visa/Mastercard) – 5% cashback on dining (capped at RM25 per card, total monthly pool of RM10,000) – 1x Member Point for every RM2 spent on other transactions – 3x complimentary access to Plaza Premium Lounge – RM200,000 travel insurance coverage New AEON Gold (Visa/Mastercard) – 5% cashback on 20th of the month at AEON stores (capped at RM100 per card per month) – 4x Member Points for every RM1 spent on 10th of every month at AEON stores – 2x Member Points for every RM1 spent at AEON stores – 1x Member Points for every RM2 spent on other transactions – 3x complimentary access to Plaza Premium Lounge – RM200,000 travel insurance coverage | – 8% cashback on Thank You Day at all AEON stores*, i.e. on 20th and 28th every month (capped at RM100 per card per month) – 5% cashback on dining (capped at RM25 per card per month) – 3x Member Points on overseas spend – 2x Member Points for every RM1 spent at all AEON stores* – 1x Member Point for every RM2 spent on other transactions – 3x complimentary access to Plaza Premium Lounge – RM200,000 travel insurance coverage * Includes AEON Retail, AEON BiG, MaxValu, Daiso (by AEON), MyAEON2Go, and AEON Wellness |

As for the AEON Platinum card, selected perks have been upgraded, including its original 5% cashback rate at AEON stores and AEON BiG on selected days:

| Current features | Updated features (Effective immediately) |

| – 5% cashback at AEON stores on 20th of each month – 5% cashback at AEON BiG on 28th of each month – 2% cashback for online utility bill payments (capped at RM25 per card, total monthly pool of RM15,000) – 4x Member Points for every RM1 spent at AEON stores and AEON BiG – 1x Member Point for every RM1 spent on other transactions – RM14 rebate on movie tickets at participating cinemas – 6x complimentary access to Plaza Premium Lounge – RM1 million travel insurance coverage – Welcome bonus: 3x Member Points for petrol, overseas spend/transactions in foreign currencies, and dining (for one year upon card approval) | – 10% cashback on Thank You Day at all AEON stores*, i.e. on 20th and 28th every month (capped at RM100 per card per month) – 2% cashback on online spend (capped at RM25 per card per month) – 6x Member Points on overseas spend – 4x Member Points for every RM1 spent at all AEON stores* – 1x Member Point for every RM1 spent on other transactions – 6x complimentary access to Plaza Premium Lounge – RM1 million travel insurance coverage * Includes AEON Retail, AEON BiG, MaxValu, Daiso (by AEON), MyAEON2Go, and AEON Wellness |

In addition to this, AEON Classic and AEON Gold cardholders will now also enjoy an automatic waiver on their annual fees for the first year, and for subsequent years if they meet the minimum spending criteria of 12 transactions per year. The annual fees for both cards – set at RM30 and RM95, respectively – were previously non-waivable.

Meanwhile, the annual fee for the AEON Platinum card remains unchanged at RM200 – free for the first year, and waivable in the following years with an annual minimum spend of RM18,000. Other card features for all three cards are also maintained.

Finally, AEON Credit Service clarified that all existing AEON Classic, Gold, and Platinum cardholders will not need to replace their current cards to enjoy the new set of benefits. They will automatically be enrolled for them as the revisions kick in, and can therefore use their cards as usual.

(Source: AEON Credit)

Comments (0)