Pang Tun Yau

8th October 2024 - 10 min read

Maybank has announced an upgrade to its World Mastercard and World Mastercard Ikhwan credit cards to the Mastercard World Elite tier, an enhancement that puts it among the highest ranks in Maybank’s credit card portfolio. Besides the usual points earning benefits, the two cards also come with exclusive perks befitting the Mastercard World Elite tier – including a buy one, get one free Business Class flight ticket and a complimentary one night stay in London or Paris.

This isn’t just a simple name change – Maybank has upgraded the World Mastercard and World Mastercard Ikhwan to Mastercard’s highest tier, unlocking premium perks catered to high net worth individuals. (For context, Mastercard has four tiers of credit cards that provide different levels of perks based on specific income levels: Gold/Titanium > Platinum > World > World Elite). With this upgrade, the new Maybank World Elite Mastercard also gains various perks reserved only for World Elite Mastercard.

Maybank World Elite Mastercard & Maybank Islamic World Elite Mastercard Ikhwan – What’s New?

In Malaysia, there are currently only two World Elite Mastercard available for application: the UOB Zenith and the CIMB Travel World Elite. The introduction of the Maybank World Elite Mastercard and Maybank Islamic World Elite Mastercard Ikhwan doubles this number, and will have the lowest income requirements among them at RM190,000/year or RM15,833/month (vs RM192,000 for the UOB Zenith and RM250,000 for the CIMB Travel World Elite).

The main new feature for the Maybank World Elite cards are in the revamped points earning mechanism. Maybank has both streamlined and changed the way the World Elite Mastercards earn TreatsPoints (TP):

- 10 TP for every RM5 spent locally

- 25 TP for every RM5 spend overseas

Essentially, it is the same rate as the current Maybank Visa Infinite and Maybank 2 Premier Amex Reserve, but in a higher multiple; where the Visa Infinite and Amex Reserve earns 2TP for every RM1 spent locally, you need to spend a minimum of RM5 to earn TP with the World Elite Mastercard – any transaction below RM5 will not earn any TP. On top of that, you earn TP in multiples of RM5 instead of RM1 – for example, if the transaction is RM49.90, you will earn 90 TP instead of 98 TP on the Maybank Visa Infinite or Amex Reserve cards. It’s a minor amount, does have the effect of a reduced TP earning potential.

The other major enhancements are the exclusive headline-grabbing perks: buy one, get one free Business Class ticket on Qatar Airways and one night’s complimentary hotel stay – both in London or Paris. We’ve gone through the T&Cs for both campaigns, and here’s what you need to know.

Buy One, Get One Free Business Class Ticket To London or Paris On Qatar Airways

The B1F1 Business Class ticket to London or Paris will be available to cardholders upon meeting a minimum spend of RM250,000 between 8 October 2024 to 8 October 2025. Once met, they will be able to book the tickets from the 25th of the following month via Maybank’s designated travel agent. Travel period is between 9 October 2024 until 8 April 2026. Note that it only covers the base fare – taxes and other fees are not included in the complimentary ticket and must be borne by the customer.

As a general reference point on how to put a number to this perk (and thus how “valuable” it is), we checked for the price of a Business Class round-trip flight from Kuala Lumpur to Paris and London on Qatar Airways for a weekday in September 2025 (to get the lowest possible fare): RM9,729 (excluding RM1,353 in taxes and fees) and RM10,516 (excluding RM2,329 in taxes and fees). Both tickets are also selected on the award-winning Qatar Airways Qsuite Business Class cabin and not on code-share Malaysia Airlines flights for the best possible experience.

Essentially and in the most basic terms, upon spending RM250,000 on various personal expenses, you can “be rewarded” with at least RM9,729 or RM10,516 in value in the form of a Qatar Airways Qsuite return ticket to London or Paris (though this does not take into equation the other ticket you’ll need to purchase and the complimentary ticket’s taxes and fees), equating to a return of 3.89% to 4.21%.

One point worth noting – Maybank has not mentioned whether this will perk will be “refreshed” every year like the airport lounge access benefit. We will be reaching out to clarify this matter, and update this section when we get a response.

Complimentary 1 Night Hotel Stay In London or Paris

Now that you’re flying in style to Paris or London, the Maybank World Elite Mastercard and Maybank Ikhwan World Elite Mastercard will also reward you with a complimentary night’s stay at the Radisson Blu Hotel in Leicester Square, London (Standard room) or the Napoleon Hotel in Paris (Superior room).

The complimentary night is only awarded upon purchasing a one-night stay at either hotel in the same room type. More importantly, there is no spend requirement here unlike the flight ticket perk.

However, do note that the stay period is between 7 October 2024 until 31 December 2025, and that it only covers the base rate excluding taxes, fees, and surcharges. Room upgrade requests are possible, but any additional costs will be incurred by the cardholder. Naturally, blackout dates may apply and the cardholder’s preferred dates may not be guaranteed.

And if you’re curious, here’s the lowest price we found for one night in both hotels in their respective room types (in March 2025): €284.11 for the Radisson Blu London and €351.82 for the Napoleon Hotel Paris (both prices excluding taxes and fees).

Lastly, just like the B1F1 Business Class ticket perk, it is not explicitly stated that this benefit will be a perpetual annual benefit. We will update this section once we get a confirmation from Maybank.

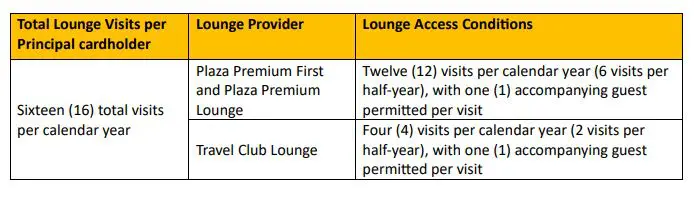

16x Airport Lounge Access – Including 1 Accompanying Guest

The airport lounge perk has also been enhanced, now offering 16x access per calendar year and includes complimentary access for one accompanying guest for each visit. The airport lounge access is broken down as below starting 1 January 2025:

From now until 31 December 2024, the airport lounge access perk is pro-rated to 6x total visits, broken down into 4x Plaza Premium First/Plaza Premium Lounge and 2x Travel Club Lounge – with 1x accompanying guest access for each visit.

Overall, the list of global lounge access covers 14 countries (including Malaysia). The full list of lounges, Aerotel outlets, and airport dining options can be found here.

Other Benefits

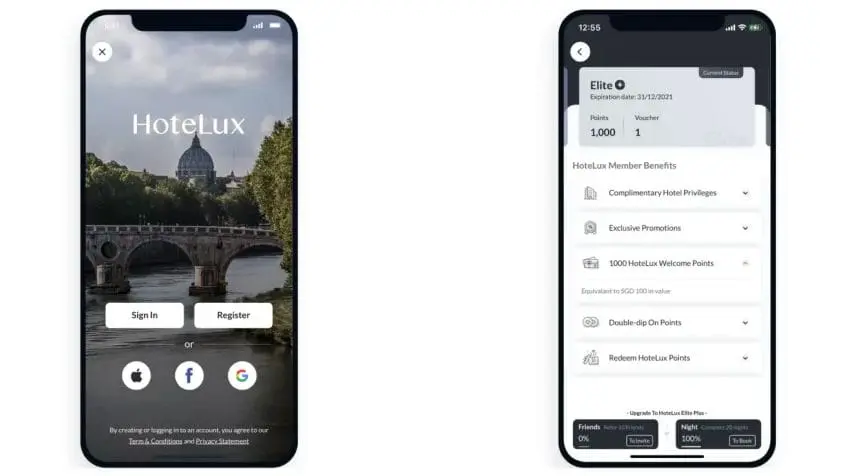

As mentioned earlier, the Mastercard World Elite tier unlocks exclusive perks catered to high net worth individuals. Specifically, you’ll enjoy fast-tracked hotel loyalty programme memberships thanks to loyalty status match at Hotelux Elite and Wyndham Diamond, which will unlock various perks at your luxury hotel stay that may be anything from complimentary room upgrades, breakfast, lounge access, hotel credits, and more.

Other Mastercard World Elite perks include a dedicated 24/7 concierge service, Mastercard Protection that includes travel insurance, purchase protection, and ID theft protection, and various shopping, dining, and travel related perks – you can view the full list here. Another Mastercard perk is the complimentary 3GB global data roaming with Flexiroam valid for 10 days across over 200 countries, with a 15% discount for additional plan purchases.

Lastly, the Maybank World Elite Mastercard and Maybank Islamic World Elite Mastercard Ikhwan will also offer the various benefits available to other premium Maybank cards, including complimentary green fees at over 100 golf clubs around the world, up to 40% dining discount at participating restaurants under Mariott Bonvoy, and up to RM2,000,000 travel insurance.

New Design, New Material

If you’re into aesthetics, you may also be happy to know that the Maybank World Elite Mastercard and Maybank Islamic World Elite Mastercard Ikhwan have a (relatively) new design featuring a similar “cityscape” motif that the other Maybank premium cards have, but with an updated series of iconic buildings that includes newer skyscrapers like Merdeka 118. Like other Mastercard World Elite cards, the card face has a monochrome silver/black colourway that also includes the Mastercard logo.

And, perhaps more importantly to some, this card is made from metal (which also explains why card replacements cost RM175 for this card and RM50 for others). It’s a long-running joke among American Express Platinum Charge Card holders that this is a “key feature”, but given that the World Elite Mastercard card is supported on Google Wallet, Apple Pay, and Samsung Pay, it is highly likely that this card may not leave your wallet as much as you’d ideally like it to.

Available For Applications Immediately; Existing Cardholders Upgraded

The Maybank World Elite Mastercard and Maybank Islamic World Elite Mastercard Ikhwan are now available for application on Maybank’s website and card centres. As mentioned earlier, this card has a minimum annual income requirement of RM190,000, and has a RM800 annual fee that is waived upon an annual spend of RM80,000.

Meanwhile, for existing Maybank World Mastercard and Maybank Islamic World Mastercard Ikhwan cardholders, they will automatically be upgraded to the new card immediately. For Maybank World Mastercard holders specifically, their accumulated Treats Air Miles will be converted to TreatsPoints at a 1:1 basis, which will expand the list of frequent flyer programmes available for redemption from Malaysia Airlines’ Enrich to also cover Cathay Pacific’s Asia Miles and Singapore Airlines’ KrisFlyer.

Final Thoughts

The Maybank World Elite Mastercard and Maybank Islamic World Elite Mastercard Ikhwan plugs a gap at the highest end of Maybank’s credit card portfolio, and one that saw intense competition in recent years with the release of the CIMB Travel World Elite in 2022 and UOB Zenith in 2023. Its main offering at this tier is the American Express Platinum Charge Card that was arguably just as good, if not better than the competition, but a combination of the RM3,000+ annual fee and lower acceptance for Amex cards in Malaysia may have meant a bigger gap in the market that Maybank had anticipated.

At the same time, the new World Elite Mastercards have the same points earning rate as the Maybank Visa Infinite and Amex Reserve – both “lower tier” cards by income level. The RM5 earning blocks will also be a point of contention, as this affects the points earning potential over time.

Compared to the competition, though, both Maybank World Elite Mastercards definitely hold their own. At a glance, both the UOB Zenith and CIMB Travel World Elite have slightly weaker earn rates on local spending, but CIMB holds the distinct advantage of having a much larger list of redemption partners, which includes 12 frequent flyer programmes and four hotel memberships – Maybank only has three frequent flyer programmes available for redemption.

Of course, this doesn’t include the additional perks unique to the two Maybank World Elite Mastercard bring to the table – after all, why go through the hassle of redeeming a flight when you can get it for free? This and the complimentary night’s hotel stay offer better value than, say, the UOB Zenith’s “Fourth Night Free” perk or the CIMB Travel World Elite’s Mariott Vacation Club complimentary 4D3N stay (which was refreshed in its second year at different locations).

All in all, we are excited to see another premium card shaking up the market – it’s a welcome change at a time when many premium air miles cards have become less popular after various revisions.

Comments (0)