Alex Cheong Pui Yin

8th March 2021 - 3 min read

Employees Provident Fund (EPF) members who would like to apply for the updated i-Sinar facility without eligibility conditions can begin to do so on i-Sinar Online, starting from today until 30 June 2021. On top of that, you can also perform other functions – including amending details for your previous applications and cancelling your i-Sinar withdrawals – during this period of time.

As had been previously announced by the EPF, all i-Sinar applications submitted by EPF members below the age of 55 will now be given automatic approval following the removal of eligibility conditions for the facility. This means that they will no longer need to abide by the previous set of application requirements, which requires them to prove a lack of contribution to the EPF for at least 2 months, or a decrease in base or total income by a minimum of 30%. However, approval is still subject to a minimum account balance of RM150 in the member’s Akaun 1.

Meanwhile, the maximum withdrawal amount for the i-Sinar facility that was previously introduced will remain unchanged. In short, eligible members with an account balance of RM100,000 will still be able to withdraw up to RM10,000, whereas those with a balance of more than RM100,000 can take out up to 10% of their savings.

Following this update to the eligibility conditions, new i-Sinar applicants should also note that the interim payment of RM1,000 will now be terminated. The interim payment was originally intended as an immediate assistance for applicants who fall under Category 2, while they wait for their i-Sinar applications to be approved and verified.

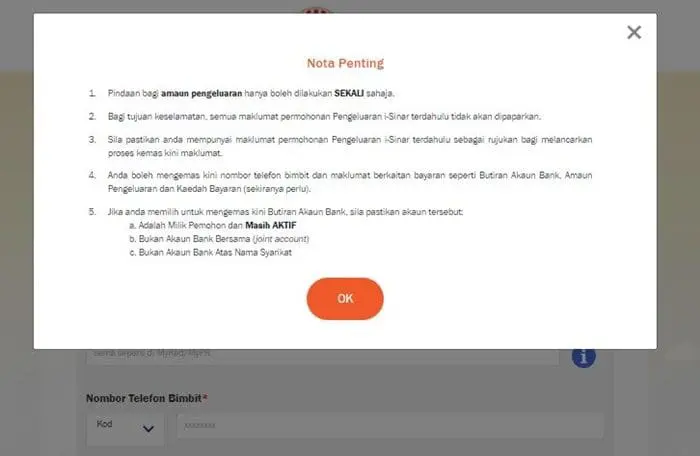

Aside from reopening the submission for new i-Sinar applications, the EPF is now also allowing members to amend certain details in their previous applications via i-Sinar Online. These details include the withdrawal amount, bank details, address, phone number, and payment method. Note, though, that the withdrawal amount can only be amended once, so do confirm your new preferred amount before proceeding with any changes. Also, the details for your original application will not be displayed during the amendment process for security reasons, so make sure to have a copy of your earlier application for reference if required.

As for those who would like to cancel their i-Sinar withdrawals, you can also do so via an online form on i-Sinar Online. These cancellations can only be done once, and you will not be allowed to re-apply for the i-Sinar facility again after the cancellation has been approved. The details for your earlier i-Sinar application will not be shown during the cancellation process either.

You can find out more about the i-Sinar withdrawal facility with its updated eligibility criteria in the official i-Sinar website here.

(Source: EPF)

Comments (0)