Diana Chai

17th September 2013 - 4 min read

Much has been said about Bank Negara’s new guidelines regarding loan tenures. The banking authority released regulations limiting tenures for home loans and personal loans in a bid to reduce escalating debt rates. The move had its supporters and detractors but as we plan to show you, in personal loans, longer is definitely not better.

According to the guidelines, the maximum number of years for which a personal loan can be taken is 10 years. It doesn’t matter if you’re looking for a BSN personal loan, a CIMB Bank personal loan, or even a Standard Chartered personal loan, the Bank Negara guideline applies to all banks in Malaysia. This ruling will affect mostly non-commercial banks as for regular commercial banks tenures typically don’t exceed 8 years. Nonetheless, taking out a loan for even 7 years could cause a serious dent in your wallet.

How personal loan interest rates work

Unlike home loans or credit card balances, personal loan interest rates are calculated every year based on the amount you borrowed and not the amount you have remaining to repay. This means that even when your balance hits its final monthly payment of, say, RM400, you are still paying interest on the RM10,000 you borrowed.

How is this different from the earlier mentioned banking products?

For credit cards and home loans, even though your interest rate is a fixed 18% or 4% per annum; this percentage is calculated on the balance you have remaining at the end of the month and NOT the amount you started out with. And this can make a big difference. If you have an RM10,000 balance on your credit card and RM10,000 in personal loans, after paying a minimum of RM500 for 12 months (equivalent to approximately RM6000), the interest you pay on the 7th month is RM60 on the credit card and RM75 on the personal loan. Despite the interest on a credit card being 18%, and the personal loan being 9%; you still pay more on the personal loan because of the method of calculation.

Bad news for longer tenures

Whilst it seems almost obvious that paying a loan over a longer period of time will cost you more money; the damage is especially pronounced when you’re continually paying for a principal amount you no longer carry with your bank.

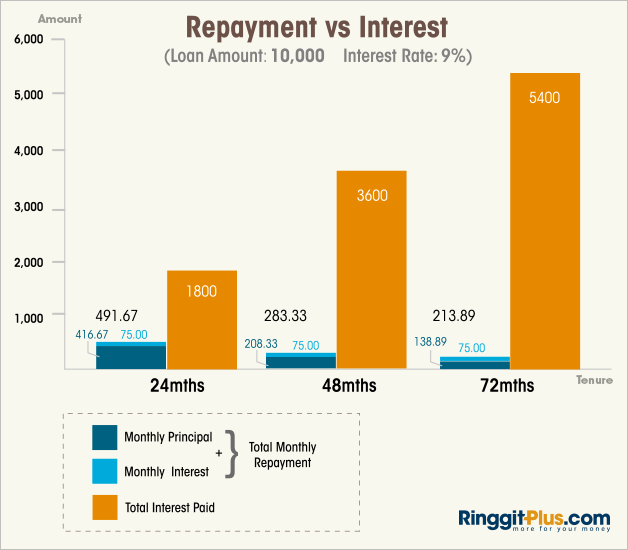

We’ve done the math for you. Using the same example above, a loan of RM10,000 on a 9% interest rate, you can expect to pay the following amounts in interest:

A quick look at the calculations above show the true amount you will be paying in interest alone. For an RM10,000 loan, the total interest is RM12,600 if you take it over 6 years: more than 50% of the original borrowed amount. The monthly repayment amount is low to be sure; only RM213.89 per month and as such, many would take out such a loan and repay without realising how much it has cost them. In the above scenario, opting to pay just and extra RM300 could save you RM3600.

A case of affordability?

For those who truly need the money and are unable to pay more than the very minimum amount, it is understandable to opt for a long tenure but if you are able to repay just a little bit more, the interest savings would make the inconvenience worthwhile.

A personal loan is no doubt an expensive banking product but its usefulness in times of emergencies is undoubted. A credit card will not always be able to patch a financial gap the way cold cash can. The inconvenient truth remains, however, that we do pay dearly for such assistance.

Comments (0)