Alex Cheong Pui Yin

5th April 2024 - 6 min read

There are quite a few types of tax reliefs that you can claim to reduce your chargeable income and thus pay less in taxes, and some of the biggest reliefs you can get are from any insurance policies that you may own.

If this is your first time filing your taxes, claiming for your insurance premiums is not as straight forward as putting the total premium you pay for your policy each year. The premium is broken down into a few charges, such as Life, Medical, and Others. It is important that you make the proper claims for income tax relief when filing your tax returns in Malaysia, because you may end up overstating the amount in your tax filing and risk being penalised for this error.

In this article, we will walk you through claiming tax reliefs for your insurance payments. More precisely, we will help you identify what to look out for in your annual insurance statements, as well as how exactly to claim for tax reliefs for your insurance in your income tax returns form (ITRF).

What are the income tax reliefs offered for insurance?

When it comes to insurance policies, these are the claimable tax reliefs offered for Malaysia personal income tax:

| Malaysia Income Tax Relief | Claim Allowed |

| Life insurance and EPF | – Up to RM3,000 for life insurance and additional voluntary EPF contributions – Up to RM4,000 for EPF contributions and other permitted schemes (inclusive of voluntary EPF contributions) |

| Education and medical insurance | Up to RM3,000 for self, spouse, or child |

| Private retirement scheme (PRS) and deferred annuity | Up to RM3,000 |

For context, the government had made a revision to the tax relief permitted for life insurance and EPF contributions under Budget 2023, which is applicable for YA 2023 and the subsequent years. Specifically, it has been amended so that pensionable civil servants (who do not make voluntary EPF contributions) and private sector employees (who make statutory/voluntary EPF contributions) are now both subjected to the same RM3,000/RM4,000 breakdown for life insurance premiums and EPF contributions.

Previously, pensionable civil servants were allowed to claim the full RM7,000 relief for life insurance premiums/takaful contributions if they do not make any voluntary EPF contributions. Now – just like private sector employees – they can only claim up to RM3,000 for life insurance, and must contribute to the EPF if they wish to tap into the remaining RM4,000 tax relief allocated. This new structure was introduced in a bid to encourage all Malaysians to save more for their retirement.

What is an annual insurance statement?

Your annual insurance statement, also sometimes called an annual premium statement, is a document that lists out your insurance plans with that particular insurer, the amount of premium paid for that year, and the types of coverage you are entitled to. These details will be vital in helping you claim your insurance tax reliefs.

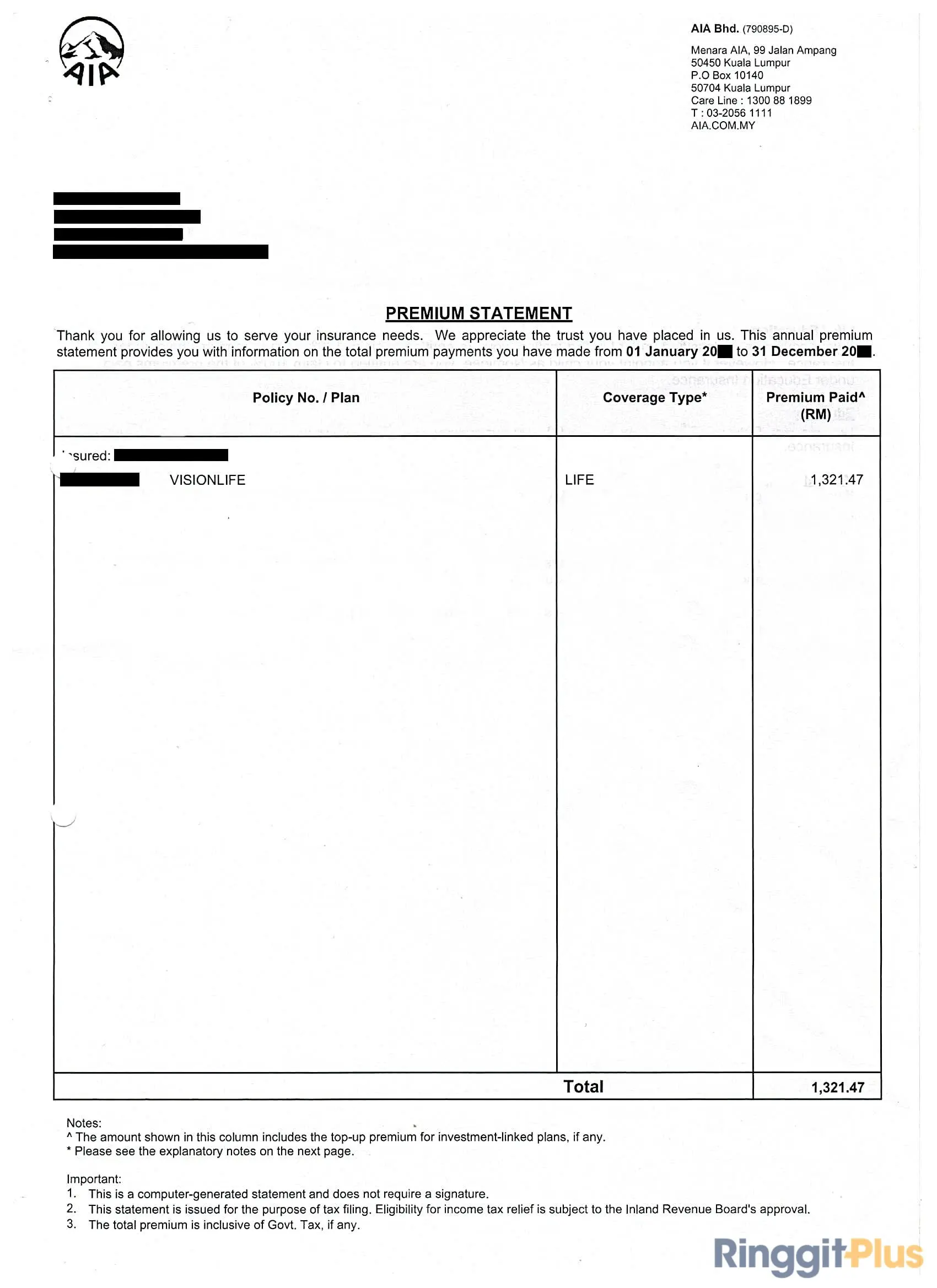

Here is how a typical annual insurance statement would look like:

How to read your annual insurance statement for tax relief claims

For the purposes of income tax relief claims, you will need to depend on your annual insurance statement to know how much you are entitled to claim for. Most insurers already make this quite easy for you, as the statement will break down the amount you can claim under Life, Medical, Critical Illness (also sometimes referred to as “Medical/Life”), and others.

Your different types of insurance or coverage will need to be properly sorted out and claimed accordingly under the different types of income tax relief available for insurance. Here’s a table to help you match your insurance types to the right category:

| Claim under | Types of Insurance/Coverage |

| Life insurance premium | Life

Disability

Life/Education 100% of premium claimable (*Alternatively, claim under “Education and medical insurance” if your nominee is a child) |

| Education and medical insurance | Education

Medical

Critical Illness

|

| Private retirement scheme (PRS) and deferred annuity | Annuity/Deferred Annuity

|

Do note that premiums paid for accidental and waiver riders are not eligible for tax reliefs.

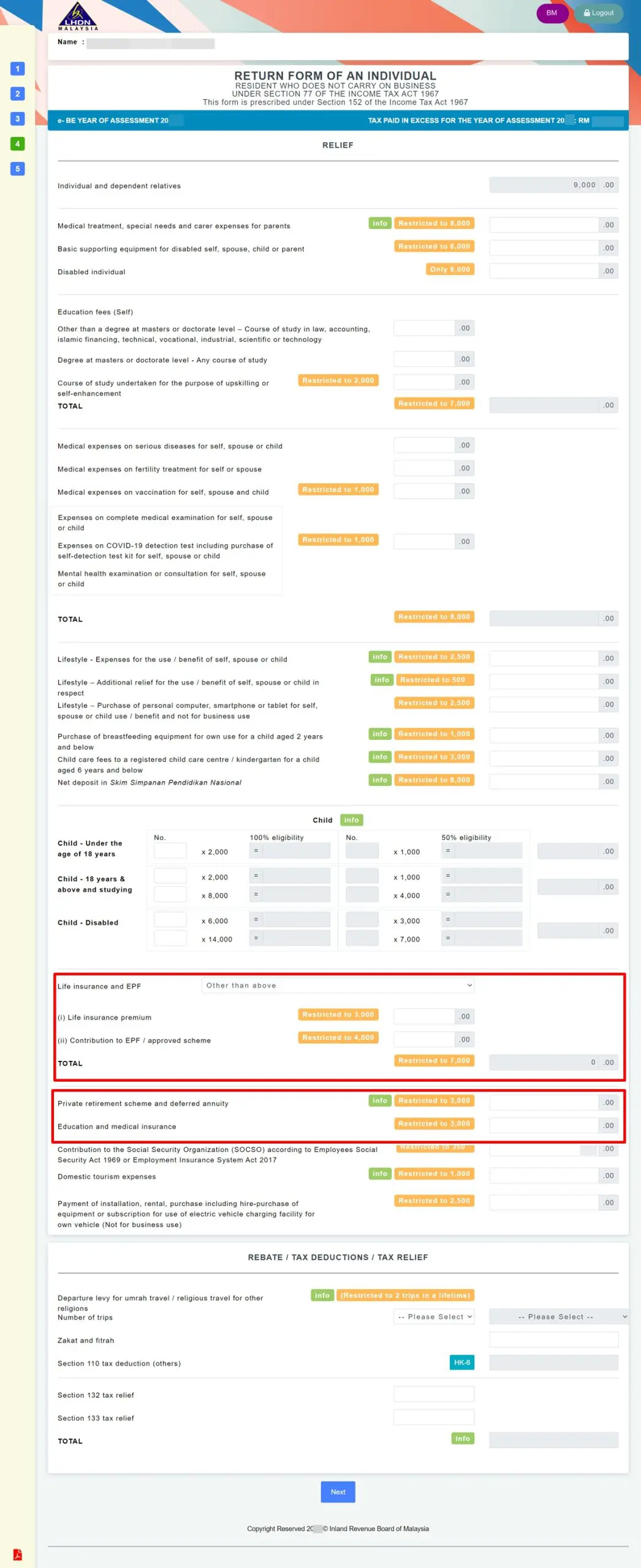

Filling in your income tax

In your online tax filing form (under the “Relief” section), here’s where you should enter the corresponding amounts in your premium statements – we’ve highlighted the relevant items in red:

Examples

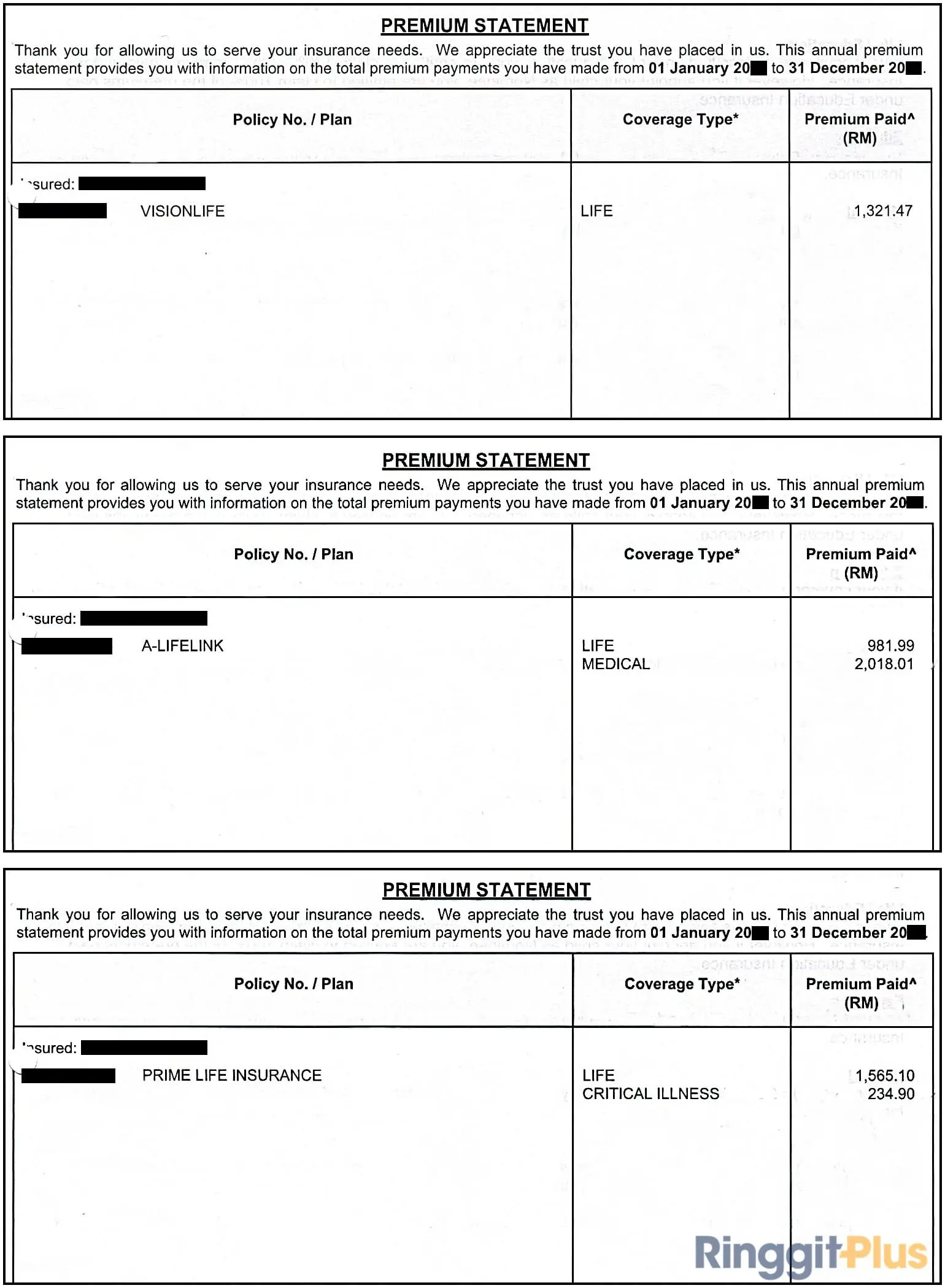

To illustrate how you should calculate your insurance tax reliefs, here’s a scenario: let’s say an individual has three insurance plans with AIA that includes a few types of coverage. Here are his annual insurance statements:

In the example above, the statement expressly states the amount of premium paid for each coverage type. From here, it’s as simple as adding up the amount for each coverage type. Note that for Critical Illness, the individual can either claim 60% of that amount under Education & Medical Insurance, or 100% of it under Life Insurance. Play around with the figures: the aim here is to maximise claims from both Life Insurance and Education & Medical Insurance since they are two separate allocations.

Based on the three statements provided above, here’s how the calculation for tax relief claims will look like:

| Life insurance premium | Education and medical insurance | PRS and deferred annuity | |

| Statement 1 | 1,321.47 | – | – |

| Statement 2 | 981.99 | 2,018.01 | – |

| Statement 3 | 1,565.10 | 140.94 (60% x 234.90) | – |

| Total | 3,868.56 | 2,158.95 | – |

In other words, the individual is actually entitled to claim RM3,868.56 under Life insurance and RM2,158.95 under Education & Medical insurance. However, the Inland Revenue Board (LHDN) has specified that an individual can only claim a maximum of RM3,000 for Life insurance (for non-public servant) as well as RM4,000 for Education & Medical insurance, respectively.

Since the RM3,000 Life insurance allocation has been maxed out, it makes more sense to claim the remaining Critical Illness insurance under Education & Medical insurance, even if the individual can only claim 60% of the amount.

As such, the final insurance tax reliefs will ultimately look like this:

As mentioned earlier, some insurers provide annual insurance statements that have been prepared especially for income tax relief claims, where the premiums are already itemised to easily show how much you can claim for each relief. If that is the case, then all you need to do is to input the figures provided in your statement into your income tax return form – no need for calculations!

***

By protecting yourself and your loved ones with your insurance plans, you also reduce your total taxable income (and hence paying less income tax overall). This is actually one of the many ways the Malaysian government is encouraging Malaysians to be insured.

Hopefully, this will help you better understand how to claim your insurance tax reliefs. If you have any other questions about filing your tax income, do check out our Income Tax page, or start with any of these articles below:

- How To File Your Taxes For The First Time

- Everything You Should Claim As Income Tax Relief Malaysia 2023 (YA 2022)

- Malaysia Personal Income Tax Guide 2023 (YA 2022)

- Understanding Income Tax Reliefs, Rebates, Deductions, And Exemptions In Malaysia

- Income Tax Malaysia: Quick Guide To Tax Deductions For Donations And Gifts

Previously covered recruitment-related stories and had a short stint as a copywriter for the property industry. She subsequently developed an interest in investment and robo-advisors.

Comments (19)

is it this one still valid for 2024 ?

Hi! Just wanna check if hibah is claimable under life insurance? by right its similar to life insurance right

Yep, hibah is usually claimable under life insurance. It’s pretty much like life insurance in that sense.

Hi

I am a foreigner and working in Malaysia. I am paying life insurance premium in my home country. I use my Malaysia income to pay for the premium.

Can I use this expense for claiming tax relief in Malaysia under “Life Insurance Premium”

Thanks

Nitin

Typically, tax relief for life insurance premiums is applicable for policies purchased within Malaysia. I recommend consulting with a tax advisor or contacting the Inland Revenue Board of Malaysia (LHDN) directly.

Hi Nitin, did you get your answer on your query ? I also has exactly the same situation as yours.

Can we still submit for tax relief on the insurance premiums (life or medical) paid in year 2020 & 2021 which were not reported in thier respective year ?

good day….. juat want to know whether can i claim for tax relief if i bought endownment plan. thank you

You should check the plan’s annual statement to see which portion of the premium paid is tax deductible.

Ex-wife of my partner is asking for children’s insurance premium statements for 2019 as LHDN AUDIT unit requires them. Can she claim relief when she didn’t even pay a cent for the children’s insurance?

I noticed Critical illness is only eligible to claim 60% (60% x 234.90=140.94) under Education and Medical insurance. Since 100% of the Critical Illness premium paid is eligible for life insurance tax relief, assuming I only have one policy, can I add the balance of premium paid for Critical Illness (234.90-140.94=93.96) to my life insurance premium of RM1,565.10 to make it RM1,659.06 and claim the amount RM1,659.06 under life insurance tax relief please? Thank you.

2 years later still no answer

You can combine the premiums for Critical Illness and Life Insurance to claim tax relief, as long as the total claimed amount doesn’t exceed the maximum limit for Life Insurance relief. So, you can add the remaining Critical Illness premium to your Life Insurance premium and claim it under Life Insurance relief. Contact your insurance provider for more clarification!

Not correct. You can only claim critical illness under either one: 100% under Life Insurance; or 60% under Medical Insurance. Remaining 40% cannot be claimed under Life Insurance.

Thank you for your input. Insurance policies can vary, so it’s best to check with your provider for specific details on critical illness claims.

On joint assessment with wife earning and husband retired (no income), can wife claim tax relief for husband’s life premium and children’s life and medical premiums up to her limit?

Can CLTA/MRTA insurance claimable under Tax Relief since it’s similar to Life Insurance for Death/TPD?

Thanks for the info.

Someone know if I can deduct Medical Insurance Premiums paid in another country ?

Thx

Olivier

My daughter is 25 years old, still unemployed and son 21 years old , student at a university.

I have been paying for their insurance for the past 15 years and am still paying those premiums.

Can I claim for those premiums, some are life, some education/ life/ medical?

Thank you