Alex Cheong Pui Yin

3rd April 2024 - 6 min read

If you’ve visited the Inland Revenue Board (LHDN) and eZHASiL website in preparation for filing your taxes for this year, you’ll find yourself redirected to the MyTax portal instead. Launched in December 2020, MyTax is intended to be a one-stop service portal where taxpayers can access all the latest tax-related information and services without having to visit the LHDN office.

During its launch, the LHDN emphasised that the portal will be a useful instrument in helping to minimise the country’s revenue leakage while simultaneously boosting revenue collection. Since then, the agency has been gradually migrating its services over to the portal over the past years. This year, all tax-related matters can be conducted on the portal.

But how exactly does MyTax work? What kind of convenience does it bring to taxpayers? How do you access it? Read on to find out more.

What is MyTax?

MyTax is a one-stop platform where you can find and access all tax-related resources and services with a single sign-on. This basically means that with MyTax, you will no longer have to go through the hassle of keying in your passwords multiple times in order to access the different services or information from LHDN via different locations/sites – as was the case previously.

Within MyTax, you’ll find links that let you carry out functions such as filing your income tax returns via e-Filing, paying your taxes via byrHASiL, and updating your tax profile. On top of that, you’ll also be able to find various tax related information and guides, alongside a personal dashboard and mailbox that keeps you updated on your latest tax status.

Aside from being accessible via website, MyTax is also available as a mobile app for those of you who prefer it as such (can be downloaded for free on Google Play, the App Store, and Huawei AppGallery).

Do I need to go through another registration to use MyTax?

Taxpayers who’ve tried to access the ezHASiL website to fill in their income tax relief forms (ITRF) this year – as they’ve normally done in previous years – will be immediately redirected to the MyTax portal, so don’t panic!

If you’re an existing taxpayer, you will not need to go through another registration to use MyTax. Just go ahead and key in the same ID and password that you use to log into your ezHASiL account and access e-Filing previously.

First-time taxpayers, meanwhile, will need to go through the process of registering as a taxpayer and setting up your MyTax account before you can access your dashboard. You can start the registration process from MyTax itself, via e-Daftar.

What will I find in MyTax?

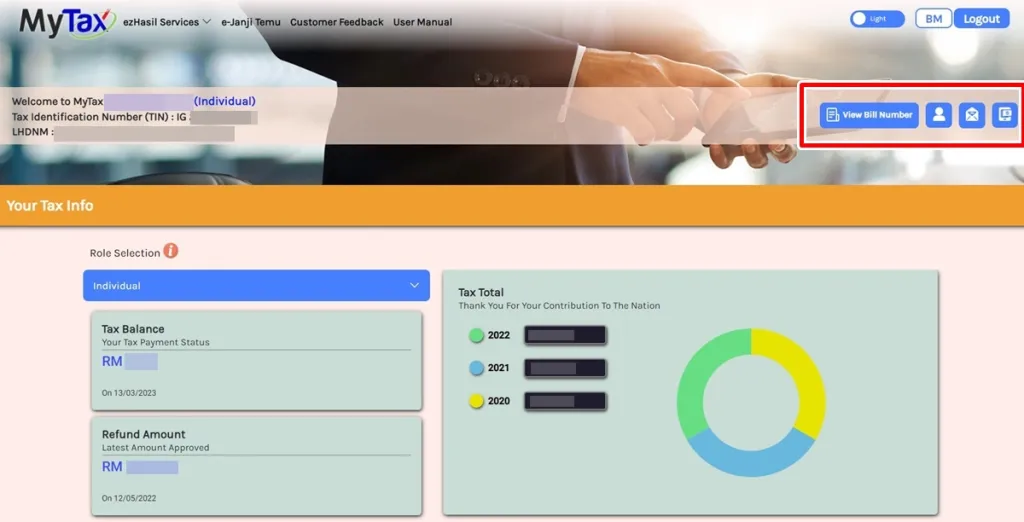

Upon logging in to MyTax, you’ll see your personal dashboard, which contains all the information that you need to grasp with regard to your tax status at one glance. Here’s how your dashboard will look like:

As you can see, you’ll be able to quickly get details such as:

- Your tax balance (how much tax you’ve paid in the previous year)

- The amount of income tax refund that you’ve previously received

- If you have any travel restrictions

- Status on the filing of your income tax

- A summary of how much tax you’ve paid in previous years

To the right corner, you’ll be able to access a number of things, including your bill number, MyTax mailbox, taxpayer profile, and MyTax status. The bill number button is a new inclusion this year, following LHDN’s latest decision to require taxpayers to now use bill numbers as the reference for their tax payments (as opposed to your tax identification number as reference previously).

Aside from that, your MyTax mailbox will contain all the latest LHDN and tax updates that you need to know. Meanwhile, your taxpayer profile shows you details such as your tax number, the LHDN branch that you’re registered with, and your bank account details that have been registered with LHDN. Finally, the MyTax status button leads you to details such as your monthly tax deductions (MTD/PCB), ledgers, previous ITRFs, refunds, and so on.

The navigation bar at the top, meanwhile, offers all the links that you need in order to access LHDN’s services, along with other resources. Clicking on the “ezHasil Services” tab will result in a dropdown menu, with convenient links to services like e-Filing (to file your income tax) or e-Billing (to pay your income tax). Other functions include the PCB Calculator, e-Kemaskini, and e-Lejar.

Meanwhile, the “e-Janji Temu” and “Customer Feedback” tabs let you set up appointments with LHDN personnel for in-person assistance and submit enquiries/feedback, respectively. But most important of all is the “User Manual” tab, where LHDN has archived its manuals, which you can refer to whenever you need any clarification on how to use key services on MyTax. These include guides and FAQs for:

- MyTax (web and mobile version)

- eDaftar

- e-Kemaskini

- e-Billing

- How to search for bill numbers

- Electronic Telegraphic Transfer (e-TT)

You’ll also notice that there are little buttons by the vertical scroll bar on your right, which serve as quick links to various other resources for LHDN and MyTax.

How do I file my taxes via MyTax?

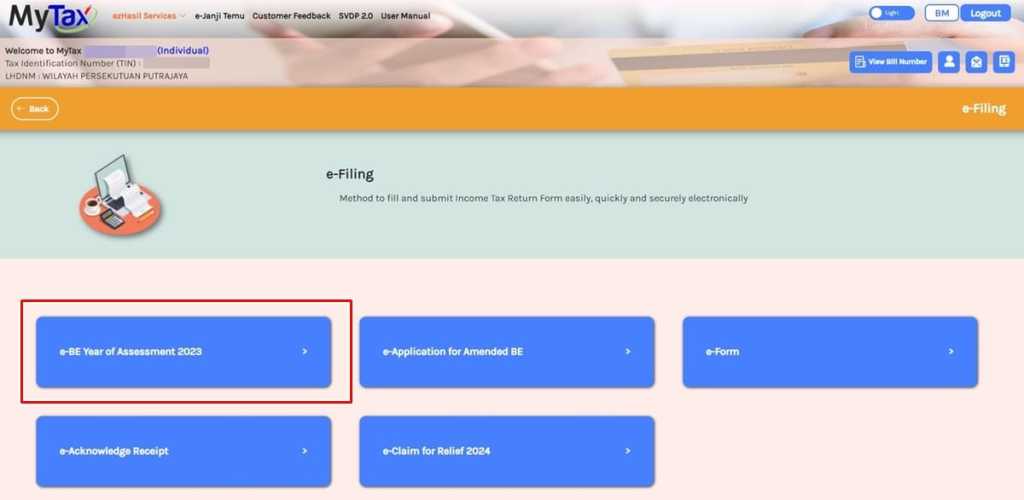

If you’re like most users, you’ll mainly be accessing your MyTax account to file your taxes. To do that, start by clicking on “ezHasil Services”, then on “e-Filing”. Once it leads you to a new page, click on “e-BE Year of Assessment 2023”, after which you’ll be led straight to your e-Filing form. Proceed to fill up your ITRF as you would usually do!

***

With this, we hope that you now have a better idea of what MyTax is, its function as a useful all-in-one tax platform, and most importantly how to navigate it! For additional guides like this, you can also check out our annual income tax guide for YA 2023, as well as all the tax reliefs that you should not miss out on when filling in your ITRF for the year. We have other income tax articles to help in specific circumstances as well, such as how to file your taxes as a first-timer, a freelancer or a side business owner, as well as if you changed jobs in the previous year.

Comments (0)