Pang Tun Yau

28th October 2021 - 8 min read

Throughout an investor’s lifelong journey, there usually are moments where we wished we would have acted differently. Whether it is hesitating on an investment or worse, riding the hype train on a trade only to be badly burnt after. Investment mistakes are common, and most of the time, even the most experienced investors make them.

Whether you’re just starting out or a seasoned investor, here are some of the most common investment mistakes we usually make – and of course, we’ll share some strategies on how to overcome them.

1) Falling in love with a stock/asset/trade

This is a fairly common mistake many new investors make. You made one, two, maybe three successful trades on this one single stock, and think of the huge gains you made – this stock is now the Apple of your eye, and you “definitely” can’t fail trading this stock after your successful trades. So when you spot another opportunity, you go in – big.

Then it happens. A material change within the company, for example. Or, like the Glove Stock Rally of 2020, the short-lived cycle was shorter than expected. Suddenly, the gains from the multiple successful trades evaporate into unrealised losses.

Can it get worse? Of course. Your love for the stock blinds you. “Look at the fundamentals” or “This is just a correction” or “Buy the dips”, you say. Except the dips keep on dipping, and dipping…

What’s most painful are the realisations:

- The market always moves ahead of actual events

- The market can be irrational longer than you can stay invested

- You fell in love with the stock/asset/trade

2) Trusting strangers online

Let’s be honest: it’s hard to allocate time to actively monitor your investments – and it’s even harder to research new investment ideas that will yield the 10-bagger every investor dreams of.

So some of us try to “outsource” this by looking for investment tips online – there seems to be an endless stream of investment gurus who just want to share tips and ideas that are “sure win” types…because he says so. Some of them even share their ideas for free, so no losses right?

Of course you know the answer. And of course, some still diligently follow their tips hoping for a quick punt.

3) Over-trading

Every investor has a finite amount of funds to invest. Sure, financially-savvy ones set aside some amount every month so there’s always some funds to invest. But here’s a dilemma modern investors face: these days, there are a lot of channels where an investor can get information from.

Even if you remove investment gurus out of the equation, there are various community-driven platforms where retail investors share investment ideas. Usually, these ideas are backed by extensive research and justification, and since it’s a community, the other users can weigh in and share their thoughts too.

So now you face a dilemma. You don’t have extra funds, but wow, this idea shared by this guy looks solid and you shouldn’t miss out! You decide to be smart about it and reallocate your portfolio, trimming or removing some positions to raise some funds for this investment. You don’t want to miss this train!

Fast forward a few weeks, and suddenly another user shares a gem of a company, unnoticed by the market makers. This looks huge, but alas! Your salary is not yet in and you’ve just reallocated your funds to the previous wonderful idea. Maybe it makes sense to take some profit or cut losses on some of your existing holdings. Maybe the previous wonderful idea isn’t as good as this gem of a company, so you shuffle your holdings. The next month, another user shares another wonderful idea, and the cycle repeats.

With every trade, you pay a brokerage fee equivalent to a portion of the investment value, stamp duty, and some other fees – all in, they add up and eventually eat into your profits.

4) Getting emotional

Unless you’re a machine, every single investor at some point will make an investment decision based on emotion. Whether it is greed or fear, hope or pessimism, emotionally-driven investment decisions rarely go well – you end up realising significant losses or miss out on bigger gains.

Another emotion that rarely gets discussed is “revenge trading” or investing with the aim of recouping prior losses. This is an extremely dangerous emotion, because just like falling in love with a stock, revenge trading throws logic out the window and you end up taking on excessively higher risk with the goal of making back what you lost. You rarely, if ever, do.

5) Lack of patience

For most individual investors, investments should be a long-term game. Full-time investors and traders may aim for higher gains over shorter periods of time, but for the rest, wealth accumulation is a gradual process.

Unfortunately, that isn’t the case with some investors. If the investment idea doesn’t pan out within a few weeks or months, they cut their losses and move to another trade. This is sometimes exacerbated by the easy access investors have to review their portfolios – being able to trade and view your holdings from your smartphone is both a boon and a bane.

How to overcome investment mistakes

It is important to understand that investors can and do make mistakes. The more important thing is what we can do about it. We spoke to our licensed financial planners, and here’s what they have to share:

1) Have an investment plan, and stick to it

“Investing should not be thrilling or exciting,” said Hann Liew, a licensed financial planner and co-founder and director of RinggitPlus. “It is a gradual wealth accumulation exercise that, when done correctly, only gets better with time.”

Every investor should have an investment plan, which is based on their individual financial goal. This helps determine the portfolio size, allocation, and investment horizon. These clear indicators will help investors determine if their investments are performing as expected, or if tweaks are needed. Naturally, this isn’t something a common investor can do by themselves – that’s where a licensed financial planner can help.

The most important thing is to stick to the plan. Manage your expectations, review your portfolio regularly, and don’t let the market cycles change your conviction to the plan.

2) Don’t invest emotionally

As many investors can relate, emotional trades rarely go well. So how do you overcome this?

“Even for seasoned investors, emotions still do get in the way sometimes. Usually, it is fear or worry based on recent developments and how it may affect our investments,” said Azril Ikram, a licensed financial planner and Islamic financial planner.

“One strategy is to analyse whether these news or developments materially changes the investment – for example, if a company we invested in loses its CEO but already has succession plans in place, the market may over-react on this event. However, if a company suddenly announces that it cannot repay its debts, it may be time to review whether it is a short-term cash flow issue or something worse. Then, we make a decision based on the facts.”

3) Automate your investments

Another way to not be ruled by emotion is to simply automate your investments. “Dollar-cost averaging (DCA) is one of the most boring investment strategies you’ll come across, but it absolutely works. Bull or bear, simply invest a fixed amount at a fixed interval, and let Father Time do its job,” Hann said.

DCA is an age-old proven method not only to stay invested regardless of market conditions, but it also changes the narrative – with DCA, poor market conditions work for you, allowing you to purchase more units of an investment and lowering your average purchase cost. When the market recovers, you now have more units to reap benefits from.

More recently, the development of financial technology has led to the rise and popularity of digital investment management platforms, or better known as robo-advisors. These platforms take the pains of active investing away while retaining most of its benefits, using a mix of algorithms and portfolio customisation to automate your investments.

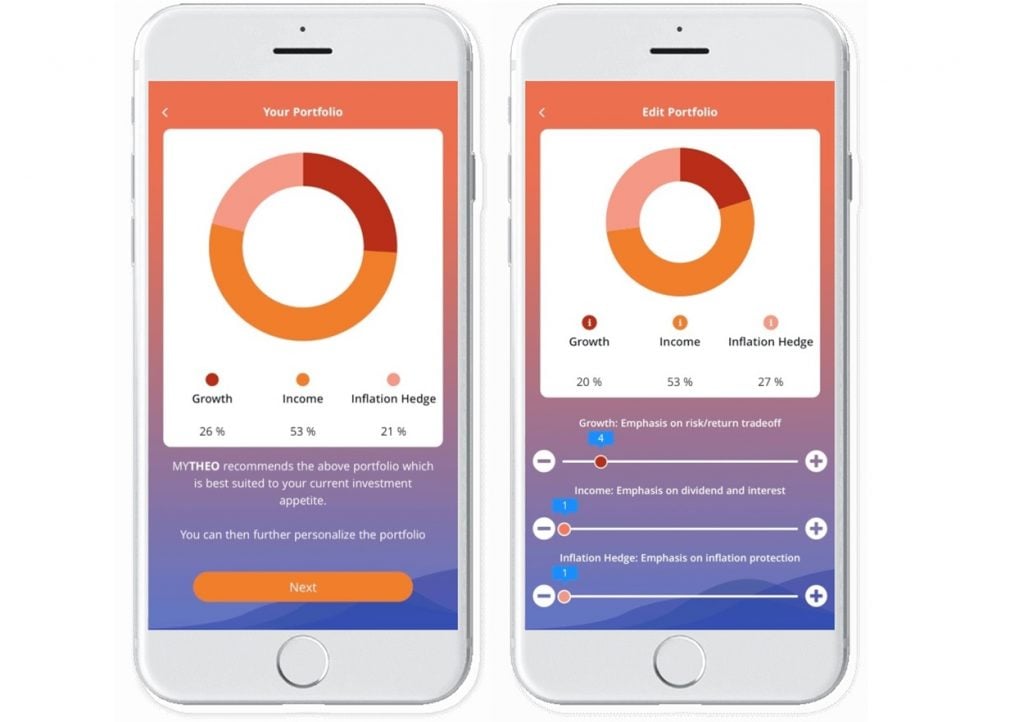

Robo-advisors, such as MYTHEO in Malaysia, are also more affordable and provide access to investment vehicles that most retail investors normally cannot invest in. MYTHEO goes a step further, offering features suited for both new and seasoned investors such as the exposure to over 10,000 underlying securities, an “omakase”-style approach to its dynamic portfolio allocation, and of course, a data-driven approach to your investments. Each MYTHEO investor’s portfolio is customised and auto-rebalanced to achieve an optimum combination of growth equities, income and inflation hedge asset classes. Plus, MYTHEO also offers standing instructions to further automate your investment and stay invested.

*****

Every investor’s journey comes with its ups and downs, and there isn’t a single investor who hasn’t made any of the mistakes listed in this article. What’s more important is what we do after and apply the lessons learned from making them.

What was your worst investment mistake? Share them in the comments section below!

A seasoned tech journalist who now focuses on his other passion, Pang is a firm believer in old-school DCA and optimised spending.

Comments (0)