Nur Adilah Ramli

1st September 2022 - 2 min read

Maybank has re-enabled the online application service for Share Trading (Cash Account) via its Maybank2u website, after having temporarily disabled it since 18 August 2022 for system enhancement.

Following this update, existing Maybank customers who have registered for a Maybank2u account may once again proceed to apply for Share Trading (Cash Account) fully online via the bank’s website, following these steps:

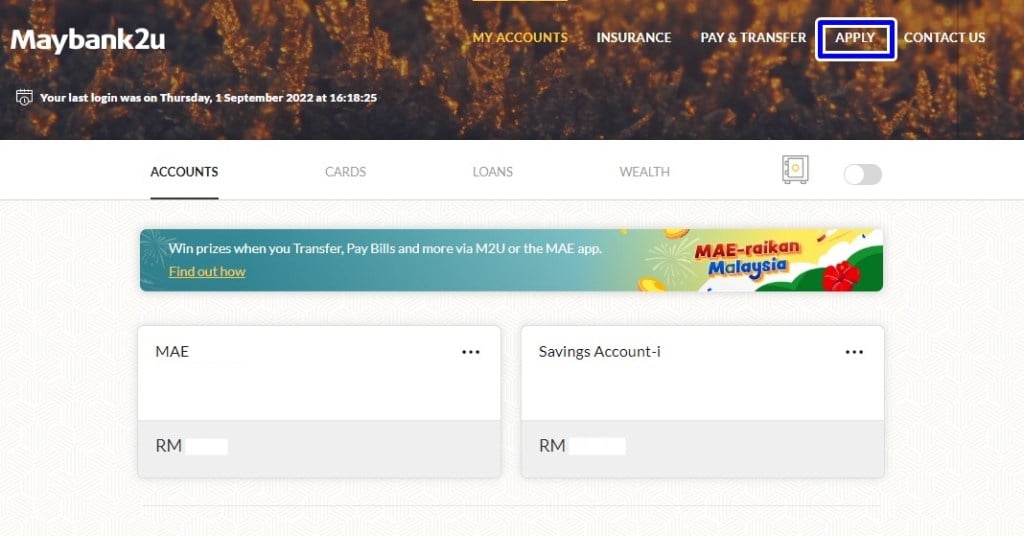

- Log in to your account

- Tap on the menu button at the top left of the page, and click on ‘Apply’

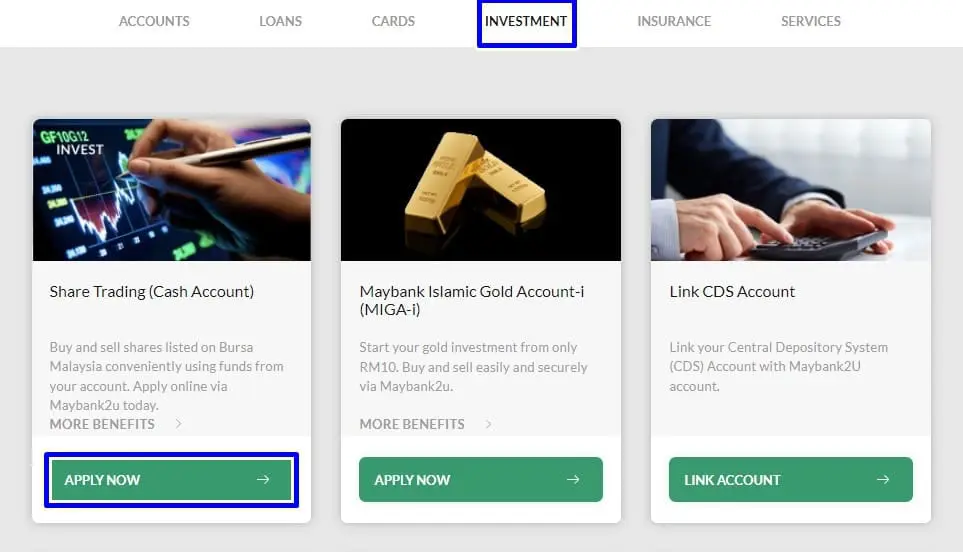

- Tap on ‘Investment’, followed by ‘Share Trading (Cash Account)’, and ‘Apply Now’

- Click on ‘Let’s Start’, and fill out the application form

- Submit the form and pay RM10 to open a Central Depository System (CDS) account

- Upload your salary statement to activate your account

Ultimately, all Maybank customers who apply for Share Trading (Cash Account) will end up with four accounts to facilitate their trading, namely:

| Account | Purpose |

| Maybank2u Cash Trade Account | For trade settlement |

| Maybank Share Trading Account | For trade execution on the local exchange |

| Nominees CDS Account (by Bursa Malaysia) | – Mandatory account that must be opened by every investor who wishes to trade on Bursa Malaysia – Represents ownership and is used to carry out transactions on Bursa Malaysia |

| Maybank current/savings account | – For new Maybank customers – To facilitate fund withdrawal from your Maybank2u Cash Trade Account |

Maybank will notify you once your accounts are successfully opened, either through email, SMS, or push notification on your mobile banking app.

As for new Maybank customers, you, too, can apply for a Share Trading (Cash Account) online via the Maybank2u website. However, you will be required to take an extra step of visiting a Maybank branch within 14 days of your application to complete the account opening process.

For any enquiries regarding Maybank’s Share Trading (Cash Account), you may call Maybank IB Equities Helpdesk at 1300 22 3888, or email them at equities.helpdesk@maybank-ib.com.

Comments (0)