Iman Aminuddin

18th December 2025 - 4 min read

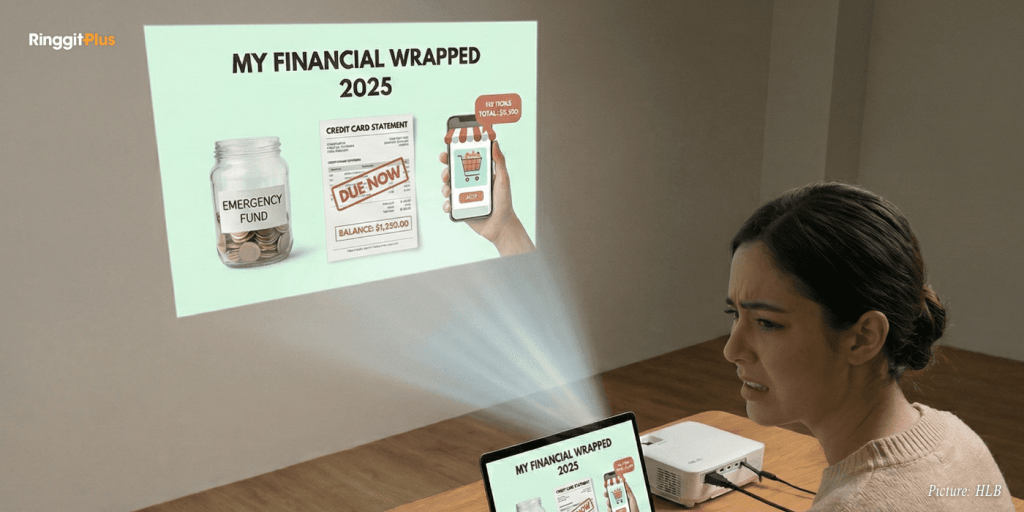

The one where I’m both the employee and the manager.

I found my 2025 financial goals document last week. Had to dig through my Downloads folder for it: “2025 Financial Goals: LET’S DO THIS!” The exclamation mark aged badly. Reading it now makes me feel like proper dungu.

At work, I’ve just finished rating myself on key objectives and listing goals for next year. Standard corporate stuff. But looking at that January document, I realised I’ve never given myself the same treatment for my own money. No ratings, no honest assessment, no consequences.

So here it is. My financial performance review for 2025, written the way my manager would write it if my manager could see my bank statements.

The Goals I Set In January

Goal 1: Save RM500 per month

Status: Abandoned by March

Actual savings: RM200 per month on average, and that’s being generous. Some months it was RM50 because “something came up.” Something always comes up when you don’t make saving automatic.

Goal 2: Build a six-month emergency fund

Status: Currently at 0.8 months

My monthly expenses are about RM3,000. I have RM2,400 sitting in my Maybank savings account earning 0.25% p.a. That’s not an emergency fund. That’s one car breakdown away from being back at zero.

Goal 3: Clear my credit card balance by June

Status: Balance increased by 40%

Started the year owing RM9,100. Now owing RM12,800. The 18% p.a. interest rate means I’m paying about RM150 per month just to stay in the same place. Every month I told myself “next month I’ll settle it.” Next month never came.

Goal 4: Start investing RM200 per month

Status: Downloaded StashAway and Versa. Funded none of them.

I read probably 30 articles about investing this year. Watched YouTube videos. Compared robo-advisors until I was convinced I understood everything. Did everything except actually put money in. Analysis paralysis champion right here.

My Honest Self-Assessment

Performance reviews always have that section where you rate yourself. Exceeds Expectations, Meets Expectations, Needs Improvement, Unsatisfactory.

Time to be brutal with my delusional self.

Spending Discipline: Needs Improvement

I have a Shopee problem. Looking at my statements, I’ve spent about RM800 on things I genuinely cannot remember buying. Some of them are still in their packaging. Every purchase felt justified at the time. “Aiya, RM39 only what.” Times 50.

Savings Consistency: Unsatisfactory

Good months exist. I can save when nothing happens. But the moment there’s a birthday, a sale, or anything remotely worth “celebrating,” the money disappears. My definition of “emergency” has somehow expanded to include “really good deals on electronics.”

Debt Management: Unsatisfactory

The credit card balance tells the whole story. I’ve been paying minimums while adding new charges. The interest alone is now higher than what I originally wanted to save each month.

If I were reading these comments about someone else’s performance, I’d be concerned. Reading about myself? Malu gila.

The Improvement Plan

At work, when someone’s performance is concerning but you want to give them another chance, you put them on a Performance Improvement Plan. Clear goals, specific timelines, regular check-ins.

If I were putting myself on one, I know what it would have to include.

This week: Set up the automatic transfer

Not “when things are better” but literally now. RM300 moved to a separate account the day after payday, before I can touch it. I’m using a Versa account because the money takes a day to withdraw, which is just enough friction to stop me raiding it for 12.12 sales.

This month: Track every ringgit for 30 days

Every coffee, every artisanal cookie, every “small” purchase under RM50 that somehow adds up to RM400 by month end. I need to see where the money actually goes, not where I think it goes.

Before year end: One extra credit card payment

RM500. Because if I can’t find RM500 to throw at a RM12,800 problem, then I need to admit I have a bigger problem than I thought.

Today: Cancel three subscriptions

The gym membership from January that I haven’t touched since March. The meditation app I used twice. The streaming service I forgot I had. That’s probably RM80 per month I’m paying for nothing.

Putting It In Writing

I’m not going to lie and say I feel great about my financial performance this year. The numbers don’t lie. I missed every major goal I set. If this were a work review, I’d be lucky to get “meets expectations” in any category.

But I’m also not going to pretend that denial is an option anymore.

The review is done. The ratings are in.

Now I have to decide whether next December’s review looks any different.

How did your 2025 financial goals turn out? We’d genuinely like to know — the honest version, not the Instagram version.

Comments (0)