Pang Tun Yau

2nd September 2024 - 3 min read

AEON Bank has officially revised a few of its features starting 1 September, as it marked the end of its promotional period in conjunction with the digital bank’s launch in May this year. Notably, its savings rate and AEON Points earning rate have been revised.

At launch, AEON Bank offered one of the more compelling promotional offers among the digital banks in Malaysia, with a 3.88% p.a. savings rate in both the standard savings account-i as well as the Savings Pot. It was clearly stated that the promotional rate will end on 31 August, and the new rates were revealed yesterday (1 September):

- Savings Account-i: 0.88% p.a.

- Savings Pot: 3% p.a.

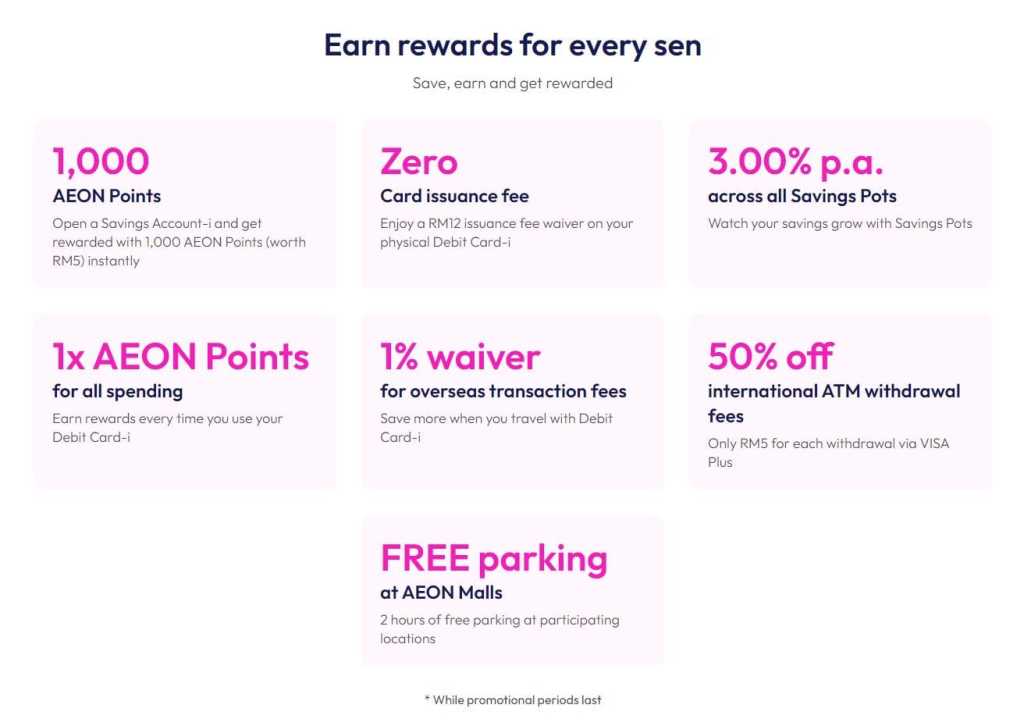

In addition, the AEON Bank Visa Debit Card-i has also seen a revision to its earning rate for AEON Points, as per the promotional period. Instead of 3x AEON Points for every RM1 spent, it has now been revised to 1x AEON Point for every RM1 spent. Lastly, the 3,000 AEON Point sign-up bonus has also been reduced to 1,000 AEON Points.

Note, however, that these changes are still part of AEON Bank’s latest campaign, running from 1 September until 31 December 2024. This means come 1 January 2025, the rates may be revised further at the bank’s discretion.

Nevertheless, it’s not all bad news. This latest campaign includes several other offers, including:

- Overseas transaction fee waiver: Waiver of the 1% service fee imposed by AEON Bank on Debit Card-i transactions made outside of Malaysia in foreign currency (physical transactions) and/or made online in foreign currencies (virtual transactions) (note that this fee is imposed by AEON Bank, there is another 1% fee imposed by Visa that still apply)

- RM5 discount on international cash withdrawals: RM5 discount for cash withdrawal using AEON Bank Debit Card-i at any international ATM via VISA Plus

- Free AEON Mall parking: Free 2 hours parking at various AEON Mall outlets when entering parking using AEON Bank Debit Card-i

Interestingly, the revision of rates have caught some AEON Bank customers fully unawares, with many frustrated customers making their feelings known at AEON Bank’s Facebook and Instagram pages. Many have also threatened to withdraw their funds to other digital banks.

Regardless, it is unlikely that AEON Bank will reverse any rates-related decisions, as it had been made known from the start that it was a three-month promotion to encourage Malaysians to sign up for AEON Bank.

The full terms and conditions of the latest AEON Bank campaign can be found here.

Comments (0)