Alex Cheong Pui Yin

25th August 2023 - 3 min read

Bank Negara Malaysia (BNM) has signed three memoranda of understanding (MOU) with Bank Indonesia (BI) and the Bank of Thailand (BOT) to further strengthen their cooperation in promoting bilateral transactions in local currencies between the countries. These are set to improve on the existing local currency settlement framework (LCSF) that had been signed between the three central banks back in 2015 and 2016.

To explain, the 2015/2016 version of the LCSF sought to encourage Malaysian, Thai, and Indonesian traders to convert their local currencies into the receiver’s local currency for payments and money transfers, instead of relying on the US dollar (USD) – as was the previous case. This was meant to help reduce foreign exchange costs, among other benefits:

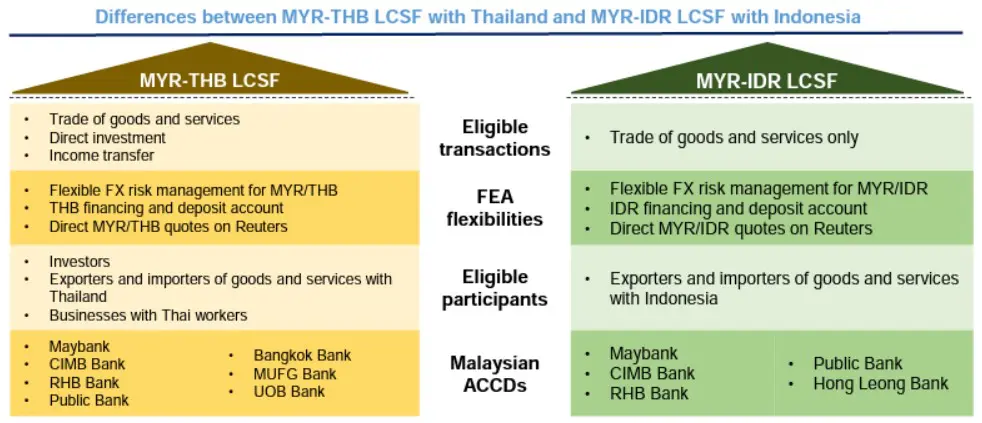

This earlier framework was, however, only implemented on a few types of transactions, namely trade of goods and services, direct investments, and income transfers.

As such, the new MOU will expand the scope of the framework to cover more eligible cross-border transactions, beyond trade and direct investments. This will be implemented gradually, taking into consideration other cross-border payment initiatives that may be executed for more accessible and efficient local currency settlements as well.

“The MOUs are set to strengthen cross-border economic activities, enhance regional financial market stability, and deepen local currency markets in the three countries,” BNM said in a joint statement today, following the signing ceremony at the 10th ASEAN Finance Ministers’ and Central Bank Governors’ Meeting (AFMGM) in Indonesia.

On top of the successful signing of MOU to promote bilateral transactions in local currencies, the AFMGM event also saw the expansion of the Memorandum of Understanding on Cooperation in Regional Payment Connectivity (MOU RPC) to now include the central bank of Vietnam, the State Bank of Vietnam (SBV).

The RPC was originally signed between the central banks of five ASEAN countries back in 2022: Malaysia, Indonesia, Singapore, Thailand, and the Philippines. This agreement was meant to bring about faster, cheaper, more transparent, and more inclusive cross-border payment processes between the countries.

“The inclusion of SBV has increased the RPC group from five to six ASEAN central banks. This partnership aims to further support post-pandemic economic activities across the ASEAN region, including the promotion of tourism and other service industries. The expansion is also expected to benefit small and medium-sized enterprises, which are crucial to the region’s economic growth,” said BNM in a separate joint statement, adding that this effort will widen financial inclusion in the region and significantly contribute to the overall advancement of the ASEAN economic community.

Moving forward, BNM expects the RPC to be further expanded to include more neighbouring economies and other countries beyond the ASEAN region.

Comments (0)