Alex Cheong Pui Yin

17th November 2020 - 4 min read

(Image: The Edge Markets)

The Employees Provident Fund (EPF) has announced the i-Sinar facility, which allows eligible members to take out an advance from their Akaun 1 to help them weather through their current financial crisis. It is expected to benefit 2 million contributors, with an estimated advance amount of RM14 billion to be made available.

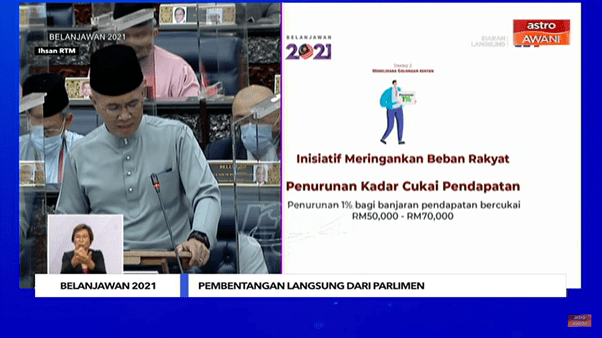

The i-Sinar facility was introduced following a proposal to allow targeted EPF contributors to make withdrawals from their EPF Akaun 1, which was announced by Finance Minister Tengku Zafrul Abdul Aziz during the tabling of Budget 2021. At that time, Tengku Zafrul proposed to allow eligible contributors to withdraw RM500 a month for up to RM6,000 for 12 months. In response, the EPF said that it will consult all stakeholders before making a decision. This eventually led to the introduction of i-Sinar.

According to the chief executive officer of EPF, Tunku Alizakri Raja Muhammad Alias, the i-Sinar facility will only be made available to active members who have lost their jobs, are on unpaid leave, or have no alternative income source. “This facility has allowed us to assist those in need of assistance, as well as work with our mandate – to safeguard members’ future retirement savings,” he added.

How does the i-Sinar facility work

(Image: Malay Mail/Miera Zulyana)

(Image: Malay Mail/Miera Zulyana)

The i-Sinar facility will enable eligible members to have access of up to 10% of their savings in Akaun 1, subject to maintaining a minimum balance of RM100. However, this also depends on the existing balance that you have in your Akaun 1.

“For those who have RM90,000 and below in Akaun 1, they have access to any amount up to RM9,000. For those who have above RM90,000 in Akaun 1, they have access of up to 10% of their Akaun 1 savings. However, the maximum total amount allowed to be advanced is RM60,000,” clarified Tunku Alizakri.

Tunku Alizakri also explained that the advances that are paid out will be staggered over a period of six months, with a first month advance of up to RM4,000 for those with Akaun 1 savings of RM90,000 and below, and of up to RM10,000 for those with more than RM90,000 in Akaun 1.

Here’s a summary from the EPF to help you better understand the mechanics of the i-Sinar facility:

When can you start applying?

The EPF will start accepting applications for the i-Sinar facility in December 2020, but has not released detailed information on where or how to do so as of now. Upon approval, the funds will be credited to the bank accounts of approved members, with the first crediting to begin in January 2021, and the advances will be made over a period of six months from the first date of crediting.

i-Sinar is an advance facility, and must be replenished

(Image: Bernama)

Tunku Alizakri also reminded members that the i-Sinar is not a withdrawal facility, but rather an advance facility. In other words, members who do tap into it will need to replenish the amount taken out.

To replenish the advances taken out from Akaun 1, the future contributions of affected members will be credited 100% to Akaun 1 until the amount is fully replaced. Only once that is accomplished will the contributions be reverted back to the original distribution of 70% for Akaun 1 and 30% for Akaun 2.

Tunku Alizakri also clarified that there is no timeline for members to replenish the amount advanced. “This will only start when the affected member gets reemployed or when their businesses start picking up again,” he said.

Implications of tapping into i-Sinar

(Image: The Malaysian Reserve)

Tunku Alizakri further highlighted that there will be implications for members who choose to utilise the i-Sinar facility as they will be forgoing their compounded returns when they take an advance from Akaun 1. As such, members are urged to seek advice from the EPF’s Retirement Advisory Services (RAS) or the Credit Counselling and Debt Management Agency (AKPK) to determine the right amount that they should apply under i-Sinar and ensure sustainability during this crisis.

Other EPF members who are not eligible for the facility will also be affected by the implementation of i-Sinar. This is because the advance facility – which requires an allocation of another RM11 billion to RM15 billion – will reduce the pool of money that the provident fund has for investment. In return, this will affect future dividend payouts.

***

For more information, you can head on over to EPF’s website to find out more about the i-Sinar facility. The provident fund also noted that full details on the facility’s eligibility and terms and conditions will be available soon; and we will be releasing a guide on this.

Comments (1)

It is so complicated , suppose this is the time that EPF should be released to help out with pending loans , EPF also must consider for those who are under AKPK DMP [Debt Management Program] to withdrawal and reduce the pending outstanding commitment regardless of they are currently employed or not