Alex Cheong Pui Yin

12th December 2023 - 2 min read

Payments Network Malaysia (PayNet) has launched its new MY TouristPay app, which is aimed at enabling tourists who visit Malaysia to also be able to make DuitNow QR payments – just like a local.

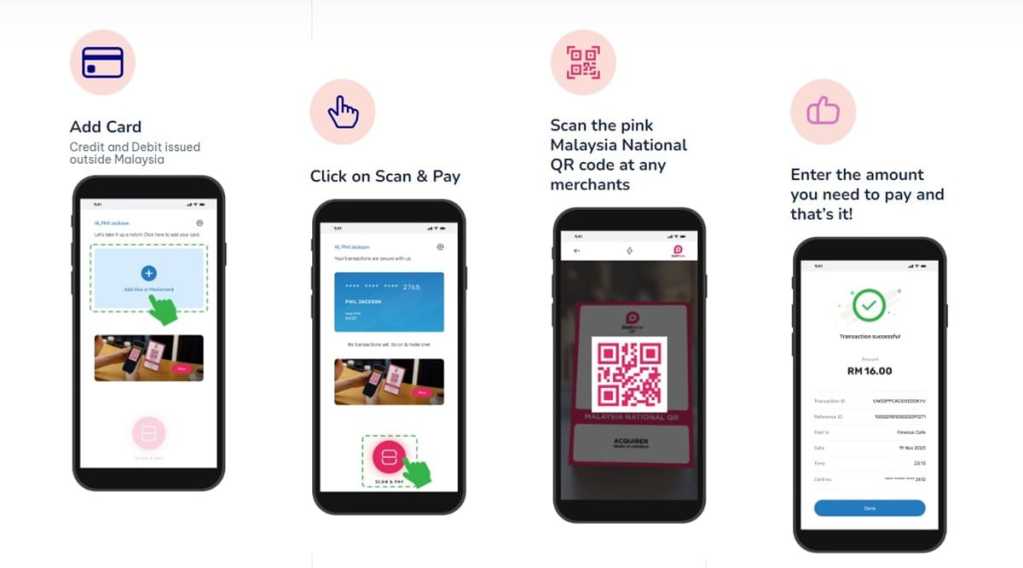

In its website, PayNet explained that the new app will allow tourists to add their foreign-issued Visa or Mastercard debit and credit cards as a source of fund, after which they can use the app to make payments via DuitNow QR codes with over 1.9 million merchants nationwide. Similar to Malaysians, they will only need to scan the national QR code provided by participating merchants, and enter the amount that needs to be paid.

“We expect this initiative to significantly boost sales for small and medium-sized businesses in Malaysia who currently don’t accept cards,” said the group chief executive officer of PayNet, Farhan Ahmad, who added that the app not only makes payments more convenient for travellers visiting Malaysia, but also offers some form of security as it reduces the possibility of loss or theft.

Tourists who would like to give the MY TouristPay app a try can download it for free from Google Play; it will also be made available soon on the App Store and Huawei AppGallery. Once downloaded, launch the app and click on “Get Started”, then key in the required details, such as your passport number, email address, and phone number. You will receive a notification once you have successfully signed up.

This new payment app is set to complement Malaysia’s other efforts in making payments easier for tourists who visit the country. Existing initiatives that have been made thus far include the enabling of cross-border QR payment linkages, allowing travellers from selected countries – such as Thailand, Indonesia, Singapore, China and South Korea – to pay for their purchases in Malaysia using their home e-wallets and payment apps.

(Sources: New Straits Times, PayNet)

Previously covered recruitment-related stories and had a short stint as a copywriter for the property industry. She subsequently developed an interest in investment and robo-advisors.

Comments (0)