Alex Cheong Pui Yin

7th April 2022 - 2 min read

The percentage of Malaysians who prefer to pay by cash has fallen from 89% before the Covid-19 pandemic to 78% in 2021, said Payments Network Malaysia Sdn Bhd (PayNet) in its inaugural PayNet Digital Payments Insight Study 2022 report.

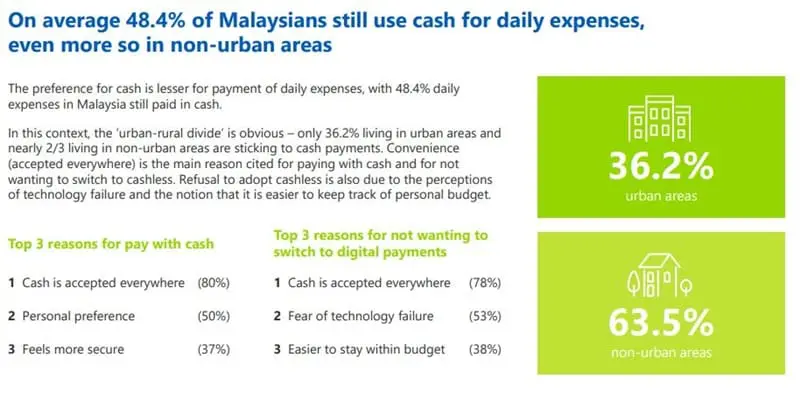

In its study, PayNet revealed that while cash still reigns as the preferred payment method among Malaysians, the overall reliance on cash has dropped – a trend that is also observed in other countries. The study also found that fewer Malaysians used cash when it came to daily payments (48.4%). Area-wise, those in rural areas appeared to have a higher preference for cash payment (63.5%) than those in urban areas (36.2%).

PayNet further explained that this declining preference for cash payment is likely driven by the rise in QR payments, established trust in debit cards, as well as concerns of Covid-19 infection via the handling of cash.

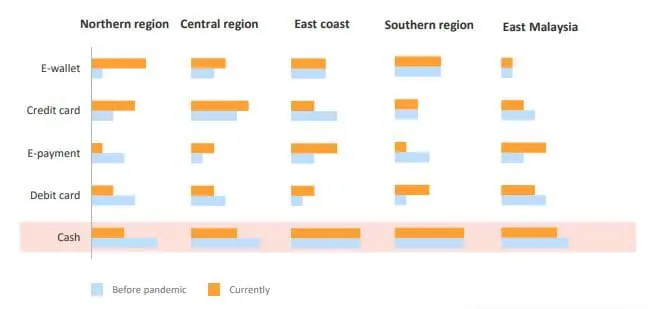

Moreover, the study shared that many businesses across the country have also noticed changes in customer payment behaviours since the start of the pandemic, with more preferring to pay via e-payment services or e-wallets. This is particularly apparent for those operating in the northern and central region of Peninsular Malaysia, as well as East Malaysia. Meanwhile, those in the east coast and southern region of Peninsular Malaysia still tend to opt for cash.

Other key findings that are highlighted in PayNet’s study include the priorities that small and medium enterprises (SMEs) focus on during their digital transformation journey, as well as barriers that they face in adopting digital payments. It also listed several key factors that will propel digital payment adoption.

“This is our inaugural study and we plan to undertake future studies to better understand the payment behaviours of the rakyat, their attitudes towards digital payment methods, and the factors driving changes in payment preferences – to ensure PayNet and its ecosystem maintain a secure, reliable, efficient, and inclusive central payment infrastructure for Malaysia,” said the group chief executive officer of PayNet, Peter Schiesser.

The PayNet Digital Payments Insight Study 2022 was carried out in the fourth quarter of 2021, conducted with the help of Nielsen IQ.

(Sources: PayNet, The Edge Markets)

Comments (0)