Samuel Chua

13th August 2025 - 5 min read

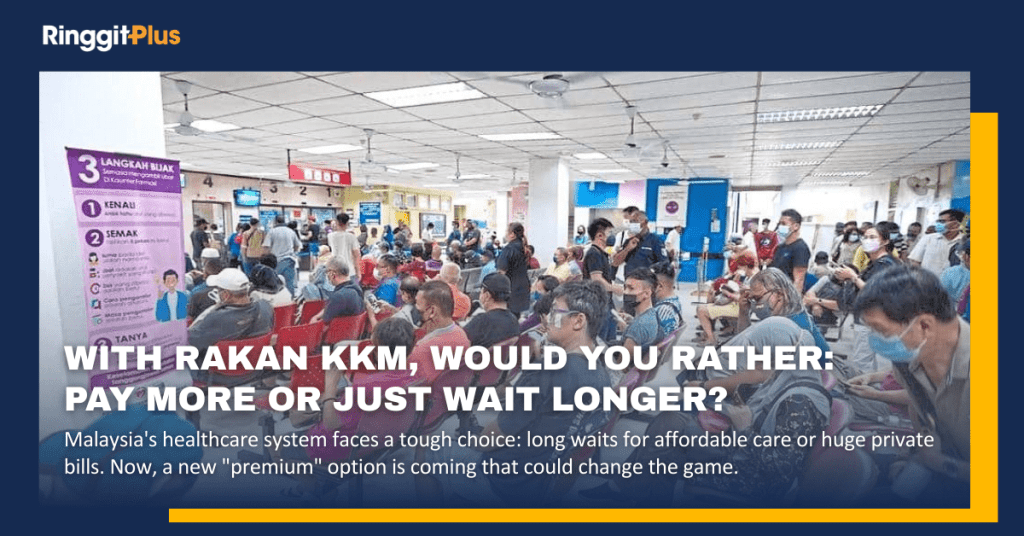

Malaysia’s healthcare system has long operated on two levels. Public hospitals offer highly subsidised treatment, with consultation fees as low as RM1. However, this affordability often comes with long waiting times and limited choices. Private hospitals provide faster access and more comfort, but the costs are significantly higher and often out of reach for many working adults.

To bridge this gap, the government is introducing Rakan KKM, short for Rakan Kementerian Kesihatan Malaysia. The programme aims to create a middle option within the public hospital system, offering more personalised services at a higher cost than standard care, but still below private hospital pricing.

Why Rakan KKM Is Being Introduced

Malaysia’s public healthcare system is under growing strain. Despite receiving RM45.3 billion under Budget 2025, which accounts for 10.7% of the total national allocation, the Ministry of Health continues to face funding and staffing challenges. The low consultation fees charged to patients, typically RM1 for outpatient care and RM5 for specialist services, are not financially sustainable in the long term.

The system is also losing medical professionals at an increasing rate. From 2019 to 2023, more than 6,400 medical officers left public service. Malaysia is also projected to face a shortage of over 130,000 nurses. A key factor is the pay gap between public sector doctors and those in private hospitals or overseas. For example, a Malaysian doctor earning RM6,000 a month might receive a compensation package worth more than RM380,000 per year to work in Singapore.

These pressures have contributed to longer wait times and limited capacity, prompting the government to explore new approaches.

Lessons from the Full-Paying Patient Programme

The Rakan KKM initiative builds on the earlier Full-Paying Patient (FPP) programme introduced in 2007. FPP allowed patients in public hospitals to pay for premium services, such as selecting their specialist and accessing private wards. These fees remained lower than those charged by private hospitals. For example, a caesarean delivery under FPP might cost RM3,000 to RM5,000, compared to RM6,000 to RM15,000 in a private setting.

FPP also aimed to retain top specialists by giving them a share of collected fees. However, the programme had limitations. Other hospital staff were not officially paid for their extra work under the programme, so some specialists ended up giving them a portion of their own fees to keep things running. Limited hospital capacity and weak uptake contributed to its decline. By 2019, FPP cases accounted for only 0.13 percent of total patient visits under the Ministry of Health.

What Makes Rakan KKM Different

Rakan KKM is intended as a larger-scale, more inclusive version of FPP. The service will be operated by a company owned by the Ministry of Finance and priced higher than standard public care but still lower than private hospital fees.

Unlike FPP, all healthcare staff involved in Rakan KKM will receive formal compensation. Revenue will be reinvested into public healthcare, with the aim of improving system-wide efficiency and funding.

For patients, Rakan KKM provides access to non-urgent procedures with shorter waiting times, more choice in selecting doctors, and the comfort of private wards, all within the public healthcare system.

Potential Benefits and Concerns

Rakan KKM may appeal to working adults who find private healthcare too expensive but want faster or more customised care than what is typically available in the public system. It could also help moderate private sector prices by creating a new point of comparison.

At the same time, some worry that the system could become unfair. Introducing a paid tier in public hospitals might allow those who can afford it to get faster access to non-urgent treatment, while others are left waiting. This could put more pressure on shared resources like doctors, beds, and operating theatres.

Emergency care will remain equally accessible to all, but the existence of a parallel pathway for non-urgent cases raises questions about fairness and long-term system balance. The Malaysian Medical Association (MMA) has emphasised that because Rakan KKM will be managed by a private company, strong transparency and oversight are needed to maintain public trust.

What Rakan KKM Means for Your Finances

Rakan KKM represents a shift in how some healthcare services will be delivered and funded. While emergency care remains highly subsidised, patients opting for elective treatment through this programme may face additional out-of-pocket costs.

Before making any decisions, it is advisable to check with your insurance provider to confirm whether Rakan KKM services are included in your policy. This will help you plan ahead for any financial impact.

Being financially prepared will make it easier to manage future healthcare needs. Knowing which treatments are covered, which are not, and what your alternatives are can help support better decisions.

What Happens Next

Rakan KKM is still in the early stages of implementation. The government hopes it will improve public healthcare capacity, help retain medical professionals, and give patients more choices without matching private hospital prices.

However, adding a paid option within the public system brings new challenges. The programme will need clear rules, fair access for all patients, and strong oversight to ensure it works as intended.

As more details emerge, it’s a good idea to review your healthcare options and insurance coverage so you can make informed decisions in a system that’s becoming more complex.

Follow us on our official WhatsApp channel for the latest money tips and updates.

Comments (0)