Alex Cheong Pui Yin

20th October 2023 - 4 min read

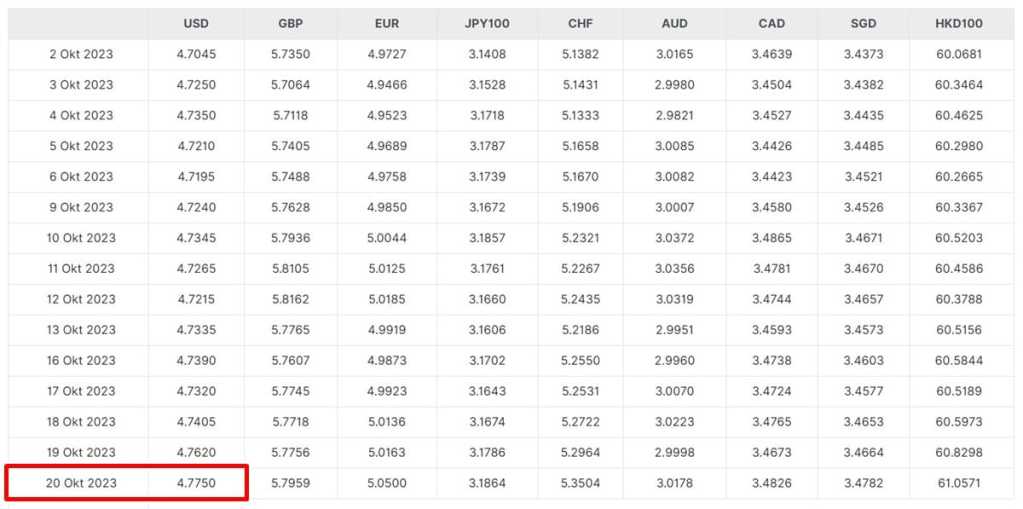

The Malaysian ringgit has fallen to its lowest level in 25 years, with the local currency weakened to 4.7750 per US dollar as at the time of writing – a level last seen during the Asian Financial Crisis in 1998. As a result of this tumble in value, the ringgit has been considered the worst performer in Asia for the year, underperformed only by the Japanese yen.

The currency’s decline is attributed primarily to the strengthening of the US dollar and increasing rate differential with the United States, which is driven by various factors. These include the recent Israel-Hamas conflict – thereby increasing demand for the US dollar as a safe-haven currency – as well as Malaysia’s declining exports for six consecutive months, due partly to an economic slowdown in China as Malaysia’s largest trading partner.

Bank Negara Malaysia’s (BNM) decision to pause interest hikes at 3% since July also exacerbated the situation, given that the US Federal Reserve had increased US’ interest rate to 5.25% to 5.50% to date. This contributed to the widening of the gap between the ringgit and US dollar’s value as well, with the local overnight policy rate (OPR) now at a record discount in relation to the US federal funds rate ceiling.

Head of economics and strategy at Mizuho Bank Ltd Singapore, Vishnu Varathan further commented that the local currency’s plunge in value is due to “real rate spreads that could turn a lot more unfavourable, especially as the subsidy rollback hits inflation and reveals softer real policy rates.” More worryingly, policymakers are caught between deciding whether they should respond to the situation by increasing Malaysia’s interest rate and facing the subsequent economic headwinds, or not increasing it and putting the macro and ringgit’s stability at risk.

Against this bleak picture, however, Secretary General of Treasury the Finance Ministry, Datuk Johan Mahmood Merican expressed optimism, stating that the local currency’s performance will improve in time to mirror Malaysia’s robust economic fundamentals.

“I believe the general issue is that the movement in currency is more a result of the US dollar strengthening rather than the ringgit weakening. I mean, because you can observe that many of our neighbouring countries are also similarly weakening relative to the US dollar,” said Datuk Johan, adding that Malaysia’s improving economic conditions are reflected via several key indicators, like the lower unemployment rate and increasing investment activities.

Meanwhile, several economists have come forward to suggest that the ringgit is unlikely to breach 5.000 to the US dollar, provided that the current global conditions do not worsen.

“To strengthen the ringgit, the only real thing (to do) is to clarify policy, endure market liquidity, and maintain sound fiscal and monetary policy conditions to promote price stability, as well as sustainable growth and investment. These are the lessons to be learnt from the past. I believe this is not a time for drastic measures. The ringgit will eventually moderate, it will not hit 5.000 (to the dollar),” said Dr Geoffrey Williams from the Malaysia University of Science and Technology.

Assistant professor of finance at UCSI University, Dr Liew Chee Yoong, meanwhile, said that the ringgit might hit 5.000 to the dollar, but only if global economic conditions further deteriorate due to the conflict in the Middle East. “Thus, reflecting on the past Asian Financial Crisis, it is important to educate policymakers that strong financial oversight is important to manage currency risk. It also underscores the significance of maintaining substantial foreign exchange reserves and adhering to principles of fiscal prudence,” he said.

The managing partner of SPI Asset Management, Stephen Innes, on the other hand, compared and tied the ringgit’s performance to China’s renmenbi, noting that Malaysia’s currency is currently trading at an acceptable trading range at 1.54. “If the Israel-Gaza crisis remains isolated and does not spread, then the dollar could ease. I do not think the People’s Bank of China (PBoC) will let the renminbi weaken dramatically, hence the ringgit could remain anchored below 5.000 (to the dollar) levels,” he said.

(Sources: Bloomberg, New Straits Times (1, 2))

Comments (0)