Alex Cheong Pui Yin

2nd December 2020 - 3 min read

A global survey by Standard Chartered Bank has revealed that the millennial generation around the world (aged between 25 to 44) has been spurred to improve their money management skills for a better financial future due to the Covid-19 pandemic. This includes Malaysia, where 36% of millennials polled said that they are now more confident about reaching their financial goals than before the outbreak of Covid-19.

To set the stage, Standard Chartered’s survey found that 74% of its millennial respondents in Malaysia experienced a more challenging time in managing their money day-to-day since the start of the Covid-19 pandemic. The group is also 107% more likely to feel that they do not have control of their bank account balance in comparison to those aged over 45 years old.

On top of that, Standard Chartered’s survey noted that 23% of these respondents reported an increased borrowing in the last month, as compared to 15% of those aged over 45 years old.

Despite such challenges, however, local millennials are also found to be the generation that are actively in pursuit of long-term financial goals. For instance, 45% of those surveyed said that they are committed to saving more for their retirement, in comparison to 44% of those above the age of 45. 34% of these respondents are also saving for a major purchase, such as a new car or home, as opposed to 20% of those above 45 years old.

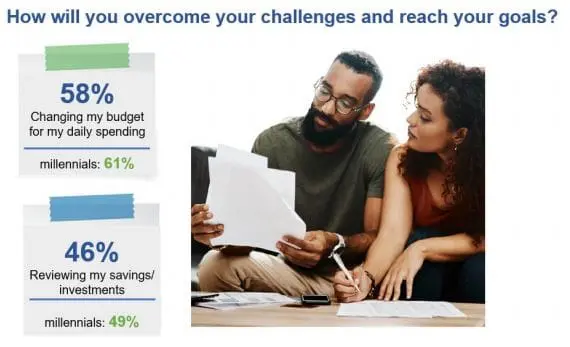

Additionally, half of the millennial respondents indicated that they want to better track and budget their spending, as shown in the following figures:

- 61% want to change their budget for daily spending

- 28% started using a new money management or budgeting app since the pandemic

- 63% of those who have not used such apps plan to do so in the next three years

The survey also made further comparison between the millennial respondents with those aged over 45 on their financial habits since the start of Covid-19, noting that millennials are:

- 340% more likely to have started a digital piggy bank

- 65% more likely to have started using a money management or budgeting app

- 150% more likely to have started using a savings or investment app for the first time

Standard Chartered went on to justify that this adoption of technology is a major reason as to why more than one third of millennials in Malaysia (36%) are more confident in achieving their long-term financial goals than before the pandemic started. In contrast, only 21% of Malaysians aged over 45 years old feel more confident about reaching their financial goals amidst the current landscape.

(Image: The Star)

“Malaysian millennials are indicating a sense of responsibility with their finances in the aftermath of the Covid-19 pandemic. There is no question that the crisis is a formative phenomenon that will shape this generation for the rest of their lives,” said the managing director and chief executive officer of Standard Chartered Malaysia, Abrar A. Anwar.

This global survey by Standard Chartered is the last of a three-part series that seeks to look at how Covid-19 has transformed people’s life, and to gauge what changes are permanent. Involving 12,000 respondents from across 12 countries, the first part of the series focused on the pandemic’s impact on the respondents’ earnings. Meanwhile, the second examined their changing spending habits.

You can read the full report of Standard Chartered’s survey on its website here.

(Source: Standard Chartered)

Comments (0)