Samuel Chua

30th May 2025 - 6 min read

Visa has unveiled six new payment and commerce solutions in Asia Pacific, marking a major step forward in bringing the future of digital transactions to one of the world’s most tech-savvy regions. Announced at the Visa Asia Pacific Media Showcase, the new offerings span artificial intelligence, stablecoins, digital identity and small business enablement. Each is designed to simplify and secure how consumers and businesses across the region pay and get paid.

The company says these solutions reflect its commitment to making commerce more intelligent, connected and seamless. Highlighting the scale and significance of the announcement, Jack Forestell, Chief Product and Strategy Officer at Visa, noted the importance of both Visa’s global reach and its local innovation credentials.

“Combining the strength of our global network with our leadership in payment innovation here in Asia Pacific, we are bringing new products and solutions that will transform commerce and deliver trust and security to AI-enabled payments across the region.”

Here are the six solutions Visa is introducing across Asia Pacific:

Visa Intelligent Commerce: AI Agents Meet Trusted Payments

To support the rise of AI-powered shopping experiences, Visa has introduced Visa Intelligent Commerce. This solution is built for developers creating AI agents that can browse, purchase and manage transactions on behalf of users. The programme includes a set of application programming interfaces (APIs), allowing secure data exchange, along with a partner onboarding framework designed to scale AI commerce responsibly.

Visa is already in discussions with Ant International, Grab and Tencent to explore secure checkout integrations. These partnerships aim to bring trusted payment capabilities directly into the region’s leading platforms, enabling seamless and intelligent transactions.

Stablecoins: Making Digital Currencies Easier to Spend and Settle

Visa is expanding its stablecoin initiative across Asia Pacific, helping consumers and businesses spend digital currencies like stablecoins as easily as traditional money. In partnership with DCS Singapore, DTC Pay and StraitsX, Visa is launching stablecoin-backed cards that automatically convert stablecoin balances into local currency at the time of purchase. This allows users to shop globally with minimal friction.

To speed up money movement, Visa is also enabling seven-day-a-week settlement. Through collaboration with StraitsX, partners can move funds using stablecoins such as USDC, even on weekends. Visa has already processed more than 225 million US dollars in stablecoin volume and is targeting one billion dollars globally by the end of fiscal year 2026.

Additionally, the company is scaling its Tokenized Asset Platform. This provides partners with the tools to issue and manage tokenised representations of fiat currencies. The platform will support new types of programmable payments and is set to expand across the region later this year and into 2026.

Visa said all digital currency-related innovations are governed by the same high standards of compliance, risk and security that underpin its core payment systems.

Flex Credential: One Card, Multiple Accounts, Greater Flexibility

Visa’s Flex Credential offers cardholders the ability to toggle between different payment sources, such as debit, credit or rewards points, all on a single card. They can manually select the funding source before each transaction or rely on preset rules that trigger specific sources based on transaction size, merchant category or location.

Originally launched in Japan with the Olive card through partnerships with Sumitomo Mitsui Banking Corporation and Sumitomo Mitsui Card Company, Flex Credential has already been adopted by over five million account holders. Cardholder spend has been 40 percent above the national average.

The solution is also evolving. New features include multi-currency support and small business crossover functionality. These allow users to link accounts across currencies or manage business and personal spending from a single card. Visa is now working with ACB, VIB and VP Bank to roll out Flex Credential in Vietnam.

Digital Identity: Smarter Security with Less Friction

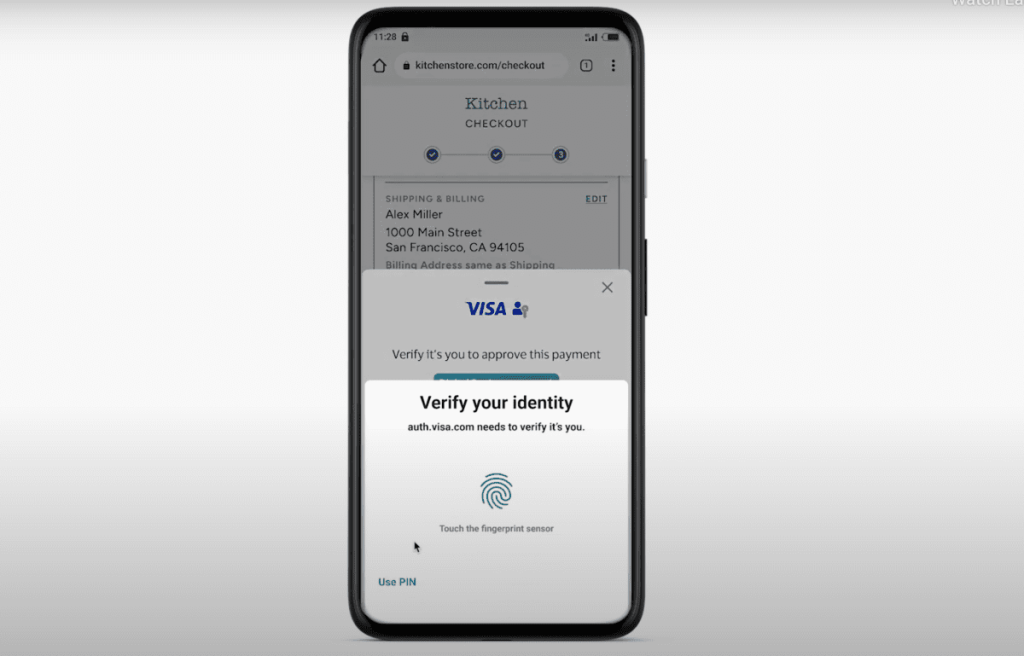

To strengthen trust in digital payments, Visa is enhancing authentication and identity verification through features such as Passkeys, Tap to Confirm and enriched transaction data.

Passkeys allow consumers to log in or approve payments using biometrics such as fingerprint or face recognition, eliminating the need for passwords. Tap to Confirm enables fast, one-tap approvals within mobile banking apps, reducing reliance on one-time passwords and improving both speed and security.

Visa has partnered with Coles, a major Australian supermarket chain, and Maybank, one of Southeast Asia’s leading financial institutions, to bring these digital identity solutions to life. These tools aim to reduce fraud and friction across both in-person and online payment experiences.

Visa Pay: Global Acceptance for Local Wallets

With Visa Pay, consumers can use their preferred local digital wallets or account-to-account payment apps to make purchases globally, whether by tapping, scanning or paying online. The service connects these local apps to Visa’s global acceptance network.

Visa has partnered with LINE Pay in Taiwan, Maya in the Philippines, OpenRice in Hong Kong and Woori Card in South Korea to bring this solution to market. The goal is to meet increasing demand for wallet interoperability and enable a more consistent experience for cross-border spending.

By removing the barriers between local wallets and international merchants, Visa Pay simplifies global transactions for millions of mobile-first consumers across Asia Pacific.

Visa Accept: Empowering the Smallest Sellers

Visa Accept enables micro and informal sellers to accept card payments directly using an NFC-enabled smartphone and their banking app, without the need for additional hardware. This brings simple, secure payment acceptance to segments of the economy that have traditionally relied on cash or peer-to-peer apps.

In Vietnam, Visa is partnering with ACB, Sacombank and VP Bank to launch the service. Sellers such as street vendors, home-based businesses and freelancers can now accept contactless payments and receive funds directly into their Visa-linked accounts.

The programme is intended to broaden financial inclusion by making it easier for anyone, from food cart operators to rural service providers, to enter the digital economy.

*****

Highlighting Visa’s role in shaping the future of payments, T.R. Ramachandran, Head of Products and Solutions for Asia Pacific at Visa, emphasised the company’s continued role in shaping the future of payments.

“As global commerce continues to evolve rapidly, Visa remains at the forefront of delivering innovations that will enable the future of commerce across Asia Pacific.”

He also highlighted the potential of AI-enabled payments to become part of everyday life. “We believe AI agents will play a growing role in commerce, from handling routine purchases such as ordering food, to more complex purchases such as securing event tickets or making travel reservations. By combining AI capabilities with Visa’s trusted payment infrastructure, we are enabling a seamless, secure, and more enjoyable experience for consumers, merchants, and businesses alike.”

Visa said Asia Pacific’s rapid adoption of digital technology makes the region an ideal environment for launching these solutions. The company believes that by combining AI, digital currency, flexible credentials and merchant enablement tools with its trusted global network, it is helping to build a smarter and more inclusive commerce ecosystem for the future.

Comments (0)