Alex Cheong Pui Yin

22nd February 2024 - 4 min read

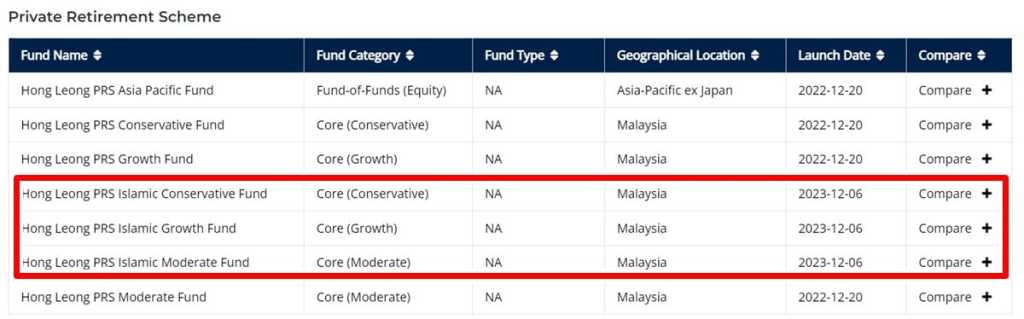

Hong Leong Asset Management (HLAM) has officially launched its first Islamic Private Retirement Scheme (PRS), dubbed the Hong Leong PRS-Islamic. Aimed at helping Malaysians to secure sufficient savings and achieve a sustainable retirement, the offering is also HLAM’s second PRS product overall.

In a statement, HLAM explained that under the Hong Leong PRS-Islamic offering, there will be three core funds that investors can choose from, depending on their retirement needs, age, and risk appetite. Here are some key details on the funds for your quick reference:

| Hong Leong PRS-Islamic funds | Risk rating | Asset allocation, based on net asset value (NAV) | Investor profile | Fees |

| Hong Leong PRS Islamic Conservative Fund | Low | – Min 80% of NAV to be placed into sukuk and/or Islamic money market collective investment schemes – Up to 20% of NAV to be placed into shariah-compliant equity and equity-related/balanced Islamic collective investment schemes | – Conservative – Low risk tolerance – Seek capital preservation – This fund will be automatically selected for members who are under the Default Option, and are 55 years old and above | – Sales charge of up to 3% of fund’s NAV per unit – Annual management fee of 1% p.a. – Annual trustee fee of 0.04% p.a. – No redemption and switching fees – Other Private Pension Administrator (PPA) fees apply |

| Hong Leong PRS Islamic Moderate Fund | Medium | – Min 30% of NAV to be placed into sukuk and/or Islamic money market collective investment schemes – Up to 70% of NAV to be placed into balanced Islamic collective investment schemes | – Focused on growing portfolio steadily and seeking income – Low to moderate risk tolerance – Want a diversified, shariah-compliant portfolio with some foreign exposure – This fund will be automatically selected for members who are under the Default Option and are 45 years old and above, but not yet 55 | – Sales charge of up to 3% of fund’s NAV per unit – Annual management fee of 1.25% p.a. – Annual trustee fee of 0.04% p.a. – No redemption and switching fees – Other Private Pension Administrator (PPA) fees apply |

| Hong Leong PRS Islamic Growth Fund | High | – Up to 30% of NAV to be placed into sukuk and/or Islamic money market collective investment schemes – Min 70% of NAV to be placed into shariah-compliant equity and equity-related Islamic collective investment schemes | – Focused on growing portfolio steadily – High to moderate risk tolerance – Want a diversified, shariah-compliant portfolio with some foreign exposure – This fund will be automatically selected for members who are under the Default Option and are below the age of 45 | – Sales charge of up to 3% of fund’s NAV per unit – Annual management fee of 1.50% p.a. – Annual trustee fee of 0.04% p.a. – No redemption and switching fees – Other Private Pension Administrator (PPA) fees apply |

All three funds will be managed by Hong Leong Islamic Asset Management Sdn Bhd, with a minimum initial subscription amount of RM100 and a minimum additional subscription amount of RM50. HLAM also highlighted that individuals who invest in PRS are currently able to claim tax relief of up to RM3,000 for their PRS investments (provided until 2025).

“With the introduction of the company’s second PRS, the Hong Leong PRS-Islamic, Hong Leong AM is pleased to offer a new option for investors to consider when exploring additional opportunities to supplement their mandatory scheme savings. Additionally, the PRS’ lock-in period is particularly beneficial in helping investors who are determined to grow their savings stay disciplined and invested for the long run,” HLAM shared, adding that young investors, in particular, will have an added advantage as they will reap compounded benefits over the years.

For further context, the three Hong Leong PRS-Islamic core funds had actually already been soft-launched back in December 2023, before it is officially rolled out this month. If you’re interested in finding out more about the new offerings, you can visit HLAM offices or reach out to its agency forces nationwide. Alternatively, you can get more information on the three core funds from HLAM’s official website here.

(Source: Hong Leong Asset Management)

Comments (0)