Sasha Belani

22nd February 2021 - 5 min read

When visiting a supermarket to stock up on your daily necessities, or while making a quick stop at the restaurant for takeaway – chances are, you would choose to simply wave your card at the payment terminal considering the current pandemic situation.

It is no surprise given a study showing that 22% of Malaysians have reported increased use of their credit card’s contactless feature since the start of the COVID-19 pandemic. Contactless payments are encouraged as the “new normal”, especially after it was revealed last year that exchanging banknotes could contribute to the spread of COVID-19.

Having said that, while keeping yourself as safe as possible by choosing contactless payments, why not get yourself rewarded for your daily purchases with a credit card which offers you cashback benefits?

Introducing BSN Visa Cash Back Credit Card, a credit card that is suited for everyday spending as it gives you up to 5% cashback on necessities such as groceries, petrol, dining, and more. Read on to find out how you can get cashback benefits with this credit card on your everyday contactless spend.

First Up, Groceries! (And Up To 5% Cashback)

A staple in any household is groceries and that includes lots of snacks. After all, for so many of us that are working from home, munching on snacks like chips or fruit is a convenient way to get an energy boost throughout the day.

Plus, if you’re handy in the kitchen, it’s more budget-friendly to go grocery shopping and make your meals at home. While you’re doing that, don’t forget to use the BSN Visa Cash Back Credit Card to get your cashback. This credit card offers up to 5% cashback on grocery spend in grocery stores and supermarkets, capped at RM15 per month per card member. For added convenience (and safety), use the credit card’s contactless feature and just wave your card at the terminal to make your payment.

Next, Stay Safe, Fuel Up & Get RM15 Cashback Per Month

Even though working from home is the new norm, you may still need to use your car to go and buy groceries, pick-up meals, or even head out for a short drive to ensure your car battery remains charged and to protect your engine.

For those short trips and any unexpected emergencies, you’ll need to keep your fuel tank full so that your car is ready to go whenever needed. And of course, fuelling up with the BSN Visa Cash Back Credit Card will give you up to 5% cashback, capped at RM15 per month! At the end of the day, even with the short drives, you’ll definitely appreciate these added savings on your petrol expenditure.

Splurge (And Save) On Your Take-Away Dinners For The Family

While home-cooked meals are more wallet-friendly and healthy, it’s nice to give yourself and the kitchen a break every once in a while. So, why not splurge a little on a nice takeaway dinner for the family over the weekend? Whether it’s the rare treat of fast food, pizza and pasta, or scrumptious Nyonya cuisine, go ahead and enjoy whatever tickles your fancy. Whatever you choose, do be on the lookout for restaurants that are close to home and heed proper physical distancing SOPs to be on the safe side.

For extra safety, be sure to use the contactless feature when paying for your takeaway dinner with the BSN Visa Cash Back Credit Card and receive up to 5% cashback on all dining, capped at RM15 per month.

Get Up To RM540 Cashback Annually With BSN Visa Cash Back Credit Card

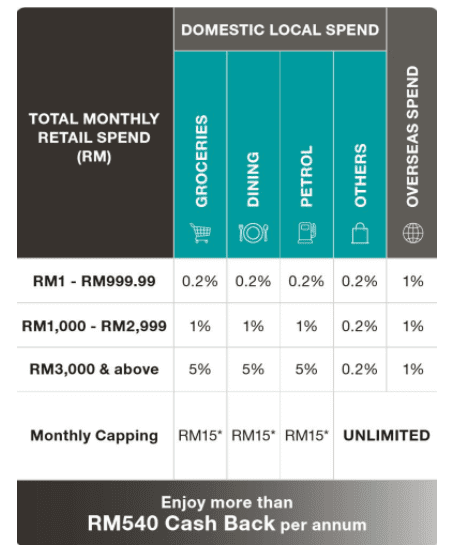

With the monthly cashback capped at RM45 per month per card member, if you maximise your cashback benefits in each category — namely, grocery, petrol, and dining — every month, you can get up to RM540 cashback annually with the BSN Visa Cash Back Credit Card.

The BSN Visa Cash Back Credit Card offers a tiered rate of cashback for each category, so while the maximum cashback you could earn is 5%, it depends on how much your expenditure is in a given month. If you spend under RM1,000 in a month, you will get 0.2% cashback, while monthly expenditure of between RM1,000 and RM2,000 will receive 1% cashback. Meanwhile, those who spend RM3,000 and above will get 5% cashback — and this is all capped at RM15 each for groceries, petrol, and dining categories.

Other cashback benefits offered by the card also include 0.2% unlimited cashback on other retail spending and 1% unlimited cashback on overseas spending.

What’s more, the BSN Visa Cash Back Credit Card does not charge annual fees for life for both principal and supplementary cardholders, thus maximising your savings even more.

So, if you’re looking for a credit card that gives you cashback benefits on your contactless spend for daily necessities such as groceries, petrol, and dining, as well as one that doesn’t charge annual fees for life, take a closer look at the BSN Visa Cash Back Credit Card.

Contact a BSN Sales Advisor today to apply, or learn more about the BSN Visa Cash Back Credit Card here.

Comments (0)