RinggitPlus

17th October 2019 - 5 min read

Most people want to buy a home eventually, but unfortunately, not everyone is well-prepared for getting a home loan approved successfully. Several different factors contribute to whether a financial institution approves a home loan; let’s discuss some of these factors now.

An Applicant’s DSR

A big chunk of a bank’s decision to approve your home loan falls on your Debt Service Ratio (DSR). This is a number that shows, in percentage form, how much of your monthly income goes into paying off your debts. While the exact acceptable percentage varies from bank to bank, a good practice is to keep your DSR below 60%.

DSR Formula = (Total loan/credit card commitments per month) / (Gross monthly income) x 100

Do note that it’s not just loans that are taken into consideration; credit card balances are also added into the calculation. Banks depend largely on the DSR to decide if your application goes through because it gives them a picture of how much debt you are currently handling, and if you can allocate more income to pay your monthly home loan commitment. Essentially, a low DSR means you are better able to take on – and repay – a loan.

If you currently have a DSR above 60% and are planning to buy a house in the future, a good first step is to reduce that number before applying for a home loan. Start by paying off all the smaller loans you have as fast as possible. Another way is, of course, to increase your income so that your current debts form a smaller percentage of your new salary.

An Applicant’s Credit Score

Your credit score is a score that banks use to determine, through analysis of your credit history, if you will be a good paymaster for your loan or not. Your credit score is calculated through a review of things like the number of loans/lines of credit you currently have, the length of the loan/credit, how good you are at keeping up with payment of those loans, what new loans and credit you have taken on in the last 12 months, as well as if you have had any legal trouble when it comes to finances.

Having a good credit score is a necessity to get your home loan approved. Keep the following tips in mind to maintain a high credit score:

- Always pay your loans and credit card balances on time, every month. Even just one skipped payment on a loan can affect your credit score, so take repayments seriously.

- Having no credit history is almost as bad as having a bad credit score. If your credit history is a blank slate, banks have less data on how good a paymaster you are, and so may be more reluctant to let you take out a home loan. To overcome this issue, build a credit history by getting a credit card to use on purchases or bill and always pay off the entire balance at the end of the statement. This way, you create a solid credit history for yourself and show good payment behaviour as well.

- Do not get yourself into any kind of legal issues if possible. This is especially true for any legal situations involving credit and payments. This leaves a bad taste in the mouths of bankers reviewing your credit history, even when it may be relatively minor offences.

- It is good practice to periodically check your credit score to make sure it is still in the green. If it isn’t, at least you are aware and can immediately take measures to rectify it.

Adequate Documentation and Honest Disclosure

Even if your credit score and DSR are amazing, a simple thing such as incomplete documentation can negatively affect the chances of your home loan application being approved. The documentation you need to prepare for a home loan application include:

- Salary slips (or proof of income if you are self-employed)

- EPF statements

- Your IC photocopy

- Letter of employment from your company

Be sure to have all the documentation ready and submit them promptly to your bank for the application. Being tardy in sending in documentation can delay the process and also create suspicion. And don’t forget to always be truthful when providing details for your application; if you are caught lying it can totally jeopardise your application.

What Else Can You Do?

What if there is a tool that prospective home owners can use to estimate how much they can borrow in a home loan, even before they apply for one?

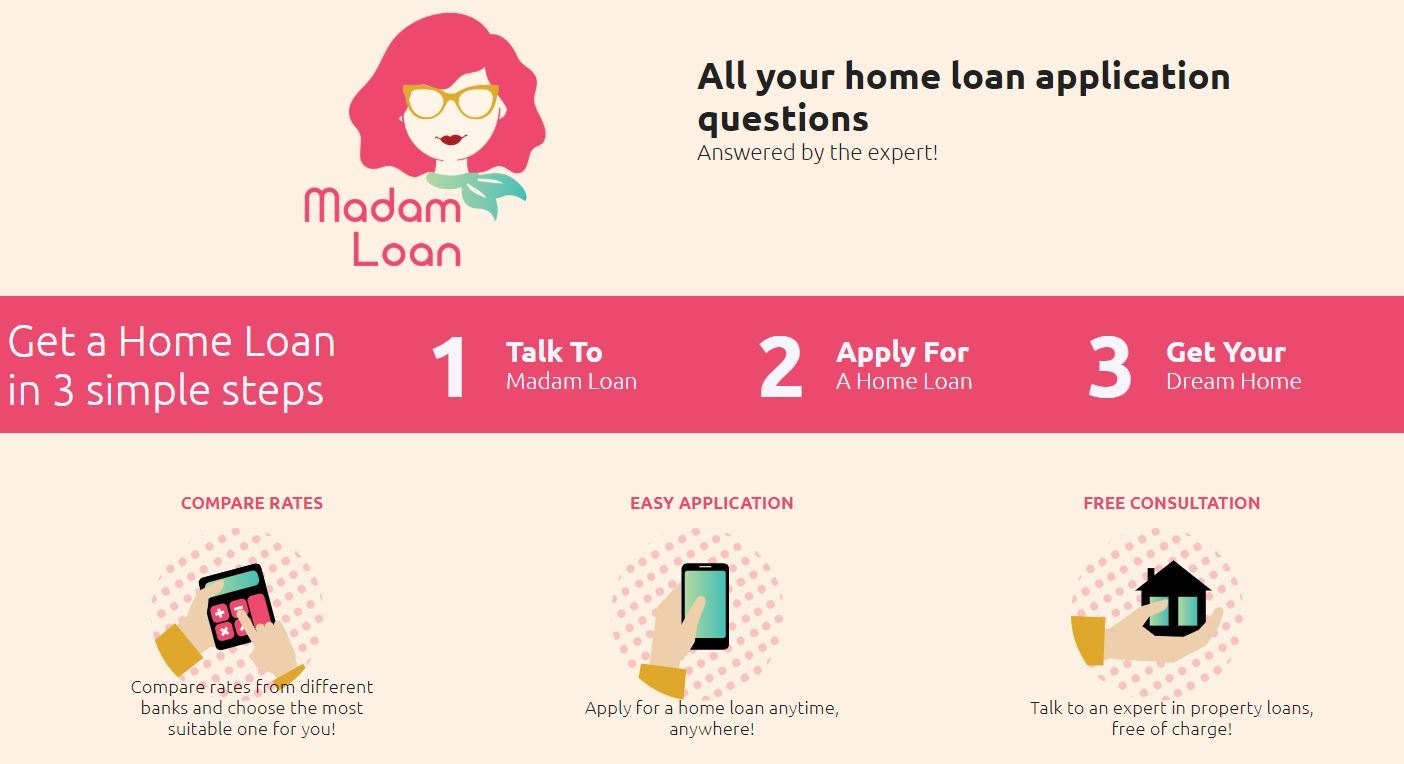

Mah Sing’s new chatbot, Madam Loan, will let you do that… and more! By just providing your monthly salary and monthly commitments, Madam Loan provides you with an estimate amount you can borrow in a home loan that has a higher chance of approval.

Try it out for yourself now at www.madamloan.com.my, and check out the available properties you can be approved for in the process.

Comments (0)