Jacie Tan

20th November 2020 - 6 min read

Over the last few years, there has been a new entry into the cashless payments landscape: e-wallets. Especially with the recent pandemic, many Malaysians have turned to a digital lifestyle, using e-wallets for contactless payments and e-commerce shopping. E-wallets come with their own host of consumer benefits, from loyalty programmes and cashback to vouchers and promotions.

For savvy e-wallet users, the best part usually lies in the fact that you can get all of these e-wallet benefits on top of the advantages your credit cards have to offer. This has led to the “double dipping” phenomenon, and it looks like it’s here to stay – which is great news for consumers!

E-wallets and credit cards: the best of both worlds

Double dipping on rewards for both credit cards and e-wallets is simple; just use your credit card to top up your e-wallets. That way, your credit card provider will reward you with the perks of your credit card (either in cashback or rewards points), while you also reap the benefits offered by the e-wallet provider too – all for the same amount of spending.

Of course, there are some downsides you should be aware of when it comes to double dipping. Some people prefer sticking to credit cards due to barriers like e-wallet size limits or payment restrictions, or even the so-called inconvenience of taking out their smartphones to scan a QR code. Worse, certain banks have also revoked their cashback or rewards benefits for e-wallet top-ups using credit cards – which means it is very important to use the right credit cards that maximise your double-dipping potential.

Thankfully, some banks have released new credit cards specifically catered for those who use them to top up e-wallets. Let’s take a look at one candidate that’s perfect for double dipping on both credit card and e-wallet rewards: the CIMB e Credit Card.

An attractive credit card for e-wallet expenditure

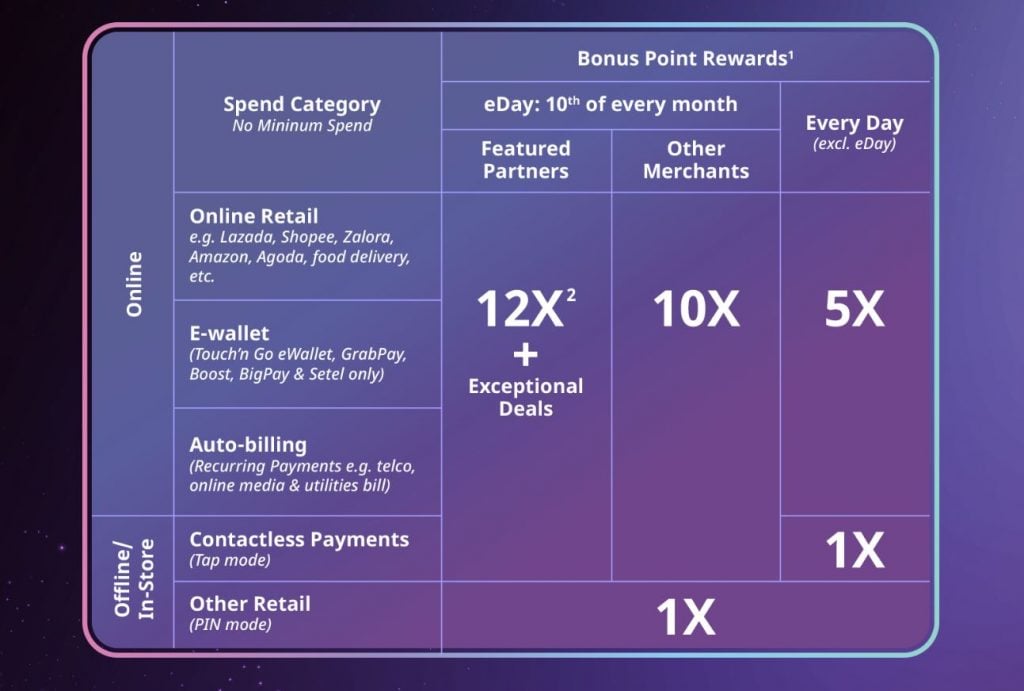

The CIMB e Credit Card offers up to 12X Bonus Points on a variety of spending, from e-wallet reloads and online shopping to auto-billing, contactless, and PIN payments too. The 12X points are reserved for spend with featured partners such as Shopee, Lazada, Taobao, ZALORA, HappyFresh, Coffee Bean, and many more on eDAY which falls on the 10th of every month. Meanwhile, 10X points are offered for non-featured partners on online, e-wallet, contactless, and auto-billing spend almost everywhere on the 10th as well. On normal days, you either get 5X or 1X Bonus Points depending on what you spend on. It’s all summarised in the table below:

The best part about the CIMB e Credit Card is that you can easily maximise your double-dipping potential just by topping up your e-wallets on the 10th of every month. For example, if you just topped up RM1,000 across your e-wallets for the month, you would easily rack up 10,000 Bonus Points already! Each CIMB e Credit Cardholder is entitled to a total of 20,000 Bonus Points per statement cycle, which means you’ll hit peak double-dip level at RM2,000 in e-wallet top-ups, which is far above what most Malaysians would spend using e-wallets in a month. Plus, with a minimum of 22,000 Bonus Points, you can redeem e-vouchers from Shopee, Lazada, Grab, Touch ‘n Go, Zalora, and lots more!

And with the CIMB e Credit Card, you don’t need to worry about meeting a minimum spend requirement in order to get rewarded, because there is none – the Bonus Points are awarded to you for all eligible transactions, so you won’t run the danger of overspending just so you can collect points.

CIMB e Credit Card: deals and rewards all in one

The card’s monthly eDAY also offers attractive deals that you can take advantage of. Not only will you enjoy up to 12X Bonus Points multiplier, you can get deals as good as RM29 off on minimum RM30 spend on selected major e-commerce websites! To better reward CIMB e Credit Cardholders during the end-of-year cyber sales period, CIMB is even extending the eDAY so you have additional days to snap up deals online. This December, the eDAY will be extended from 10-12 December instead of just one day.

What about the rest of the month? Well, you still get access to over 1,000 CIMB card deals every day; these include brands such as Pestle & Mortar, OXWHITE, Stories.my, Kind Kones, The Ruma, and Poptron – a lifestyle social commerce platform that curates local artisan brands.

Lastly, you should note that CIMB touts its e Credit Card as having one of the best bank bonus point conversion rates at 400 Bonus Points = RM1*. You can redeem cashback as part of CIMB’s rewards catalogue, effectively using your Bonus Points to offset your credit card statement – or you can offset your purchase directly on-the-spot using Pay With Points at over 9,000 offline retail outlets that accept this feature.

At 12X Bonus Points, the 400 Bonus Points to RM1 redemption rate equals to an effective return of 3% in cashback!

***

Being a smart consumer is all about taking advantage of what’s available at your disposal. Credit cards and e-wallets are not going away, and with more banks following in CIMB’s footsteps of rewarding e-wallet reloads, the double-dipping phenomenon isn’t going away anytime soon.

With its flexible points earning cashback feature and a host of additional benefits, it’s no wonder the CIMB e Credit Card is a popular choice among savvy millennials. With an annual income requirement of just RM24,000 – and a RM100 annual fee that is waived for the first year and upon an annual spending of RM12,000 afterwards – the CIMB e Credit card is both rewarding and accessible.

You can find out more about the CIMB e Credit Card here. Interested to apply? Sign up for one now!

*Best bonus points conversion of 400 Bonus Points = RM1 offered by CIMB is in comparison against other consumer banks in Malaysia published as of 1 June 2020. The conversion rate is applicable to Pay With Points participating merchants and cash back redemption.

Comments (0)