Balkish Rosly

15th September 2014 - 5 min read

Let’s be honest – most us love to swipe that plastic card but detest paying the bills. But as we get older, we soon come to the realization that credit cards are not akin free money, and the 15% – 18% interest rate is no joke. Oh where is a time machine when you need one?

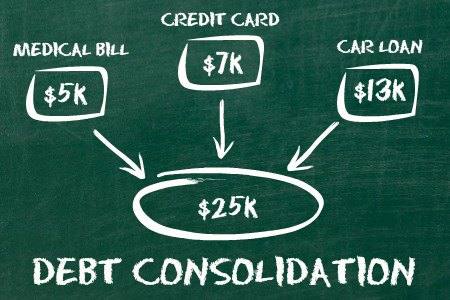

For spend-a-holics who are already in the danger debt zone, there are several ways for you to vanquish all of your credit card debt (no, physically cutting all of your ten credit cards will not make the problem go away). One of the ways is by consolidating your two, three…or ten credit cards debts by taking on a personal loan, such as a Bank Islam personal loan or a HSBC personal loan.

Most banks would actually push you to take on a hefty personal loan – not for your Paris trip, mind – but to settle off your multiple credit card debts. But should you do it?

When you should say NO to a personal loan

When the interest is higher

Credit cards are quoted on a fixed rate basis, while personal loan is quoted on a flat rate basis. What’s the difference? With a flat interest rate, the interest is calculated based on your principal amount.

Example: if you borrow RM20,000 from the bank, the interest will be calculated from RM20,000 throughout your payment tenure. Yes, even if you’ve already paid half of the amount, your interest will still be calculated from RM20,000.

Unless if you have more than two credit cards, both at 18% p.a. interest rate, then a personal loan might not offer the best interest rate for you after all. As a rule of thumb, always multiply the flat rate by 1.8 – 1.9x to compare it with the fixed rate. If it’s higher than your credit card’s interest rate, then don’t bother going down that road.

When your debt is manageable

First time card users might have quite a shock at the sight of their thousands of ringgits debt printed in black and white. But relax, if you only have less than two credit cards to manage and you can more than afford to pay them off in less than 1 year, it might not make sense to consolidate.

When you’re not facing the real problem

Just like removing the junk on your bed and shoving them into your closet is not “cleaning up”; simply shifting your debt around, without facing the real problem (your spending!) will just enable them to accumulate elsewhere. There’s no point in consolidating your debt if you can’t manage them properly.

When you should say YES to a personal loan

When it’s simpler

If you keep missing your loan payments because you are too overwhelmed to keep track of them all, then consolidation via personal financing might be a good idea – this means you only have one monthly payment to make, one due date, and only one interest rate.

When you’re saving money

Here’s an example:

Situation A: No consolidation

You have maxed out three credit cards, let’s call them card A, B, and C, and now you owe the bank RM15,000 (RM5,000 for each card). All cards have an interest rate of 18% p.a., and you are currently paying RM200 per month for each card.

So your total monthly repayment: RM600 per month

Based on our credit card debt calculator, you will need to continue paying RM600 for the next 32 months (close to 3 years) to clear off your debt. The total interest rate you’ll be paying is RM3,941.91

Situation B: Consolidate all of those debt with a personal loan

You apply for RM15,000 personal loan from Bank D at 8% flat rate and you use this to pay off all your credit card debts.

Your total interest cost will be 8% x RM15,000 x 3 years = RM3,600.

In summary, you have to pay RM18,600 for 36 months. That’s RM516.70 per month.

In this case, consolidating your debts make more sense because you’ll be paying less for your interest and monthly installments.

However, different banks have different rates when it comes to personal loans. Try comparing them and do a bit of math before you take on a personal loan.

If you have decided to consolidate your debt by applying for a personal loan, then you must take these disciplinary actions:

1. Cancel all of your credit cards but keep the best one for emergency purposes. (PS: Do take note that the sale season is not an “emergency”).

2. Make sure that you pay your personal loan installments on time to avoid any late payments.

What other options can I take?

Ah! glad you asked. A much better way is by applying for a 0% balance transfer credit card and transfer your credit card debt onto another card – at 0% interest rate (no more 18% p.a. yay!). However, this also means you need to have a credit card onto which to transfer that balance. Should you feel neither a personal loan nor a balance transfer can help you out of the monumental fix you are in: try reaching out to the folks at

AKPK.

Comments (0)