Pang Tun Yau

3rd July 2024 - 4 min read

AmBank has officially released details of its new co-brand credit card in partnership with Enrich by Malaysia Airlines. The new AmBank Enrich Visa Infinite and AmBank Enrich Visa Platinum both reward cardholders with Enrich Points as well as various exclusive perks.

The new AmBank Enrich Visa credit cards are designed for frequent travelers – and especially those who regularly fly on Malaysia Airlines. Thanks to the Enrich partnership, this card offers perks most other air miles and travel credit cards do not offer – which we’ll share further in this article.

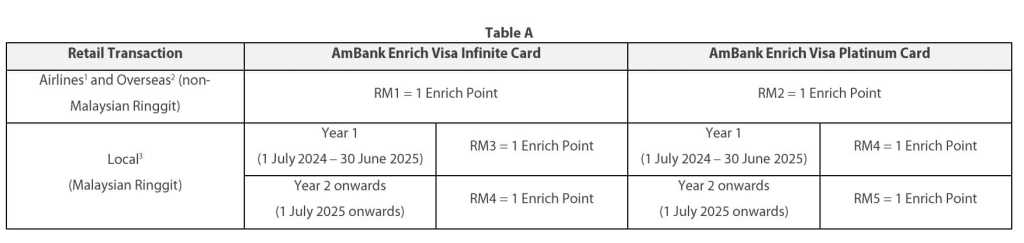

The key proposition for the AmBank Enrich Visa Infinite and Visa Platinum is the ability to earn Enrich Points that are automatically credited to the cardholder’s Enrich account. Both cards naturally earn Enrich Points at different rates: the Enrich Visa Infinite earns 1 Enrich Point for every RM1 spent overseas and airlines, and RM3 spent locally; while the Enrich Visa Platinum earns 1 Enrich Point for every RM2 spent overseas and airlines, and RM4 spent locally.

Naturally, there are some restrictions to the eligible transactions. These include e-wallet reloads as well as petrol stations, charities, government-related, and JomPay transactions.

In addition, cardholders also get up to 10% instant discount for any Malaysia Airlines flight ticket purchase using the card, as well as Malaysia Airlines Golden Lounge access – which is accessible only for Malaysia Airlines and Oneworld Alliance passengers flying Business Class and above, Enrich Gold and Platinum tiers (and their Oneworld equivalents), and anyone willing to pay the RM279 access rate.

Cardholders also enjoy fast-track status tiers with a 30% reduction in Enrich Elite Points requirements. This is a compelling perk for those who travel regularly, as Enrich Elite Points are only earned by flying with Malaysia Airlines, MASWings, Firefly, or Oneworld Alliance flights and not via banks rewards points conversion (with the exception of one-off campaigns).

Earning higher Enrich tiers unlock various perks, from higher baggage allowance, priority boarding and baggage, Golden Lounge access, and more – this tier is also recognised by Oneworld Alliance airlines so they will apply when you fly with those airlines as well.

Here’s a table summarising the full range of benefits offered by the new AmBank Enrich Visa credit cards:

| AmBank Enrich Visa Infinite | AmBank Enrich Visa Platinum | |

| Malaysia Airlines flight tickets | Up to 10% off | Up to 10% off |

| Enrich Points earned for airlines & overseas spend | RM1 = 1 Enrich Point | RM2 = 1 Enrich Point |

| Enrich Points earned for local spend | RM3 = 1 Enrich Point | RM4 = 1 Enrich Point |

| Malaysia Airlines Golden Lounge access | Unlimited for cardholder + 1 guest | 4x complimentary access annually |

| Fast track to Enrich Elite status | 30% reduction in Enrich Elite Points requirement | 30% reduction in Enrich Elite Points requirement |

| Travel insurance coverage | Up to RM2,000,000 | Up to RM500,000 |

| Annual fee | RM500, waived for first year Subsequent years: 50% waiver with RM50,000 – RM99,999 annual spend 100% waiver with RM100,000 & above annual spend | Free for life |

Beyond that, it’s also important to note the various footnotes and T&Cs of the AmBank Enrich Visa credit cards. Firstly, the local earn rate for both the Enrich Visa Infinite and Enrich Visa Platinum are “promotional” and applicable to a quota of 43,000,000 Enrich Points or until 30 June 2025, or whichever comes first. After either condition is met, the earn rates will be changed to RM4 = 1 Enrich Point for the Visa Infinite and RM5 = 1 Enrich Point for the Visa Platinum.

Lastly, the minimum income requirements and annual fees. The Enrich Visa Infinite has a minimum annual income requirement of RM100,000 (RM8,334/month) while the Enrich Visa Platinum has a much more modest annual income requirement of just RM24,000 (RM2,000/month). The Enrich Visa Platinum is free-for-life with zero annual fees, while the Enrich Visa Infinite has a RM500 annual fee with the following waiver conditions: 50% upon spending between RM50,000 – RM99,999, and 100% upon spending at least RM100,000 in 12 months.

For more information about the new AmBank Enrich Visa Infinite and AmBank Enrich Visa Platinum, check out the official product landing page here.

Comments (0)