Alex Cheong Pui Yin

15th March 2023 - 3 min read

Hong Leong Bank (HLB) is introducing two new features to beef up its online banking security against financial fraud, namely an Emergency Lock function and a cooling-off period. Both features are set to come into effect starting from tomorrow.

The Emergency Lock function is essentially a “kill switch” that can be activated when customers suspect that they have fallen prey to scams, or if their HLB Connect access has been compromised. Once triggered, all new transactions on HLB Connect will be blocked, with the exception of scheduled instructions or recurring transactions that were set prior to the activation.

However, customers will still have access to their HLB Connect account on the website and app to view their account balance. Similarly, their credit and debit card transactions, too, will not be affected when this feature is triggered. After activating the Emergency Lock, customers are also required to contact HLB at 03-7626 8899 to make a report, as well as to get further advice from the bank.

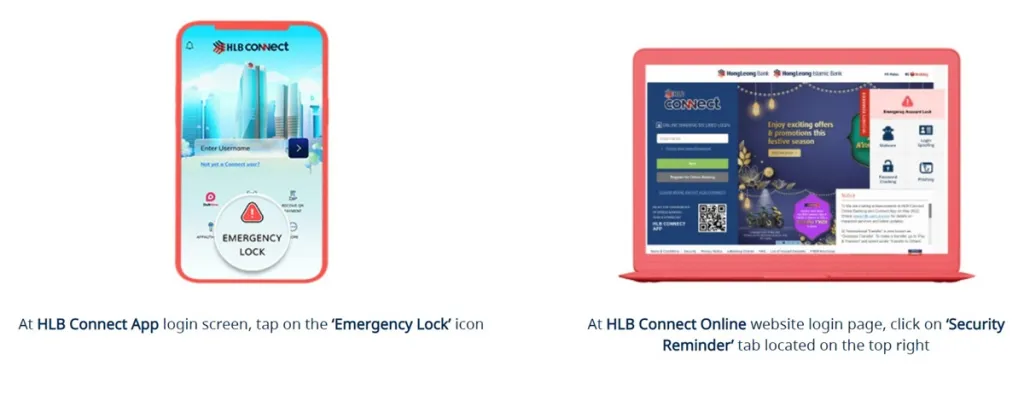

The Emergency Lock can be found on both the HLB Connect app and the HLB Connect Online website. For the HLB Connect app, customers will see the Emergency Lock immediately on the login screen. Meanwhile, those who wish to activate the feature through the HLB Connect Online website can do so by clicking on the “Security Reminder” tab (located at the top right corner of the page).

Aside from the Emergency Lock, HLB is also implementing a cooling-off period that will take effect when customers install the HLB Connect app and enable AppAuthorise on a new device, and when they increase their daily transaction limit on HLB Connect. Essentially, this means you will only be able to authorise your transactions using AppAuthorise or tap into the new transaction limit after the cooling-off period is over.

On its website, HLB did not specify the length of this cooling-off period, noting only that “the duration of the cooling-off period will be shown to you” during the process. Meanwhile, customers who are going through the cooling-off period after requesting to increase their daily transaction limit can still continue to transact like normal within the existing transaction limit. Also, if you make another request to increase your daily transaction limit before the first cooling-off period is over (after submitting a first request), the timer will reset, and you will be required to wait it out all over again.

These two new security features for HLB’s online banking services are in line with Bank Negara Malaysia’s directive for banks to implement five additional safeguards against financial scams, as well as the government’s recent call to introduce “kill switches” as another security measure under Budget 2023. Other security features that HLB had also put into place prior to this include its AppAuthorise feature, which substitutes the need for one-time passwords (OTP) via SMS to verify transactions, as well as limiting each user’s access to HLB Connect app to only one device.

(Source: Hong Leong Bank [1, 2])

Comments (0)