Alex Cheong Pui Yin

28th December 2021 - 3 min read

Hong Leong Islamic Bank (HLISB) has introduced a new digital restricted investment account, which allows its customers to conveniently invest in shariah-compliant unit trust funds on a digital platform anytime, anywhere. Dubbed the Portfolio Investment Account (PIA-i), it is said to be the first of such products to be rolled out in Malaysia.

Launched in collaboration with Hong Leong Islamic Asset Management (HLISAM), the PIA-i aims to cater to the needs of customers with an increasingly digital lifestyle. They can easily diversify their personal investments through the HL Connect digital banking platform instead of having to go through the traditional investment experience of walking into a bank branch to open the required accounts.

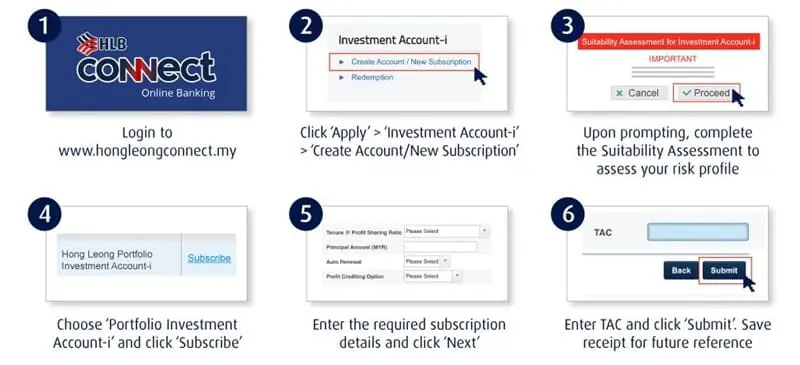

In fact, HLISB clarified that the PIA-i is only available through the HL Connect internet banking platform; you will not be able to apply for it at a bank branch. It is also not yet enabled for the HLB Connect mobile app, which means that you cannot perform any PIA-i transactions through the app. You are, however, able to review the investment account dashboard in your HLB Connect app.

Through the PIA-i – which is based on the Wakalah bi Al-Istithmar shariah principle, where you authorise HLISB to manage your investment on your behalf – your funds will be invested into three shariah-compliant investments, namely:

- Hong Leong Dana Al-Izdihar (money market fund)

- Hong Leong Dana Maa’rof (balanced fund)

- Hong Leong Dana Makmur (equity fund)

You can begin investing in the PIA-i with a minimum of RM1,000, at an expected profit return of 6% p.a.. Note that to be eligible for this product, you must be a Malaysian aged 18 years old and above, and have a current or savings account/-i with the bank. Here’s how you can easily sign up for the PIA-i:

The chief executive officer of HLISB, Jasani Abdullah said that the launch of the PIA-i is part of the bank’s efforts in facilitating its customers’ journey towards a more superior personal wealth management. “The PIA-i embraces inclusive banking services and accessible financial support by simplifying the investment process to the extent that almost anyone with basic financial literacy can start investing with ease. This is crucial as we look forward to rebuilding, recovering, and increasing resiliency beyond the pandemic,” he said.

Meanwhile, the chief executive officer of HLISAM, Noor Aini Shaik Awab said that digital technology is providing greater access for consumers to invest, as well as increasing consumer awareness in financial sustainability. “We believe by leveraging shariah investment principles with digital technologies, we will be able to make Islamic asset management a leading investment offering in Malaysia,” she commented.

(Source: Hong Leong Islamic Bank)

Comments (0)