Alex Cheong Pui Yin

7th May 2021 - 3 min read

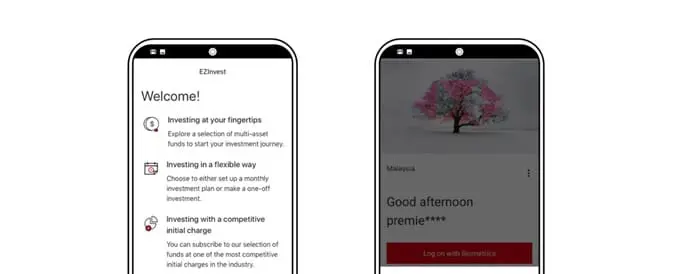

HSBC Malaysia has upgraded its mobile banking app with EZInvest, a new unit trust investment platform aimed at providing customers with the ability to access their investment portfolio at any time of the day. It is the bank’s first digital initiative that offers a simple, flexible, and affordable unit trust investment solution exclusively through the mobile app.

Available to all HSBC customers with an HSBC/HSBC Amanah unit trust investment account, EZInvest will enable them to log on to the HSBC mobile app to transact in a selected list of unit trusts. HSBC Amanah customers can also invest in a range of shariah-compliant funds.

In total, there are 11 unit trust funds to choose from, such as the Principal Islamic Lifetime Sukuk Fund, Affin Hwang Select Balanced Fund, and RHB Asia Dynamic Fund. The selection of funds is spread across different asset classes for better diversification, and also offers global exposure with security as a priority. Not only that, they also feature different risk levels to cater for investors of different risk appetites.

(Image: The Malaysian Reserve)

Interested customers can begin investing from RM500 onwards, although the bank also reminded that different funds will have different minimum investment amounts as per their prospectus. Note as well that each subscription will see a sales charge of 1% to 1.5% of the investment amount, depending on the fund type. Other fees that you should also be aware of include annual management fees, trustee fees, and admin fees – all of which are charged by the fund houses.

HSBC also reassured customers that the EZInvest platform is designed with multiple security features to protect customers’ privacy and financial details. “With multi-layer log on security verification methods, customers’ financial information is protected by a combination of biometric verification, unique username and password, or a one-time security code generated by Mobile Secure Key,” said the bank.

The head of wealth, wealth and personal and personal banking for HSBC Malaysia, Jon Chivers further commented that EZInvest is proof of the bank’s commitment in making wealth management a more seamless and convenient experience for customers. “This is part of our ongoing effort and investment in digital wealth. This is a significant milestone for us as EZInvest will be the first investment feature on our mobile app, enabling customers to go beyond payments and transfers,” he said.

Meanwhile, the head of customer propositions and marketing, wealth and personal banking, Heather Goh said that HSBC is constantly striving to introduce more digital innovations to provide a more robust banking experience. “With the introduction of EZInvest that allows customers to purchase unit trust funds right from their HSBC Malaysia mobile app anytime and anywhere, we are making progress in the right direction in being the bank in every customer’s pocket,” she said.

HSBC customers who are new to investing and would like to give EZInvest a try will need to first open an investment account by going to the nearest branch or calling 1 300 88 1388. The application process will take less than 24 hours, after which you can use the new platform on the HSBC mobile app to begin your investment journey. HSBC is also currently offering an introductory promotion where the sales charge is reduced to 0.88%, which is slated to end on 31 May 2021.

You can find out more about HSBC’s new EZInvest platform on the bank’s website.

Comments (0)