Alex Cheong Pui Yin

9th May 2023 - 3 min read

Starting from 4 June 2023, HSBC customers who wish to perform FPX transactions of RM10,000 or less will need to authorise their money transfers using a re-authentication code that is generated from the bank’s Mobile Secure Key. This comes as the bank continues to beef up its online banking security to better combat financial scams.

In its notice, HSBC said that this update means customers performing FPX transactions of such amounts will no longer receive transaction authorisation codes via SMS (also known as SMS OTPs) come June. Meanwhile, there is no change in the way you authorise FPX transfers of more than RM10,000; you can continue to use transaction verification codes that are generated from HSBC’s Mobile Secure Key to perform these transactions (and not the re-authentication code).

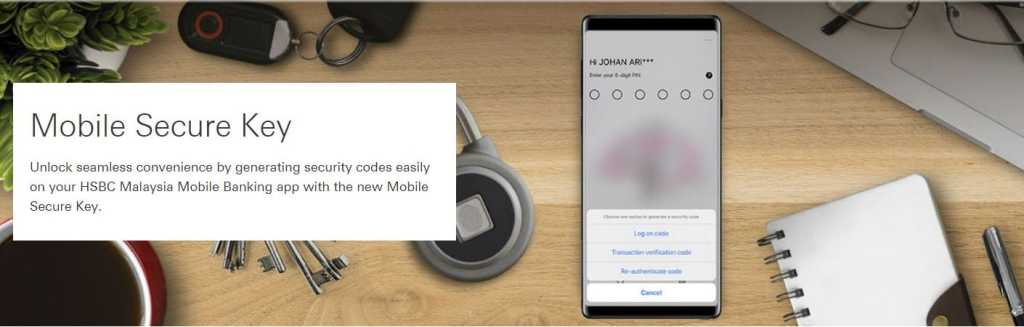

HSBC had first rolled out the Mobile Secure Key on its mobile banking app back in 2020 as a digital security feature to replace the physical Security Device that customers were using for their internet banking back then (the Security Device has been phased out since June 2021). Following Bank Negara Malaysia’s (BNM) call for banks to adopt additional online banking safeguards last year, HSBC confirmed that it has moved away from SMS OTPs to adopt security codes generated via the Mobile Secure Key as its preferred verification method for conducting transactions or banking activities.

Existing HSBC customers will also be familiar with HSBC’s practice of using different types of security codes for different types of transactions or banking activities. The transaction verification code, for instance, is typically used for payments or transfers made to another person or company. Meanwhile, the re-authentication code is usually used to update the customer’s personal details or to adjust online banking limits (but not necessarily limited to only that, as you can see in this upcoming update).

Finally, HSBC urged all customers to activate their Mobile Secure Key on their HSBC mobile banking app if they have not done so. This is to ensure that their banking activities can be performed smoothly moving forward. Here’s a quick guide from the bank on how to activate your Mobile Secure Key, as well as how to generate a transaction verification code or a re-authentication code, depending on your needs.

“Our app is compatible with iPhones with iOS version 13 or above and Android phones with Android OS version 7 or above,” the bank further reminded, adding that customers can visit the nearest HSBC branch or call its customer service at 1300-88-1388 for assistance if their mobile device is below the supported version.

(Source: HSBC)

Comments (0)