Alex Cheong Pui Yin

25th May 2021 - 2 min read

Come 8 June 2021, HSBC will be phasing out the use of its physical Security Device, replacing it with the Mobile Secure Key feature instead. With this update to its security feature, the bank hopes to offer its customers a more seamless and convenient mobile banking experience.

“From 8 June 2021, you won’t be able to access the HSBC Malaysia mobile banking app without activating the Mobile Secure Key. You can still use online banking, via browser only, if you don’t use the Mobile Secure Key,” clarified the bank in its FAQ.

For context, the Security Device is a separate physical gadget that was previously provided to HSBC accountholders so that they can authorise their internet banking transactions. Designed like a mini calculator, users use it to generate a one-time security code, which is then keyed in to approve their online payments.

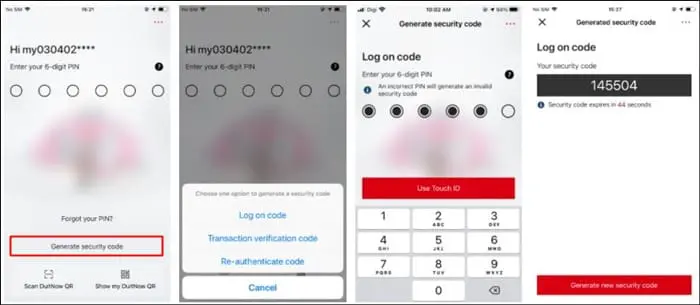

In October 2020, meanwhile, HSBC rolled out the Mobile Secure Key feature, which is essentially a digital version of the Security Device. It is housed within HSBC’s mobile banking app, enabling users to generate security codes and approve transactions on the app itself – thereby making the process more convenient and secure. It also uses upgraded security technology to ensure that you are the only person who can access your accounts, including biometric authentication such as fingerprint and facial recognition.

During the initial rollout of this feature, customers were still allowed to access their accounts and verify their transactions using both the Security Device and the new Mobile Secure Key. However, it also emphasised that the bank was already in the process of phasing out the Security Device, and that all customers were encouraged to activate their Mobile Secure Key instead.

You can find out more about HSBC’s Mobile Secure Key on the bank’s official website.

Comments (0)