RinggitPlus

4th April 2025 - 2 min read

The Malaysian banking sector may face challenges due to the 24% tariff set by President Trump, leading to slower loan growth, potential interest rate cuts to stimulate the economy and possible asset quality issues that could lead to higher credit costs.

“Our economics team preliminarily estimates slower gross domestic product (GDP) growth of 4.3%, down from the current 4.9%, which would lower our industry loan growth estimate to 4.7%, down from 5.5%.”

“The team is also of the view that we could see a 25 basis point cut in interest rates, as opposed to the current assumption of a stable overnight policy rate (OPR) of 3.00%.”

“Regarding asset quality, what is positive is that the industry’s gross impaired loans ratio of 1.45% at the end of Feb 2025 is even lower than the pre-pandemic level of 1.51% at the end of Dec 2019”, Maybank Investment Bank Bhd (Maybank IB) stated today in a note, as quoted by NST.

Maybank IB’s analysis assumes a 1% drop in loan growth, a 25-basis-point OPR cut, and a 20% rise in credit costs if economic growth slows. This would result in a manageable 3–7% earnings impact. However, dividend yields are expected to remain attractive at 4–6%.

Domestic-focused banks like Public Bank, AMMB, and Hong Leong Bank would be the least affected and have received a “Buy” rating.

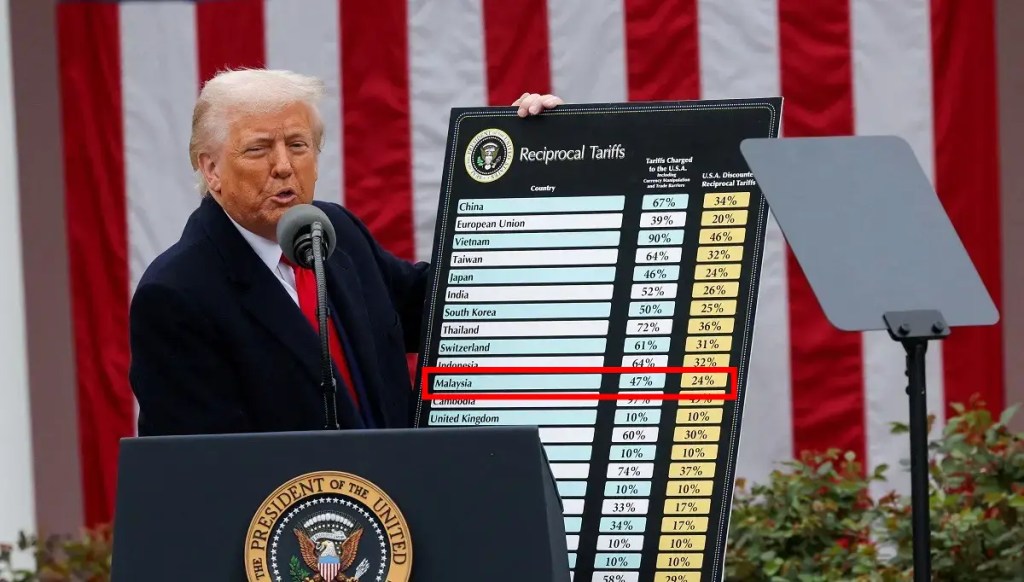

Trump had on Wednesday unveiled a list of ‘punishing tariffs‘ targeting 60 countries, including some of its closest trading partners, in a move that is said to risk sparking a global trade war.

(Source: NST)

Comments (0)