RinggitPlus

4th April 2025 - 4 min read

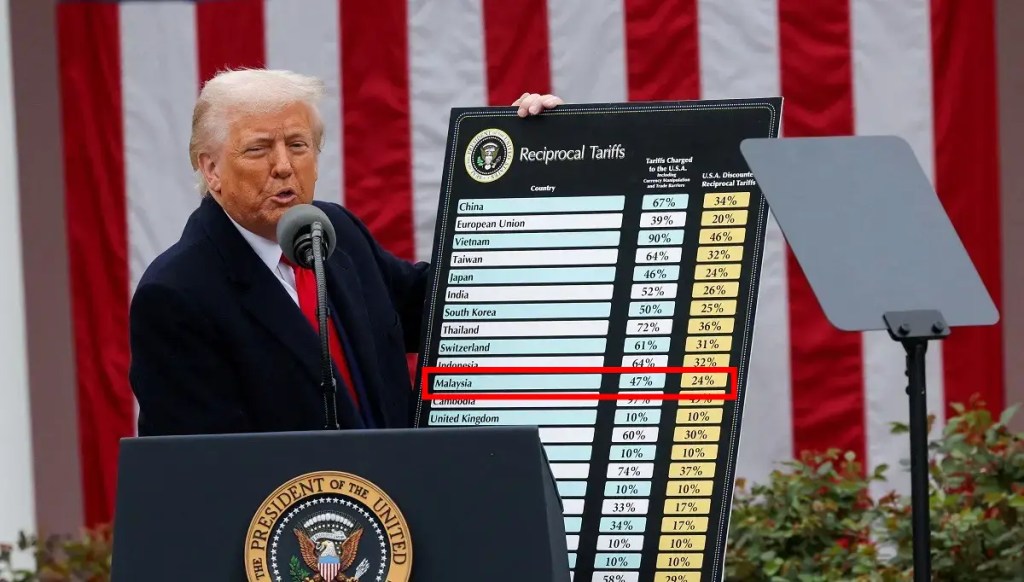

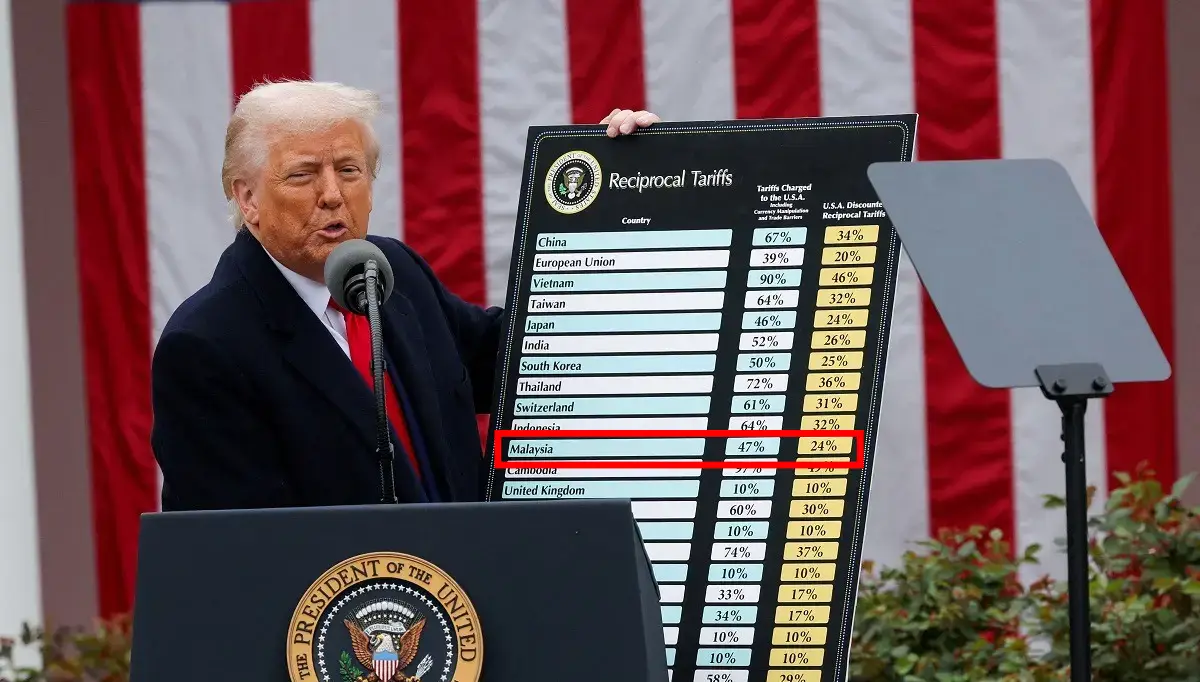

President Donald Trump had on Wednesday announced that the United States of America will implement a 10% tariff on all imports on all countries, and higher duties on some countries, including Malaysia at 24%. These reciprocal tariffs will start on 9 April 2025.

Here’s the list of new tariffs implemented on Southeast Asia nations as listed by The White House:

| Brunei | 24% |

| Cambodia | 49% |

| Indonesia | 32% |

| Laos | 48% |

| Malaysia | 24% |

| Myanmar | 45% |

| Philippines | 18% |

| Singapore | 10% |

| Thailand | 37% |

| Vietnam | 46% |

It appears that the lowest is Singapore at 10% whilst the highest is Cambodia at 49%.

As part of the president’s plan to address trade imbalances, he claimed that “for decades, our country has been looted, pillaged, raped and plundered by nations near and far, both friend and foe alike”.

As a result of this reciprocal tariff, the Federation of Malaysian Manufacturers (FMM) is urging the Malaysian government to delay new taxes.

“The manufacturing sector is already under severe cost pressures and is the largest contributor to national tax revenue, accounting for RM221bil or 68.6% of total tax collections,” said FMM president Tan Sri Soh Thian Lai, as quoted by The Star.

“The expansion of the Sales and Service Tax (SST) effective May 2025, along with impending increase in electricity tariffs in July 2025 will significantly raise compliance and operational costs for mid-tier and large manufacturers as well as vulnerable SMEs.”

“FMM reiterates its call for a moratorium on new taxes or regulatory burdens that could further strain the industry and affect employment, reinvestment and national productivity”, Soh explained.

FMM warns that these tariffs will disrupt trade and impact Malaysia’s role in global supply chains, especially in sectors like plastics, electronics (excluding semiconductors), and industrial machinery. Affected industries could see lower exports, job losses, and supply chain restructuring.

“While some categories of goods are exempt from US reciprocal tariffs including semiconductors, pharmaceuticals, copper, lumber, bullion and certain critical minerals not available in the United States as well as steel, aluminium and automotive products already covered under existing Section 232 tariffs, most other Malaysian exports to the US will be affected”, Soh said.

The broader business ecosystem, including suppliers and logistics, may also suffer due to shifts in sourcing and manufacturing decisions. FMM finds the US move “troubling”, given Malaysia’s strong trade ties with the US. However, the US has indicated that tariff reductions are possible if trade policies align with its economic and security interests.

“From FMM’s perspective, while Malaysia’s tariff rate of 24% is comparatively lower than our Asean neighbours, we are nonetheless categorised within a punitive group of economies”, Soh stressed.

“This underscores that Asean economies are facing heightened scrutiny. Within the region, Malaysia both competes and complements our regional peers.”

“In some sectors such as electronics, rubber-based products, and machinery, we are direct competitors. In others like semiconductors and industrial components, Malaysia plays a complementary role within integrated supply chains.”

FMM supports the government’s proactive steps, such as the National Geoeconomic Command Centre (NGCC), to manage economic challenges. Strengthening trade cooperation, particularly in semiconductors, investment screening, and export controls through US-Malaysia and regional agreements, will be key.

“Malaysia’s active role in the US-led Indo-Pacific Economic Framework for Prosperity (Ipef) should be recognised as evidence of shared commitment to rules-based trade, transparency and supply chain resilience.”

“Collectively, these measures will demonstrate Malaysia’s alignment with US trade priorities and may offer a pathway toward the reconsideration or reduction of the current tariff classification”.

FMM emphasises that Malaysia’s long-term economic resilience depends on diversification and strong domestic policies.

“Malaysian exporters are expected to face strong pressure from US importers to reduce their export prices to offset the 24% tariff imposed, further squeezing manufacturers’ profit margins”, Soh emphasised.

(Source: The Star)

Comments (0)