Alex Cheong Pui Yin

28th September 2022 - 3 min read

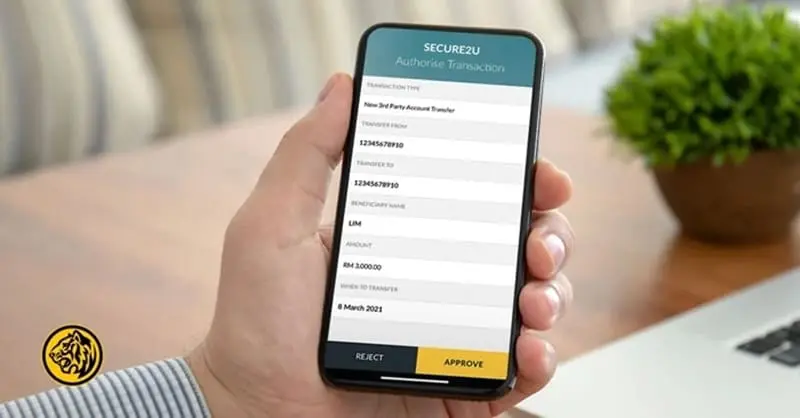

Maybank has revealed that it will fully migrate from SMS one-time passwords (OTPs) to its more secure authentication method, Secure2u by June 2023. This will be applicable for online activities and transactions, including account opening, fund transfers, payments, as well as changes to personal information and account settings.

Maybank’s announcement came following Bank Negara Malaysia’s (BNM) recent directive for banks to adopt five additional safeguards in a bid to combat financial scams, which included a call to move away from SMS OTPs. “This is in line with Bank Negara’s steer for banks to migrate from SMS One Time Passwords (OTP) to more secure authentication for these transactions,” the bank noted in a statement.

On top of that, Maybank also highlighted other ways in which it has already adopted several of the additional safeguards proposed by BNM. For instance, Maybank currently only allows one Secure2u device per accountholder, with the aim of reducing the likelihood of a customer’s online banking details from being compromised. Moreover, customers will receive alerts from the bank via SMS, push notification, and email whenever Secure2u is registered on a new device, as an added security measure.

To note, Maybank had also recently notified customers that Secure2u activations will be moved permanently from the Maybank2u mobile banking app to the MAE by Maybank2u (MAE) app – applicable to new activations. Additionally, it is introducing a 12-hour activation period to the Secure2u feature, which is set to take effect on 8 October 2022. With this, customers who activate Secure2u on a new device will need to wait for 12 hours before they can begin using the feature to authorise transactions.

Aside from the Secure2u feature, Maybank also remarked that it already has a dedicated 24/7 hotline (+603 5891 4744) for customers to report financial scam incidents or to request suspension of their bank accounts if they suspect that a fraud transaction has occurred. Alternatively, customers can contact the Maybank customer care hotline at 1 300 88 6688, and visit Maybank’s website and social media for updates on scams.

“This is done through existing security measures that are already in place, and as we progressively roll out more measures that can help deter or minimise the likelihood of customers falling prey to financial scams,” said the group president and chief executive officer of Maybank, Datuk Khairussaleh Ramli.

Finally, Datuk Khairussaleh noted that BNM’s call for the adoption of the additional safeguards is timely, especially to ensure higher standards of security for internet and mobile banking services. “The banking industry is committed to working together to combat financial scams which are increasingly prevalent in today’s digitalised environment,” he further said.

(Source: New Straits Times)

Comments (0)