Alex Cheong Pui Yin

9th March 2021 - 3 min read

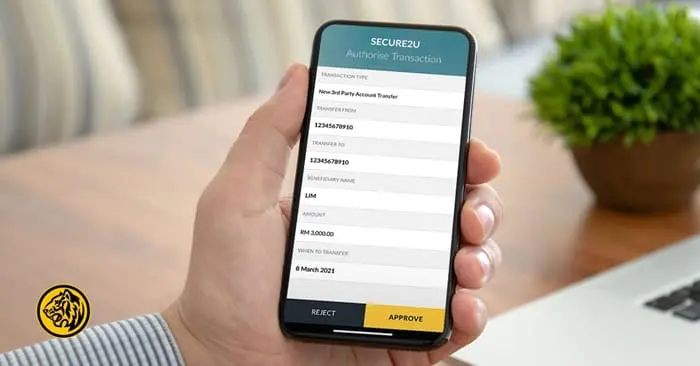

Maybank customers who perform online transactions of more than RM3,000 will now need to use Secure2u via the Maybank2u mobile app to authorise their payments. According to the bank, Secure2u will be the only authorisation option accepted for such transactions, and it will replace the existing SMS TAC as a safer and more convenient authentication method.

“Register for Secure2u today to ensure smoother transactions! Starting from today, Secure2u will be the only method to approve M2U transactions of RM3,000 and above. If you have already enrolled for the service, Secure2u will be the default method to approve ALL transactions, rather than TAC,” said the bank in a Facebook post yesterday.

Secure2u is deemed to be an improved security feature compared to the SMS TAC because it is linked only to a single device and username. It provides two different ways to authorise your transactions, depending on your preferences:

- Secure Verification: A one-tap approval method, where you approve your online transactions by responding to a push notification from the bank’s mobile app.

- Secure TAC: Generates a six-digit authorisation code (TAC) on Maybank’s mobile app, which you use to authenticate your online transactions.

Secure TAC is essentially an “upgraded” version of the SMS TAC; both employ the use of the TAC, except Secure TAC is generated from Maybank’s mobile app whereas the SMS TAC is sent via a telco. With the Secure TAC, you can do away with the wait that sometimes happens with slow SMS TAC messages.

(Image: New Straits Times)

Following this latest update for transactions of RM3,000 and above, make sure to register for the Secure2u feature so that your transactions do not get disrupted. You can do so on the Maybank2u mobile app, which can be downloaded from Google Play and the App Store.

Ever since Maybank rolled out its Secure2u security feature in 2017, the bank had been gradually enabling it for various online banking transactions, including mobile app transactions such as interbank transfers to non-favourite accounts, bill payments, and prepaid reloads (since January 2019). Earlier this year, Maybank also began enabling Secure2u for online transactions of RM5,000 and above starting on 16 February, before doing the same for transactions of RM4,000 and above on 23 February.

You can find out more about Maybank’s Secure2u security feature on the bank’s website.

(Source: Maybank)

Comments (0)