Alex Cheong Pui Yin

23rd February 2022 - 3 min read

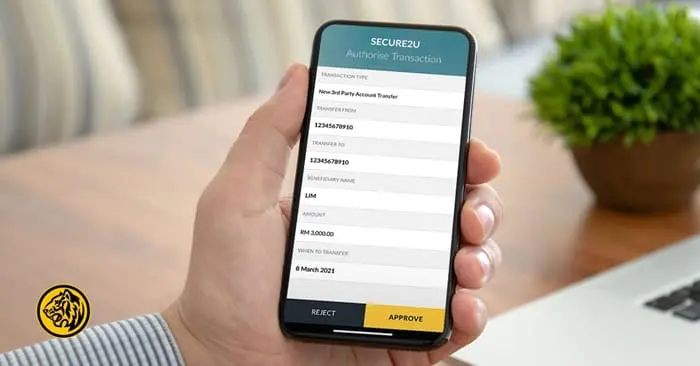

Maybank has finally announced that it is enabling Secure2u as the preferred authorisation method for all third-party (Maybank to Maybank) and Interbank GIRO (IBG) transfers via Maybank2u – regardless of amount. This is set to take effect starting from 8 March 2022.

“Effective 8 March 2022, Secure2u will be the preferred method to authorise all Maybank2u (Maybank to Maybank) and Interbank GIRO (IBG) transfers of any amount. This is part of our continuous effort to enhance our online banking security for you,” shared the bank in a Facebook post.

Maybank also clarified in a separate announcement post on its website that once this revision is implemented, customers will no longer be able to use SMS TAC to authorise any of the above transactions. As such, make sure to register for the Secure2u feature via any of Maybank’s mobile banking apps – the Maybank2u or the MAE by Maybank2u (MAE) app – to ensure that your transactions will not be disrupted.

Secure2u is Maybank’s security feature that was rolled out back in 2017 to replace the SMS TAC, in a bid to offer an extra level of security as it is tied only to a single registered device and username. This means that you’ll be better protected against SMS TAC fraud by eliminating the need to rely on telco networks for your authorisation codes. It was initially enabled only on the Maybank2u app, but was eventually made available on the MAE app as well.

Under Secure2u, there are two ways to authorise your transactions, depending on your preferences: Secure Verification and Secure TAC. Specifically, Secure Verification is a one-tap approval method, where you approve your transactions via a push notification from Maybank’s mobile banking app. The Secure TAC method, meanwhile, is similar to the SMS TAC in that you’ll also receive a six-digit TAC, but instead of receiving it via SMS, it is generated from Maybank’s mobile app itself.

Since the introduction of Secure2u, Maybank has worked to ease its customers into using its proprietary security feature by gradually implementing it for different banking transactions. For instance, the bank initially enabled Secure2u only for online transactions of RM5,000 and above in January 2021 – followed by transactions of RM4,000 and above in February, and then RM3,000 and above in March. By early 2022, authorisation via SMS TAC was available only for Maybank2u web transactions below RM1,000.

(Source: Maybank)

Comments (0)