Alex Cheong Pui Yin

26th November 2020 - 2 min read

(Image: The Edge Markets)

Finance Minister Tengku Zafrul Abdul Aziz has announced that the i-Sinar facility will be expanded to all Employees Provident Fund (EPF) contributors whose income is affected by the Covid-19 pandemic.

Speaking in the winding down session of Budget 2021 in the Parliament, the minister clarified that EPF members who are eligible for the i-Sinar facility now include individuals who suffered:

- Job losses

- Paycuts or reduction in allowance

- Forced to take unpaid leave

- Loss of income (self-employed)

The facility will be also available to both active and non-active EPF members as well.

Aside from that, the government has also agreed to increase the maximum advance limit for EPF members who have RM90,000 and below in their Akaun 1 from RM9,000 to RM10,000.

(Image: Malay Mail/Miera Zulyana)

According to Tengku Zafrul, these amendments came following a discussion between the Finance Ministry and the EPF. Prior to this, the i-Sinar facility was made available only to active members who have lost their jobs, are on unpaid leave, or have no alternative source of income. It also limited members who have RM90,000 and below in their EPF Akaun 1 to a maximum withdrawal amount of RM9,000. Meanwhile, members with more than RM90,000 in Akaun 1 will have access of up to 10% of their Akaun 1 savings (capped at RM60,000).

Tengku Zafrul also said that affected members can apply for the updated i-Sinar facility online or at any EPF branches. They will need to submit supporting documents to prove their eligibility. With these latest updates, the i-Sinar facility is expected to benefit more than 8 million EPF members, as compared to 2 million members previously.

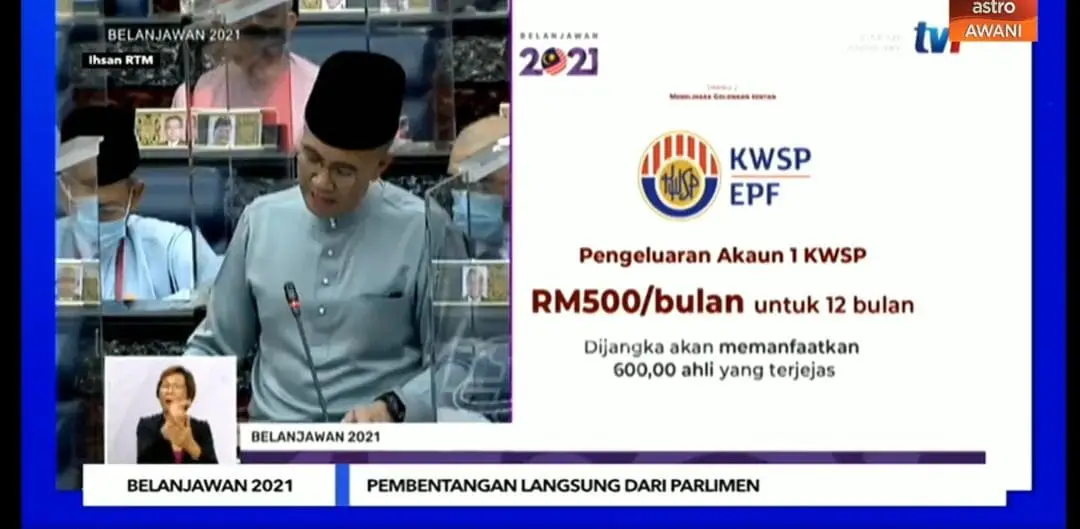

For context, the i-Sinar facility was introduced by the EPF after Tengku Zafrul proposed to let targeted EPF contributors make withdrawals from their EPF Akaun 1 during the tabling of Budget 2021. In that initial proposal, Tengku Zafrul had suggested to allow a withdrawal of RM500 per month for up to RM6,000 for 12 months. In response, the EPF consulted its stakeholders before ultimately introducing i-Sinar as an advance facility as an alternative.

Comments (0)