Alex Cheong Pui Yin

30th January 2024 - 9 min read

The Chinese community is set to celebrate Chinese New Year on 10 February this year, so we’re sure most families are already busy preparing for the festivities. Amidst the hustle and bustle, however, don’t forget to mark your calendars for another auspicious date – on the 4th of February 2024 – if you’d like to participate in the tradition of li chun in hopes of wealth and prosperity!

Li chun: Spring arrives!

Although we celebrate Chinese New Year on 10 February according to the Gregorian calendar, li chun – which falls almost a week earlier – is the date in the lunar calendar that “officially” marks the start of spring. Written as 立春 – which literally translates to “to start” and “springtime, youth, or joy” – it is linked, understandably, to the concept of revitalisation and growth after the barrenness of winter.

Accordingly, farmers in the old days would conduct ceremonies on li chun to pray for a bountiful harvest when they sow their first seeds of the year, but as societies moved away from agriculture, this practice evolved into “sowing” cash in bank accounts. This is in hopes that you, too, will end up with a good financial “reap” in the year to come.

Zodiac signs & li chun: Timing it right

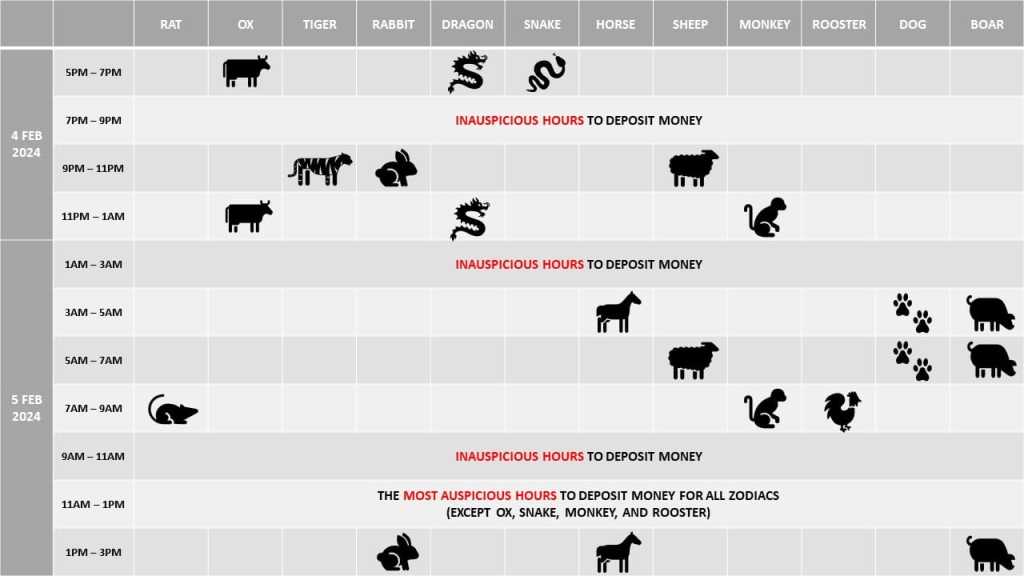

A word of caution, though: You can’t simply rush to deposit money into your bank account at any time that you like come 4 February 2024. According to feng shui masters and astrologists, there are auspicious hours, extra auspicious hours, and even inauspicious hours for different zodiac signs to deposit money throughout the day – and it wouldn’t do to make the wrong move!

For 2024, li chun is set to start at 4:37pm on 4 February 2024. Here’s the schedule for each zodiac sign to time their li chun deposits, for your reference!

Each icon in the table represents the timeslots that are good for each zodiac sign to deposit money.

For most zodiac signs, the 11am – 1pm timeslot on 5 February is a good time to make your deposits, given that it’s said to be the “most auspicious hours” – with the exception of those who born in the Year of Ox, Snake, Monkey, and Rooster. If you fall under any of these four zodiac signs, you’ll have to check the other timeslots that are available for you and act accordingly; Snake and Rooster, for instance, only have one other timeslot to make deposits, so don’t miss out on your window of opportunity!

Of course, make sure to avoid all the inauspicious hours on 4 February (7-9pm) and 5 February (1-3am, and 9-11am).

Making your li chun deposits: ATMs or online transfers?

Customarily, people would head over to automated teller machines (ATMs) to make their li chun deposits. As such, it’s not uncommon to find long lines at banks on this one special day.

That said, many Malaysians are now accustomed to the convenience of digital payments and mobile banking, and may choose to perform online transfers via DuitNow for their li chun deposits instead. Not only does it let you skip the queue, it also offers convenience and flexibility as you won’t have to set aside time in your schedule just to make a trip to the bank.

Some of the older folks may still disagree with this update to the tradition, opining that online transfers do not constitute “real” li chun deposits, but since most banks do consider such transfers to be “fresh funds”, it makes sense to accept them as proper symbolic li chun deposits too!

Don’t just rely on the myth!

While the common li chun practice is to deposit money into your savings account, there are also a variety of other options that you can tap into so that you actually gain some real earnings! Some other avenues that you can consider for your li chun this year – from the more common options to the least conventional – include:

1) Common options: Fixed deposits and high-interest savings accounts

FDs are one of the more straightforward savings options that you can tap into, and many banks do run special li chun campaigns with promotional interest rates just for the occasion. You can also check out our Best Fixed Deposit Accounts article (updated regularly) to see what other promotions are available in the market.

Of course, be mindful of the limitations and requirements that come with FDs, namely the lock-in period and the possibly substantial amount that needs to deposited to enjoy the promo rate. Most importantly, make sure that the money kept in your FDs is not your emergency fund, in case you need withdraw immediately in times of trouble.

Another alternative to consider are high-interest savings accounts, which let you earn rates that are comparable to FDs and still offer the convenience of savings accounts. These, however, may require you to meet some conditions, such as spending a certain amount or using your high-interest savings account as your salary account – so review these conditions and see if they work to your advantage!

Bonus: Malaysia saw its first digital bank, GXBank, officially opening its doors to the public in November 2023 after a period of beta-testing. You may want to check out their offerings for your li chun deposits as well. Specifically, clients can enjoy an interest rate of 3% p.a. on the funds parked in their GX account, which are protected by the Perbadanan Insurans Deposit Malaysia (PIDM) as well.

2) Less conventional: Cash management solutions

These financial products – which are technically investment instruments – have gained popularity over the past years as the public became more exposed to innovative financial solutions after Covid-19. Perhaps the best known of such solutions is the Touch ‘n Go (TNG) GO+ feature that you can find in your TNG eWallet app, although there are numerous other options in the market too. These include StashAway Simple, KDI Save, and Versa Cash – just to name a few.

By tapping into money market funds, cash management solutions are able to deliver returns that are as good as FDs with fairly low risk. And unlike FDs, you are not required to lock in your funds to enjoy the higher interest rate. You can also begin investing with low capital; some solutions let you do so with just RM1!

If you’re keen to explore this option, note that most cash management solutions are housed within robo-advisors that also come with an investment component (more on this in a bit!).

3) Most unconventional: Investment products

Finally, for those who wouldn’t mind challenging tradition a little *cough*, you can think about “sowing” your li chun deposits in even more unusual avenues, such as products that can directly contribute to your retirement. Specifically, we’re talking about making voluntary self-contributions to your Employees Provident Fund (EPF) or investing in private retirement schemes (PRS) – both of which can be done conveniently online.

Aside from being able to save directly for your retirement through compounding dividends, both options are also able to offer “returns” in the short term, in the form of tax deductions. For those who are unaware, the scope of the life insurance tax relief (up to RM3,000) has been expanded to now include EPF voluntary contributions, and you can also claim up to RM3,000 in tax relief for PRS investments (extended until 2025).

Just keep in mind that the funds you deposit into these accounts will be locked until retirement age, so if you do opt to make li chun deposits into your EPF and PRS, they must be excess funds that you won’t need for emergencies. (Technically, it is possible to make pre-retirement withdrawals for PRS, but you’ll be hit with an 8% penalty on the withdrawn amount.)

If you like, you can also look into investing via robo-advisors as another alternative. We’ve highlighted cash management solutions in robo-advisors earlier for savings, but most robo-advisors also have a separate component that is dedicated to investments. Some examples include StashAway and Versa; both have their own cash management solutions (named StashAway Simple and Versa Cash), as well as investment solutions (StashAway and Versa Invest) housed within their apps.

Aside from StashAway and Versa, other notable robo-advisors that are known among Malaysian investors include Wahed Invest, KDI, and MYTHEO. Not sure if robo-advisors are for you, but would like to find out more? Here’s an article from us that gives you the lowdown on all things related to it.

Unlock the full li chun experience with these extra steps!

Depositing money into your bank accounts come 4 February is only scratching the surface of the li chun experience. Add to the thrill of it – and maybe even “amplify” your luck – with these additional steps!

Tip #1: When making your li chun deposits, consider sticking to amounts that are typically associated with prosperity, like RM28, RM80, RM88, or even RM168! Some of you may also opt to apply lucky numbers that are linked specifically to your zodiac animal to boost your wealth. On that same note, make sure to also avoid your unlucky numbers!

Tip #2: Aside from making deposits with their lucky numbers, some people will also wear clothes in their lucky colours when fulfilling their li chun customs. If you’re interested in doing so as well, you can check out this list by the experts at Way FengShui. Otherwise, we think you won’t go wrong with wearing red!

Tip #3: Unfortunately, making multiple li chun deposits does not equal to more huat and better ong. If only it were that easy…

Tip #4: Fengshui masters are quite specific when they say that the 11am-1pm timeslot is the most auspicious hours to make your li chun deposits, so don’t miss out on this “ultimate” duration to maximise your li chun luck!

Tip #5: Make sure that your purses and wallets are not empty! They should also be filled with cash as you make your li chun deposits, implying overflowing wealth that fills both your wallet and bank accounts.

***

Like many other Chinese New Year traditions, the custom of li chun can bring families and friends closer as you join in the fun to chase the auspicious timeslots. That said, this tradition is also a compelling reminder of the importance of saving and investing money. Knowing that, we hope that you’ll take time in the coming Year of the Wood Dragon to up your financial literacy, and would like to wish you a very Happy Chinese New Year in advance!

Comments (0)